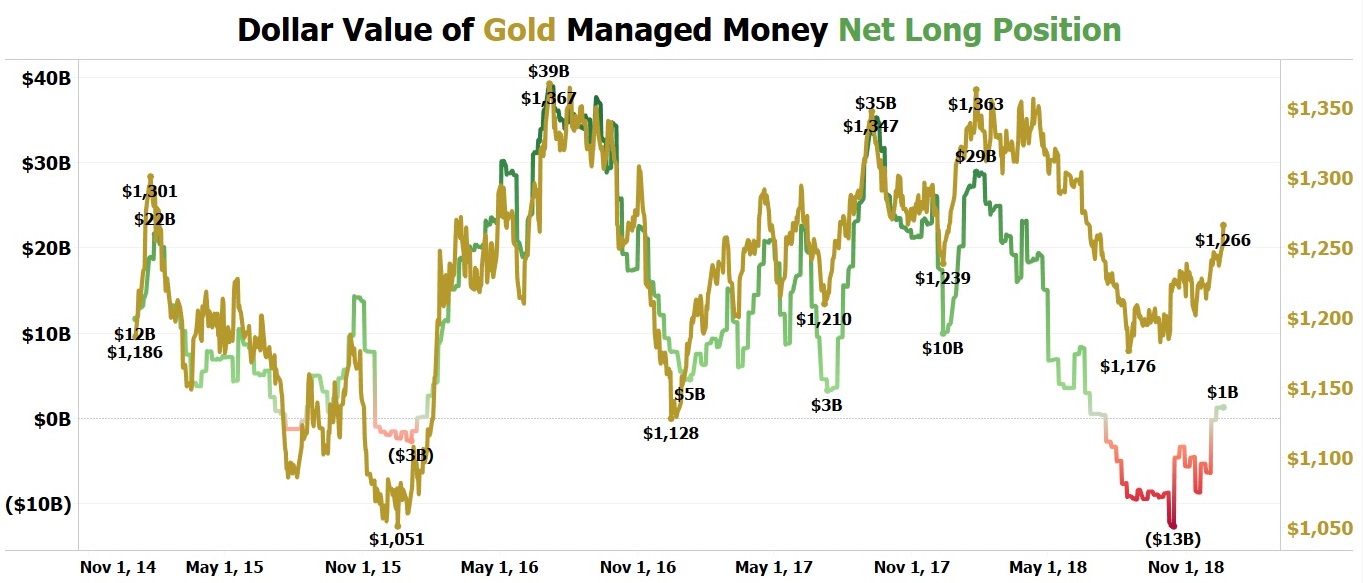

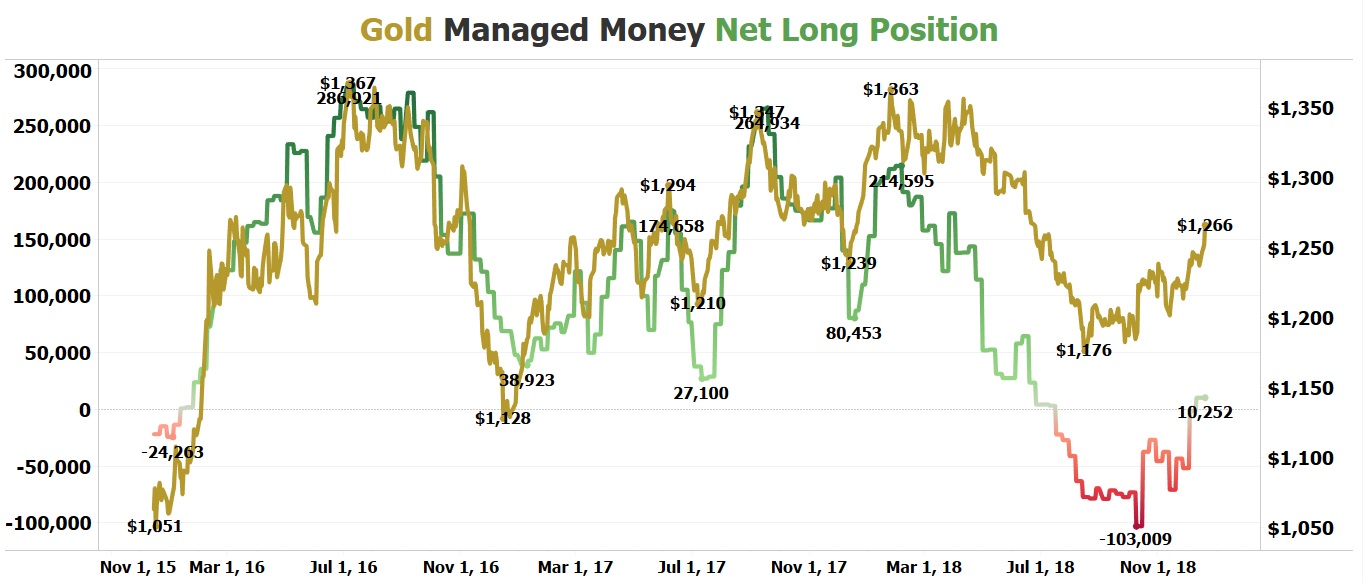

On December 3rd, NIA predicted in an alert to its members, "According to the latest COT data released after the close on Friday, hedge funds are currently short 138,047 gold futures contracts and long 86,219 gold futures contracts for a net short position of 51,828 contracts. NIA predicts that hedge funds will return to a net long position in the upcoming weeks."

We are now back to hedge funds being net long gold futures contracts, exactly like NIA predicted! Over the last two weeks, hedge funds have covered 36.25% of their shorts while simutaneously increasing their longs by 13.95%. They have gone from being net short by -51,828 contracts to being net long by 10,252 contracts!

The last time that hedge funds went from being net short back to net long was on January 12, 2016 with gold at $1,085.20 per oz. Over the following month, gold rallied by $162.70 up to a February 11, 2016 price of $1,247.90 per oz.

This time around, we have started off with a much higher gold price of $1,241.90 per oz on the day that the managed money net long position turned back to positive. A gain equal to January/February 2016 on a percentage basis will take gold in January 2019 up to $1,428 per oz!

Gold's major resistance level is between $1,365.40 and $1,377.50 per oz. When it breaks through this level, gold will make its largest short-term rally in history. Profitable, producing gold mining stocks with large gold reserves are currently trading at artificially depressed levels compared to gold and in NIA's opinion are a safe bet to gain 4-5X more than the price of gold moving forward. Fiore Gold (TSXV: F) in NIA's opinion has by far the most upside potential and could easily rise 20-30X the percentage gains of gold over the next 6-12 months. For U.S. investors without access to TSX Venture exchange trading, Fiore Gold has a symbol of FIOGF.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. Never make investment decisions based on anything NIA says. This message is meant for informational and educational purposes only and does not provide investment advice.