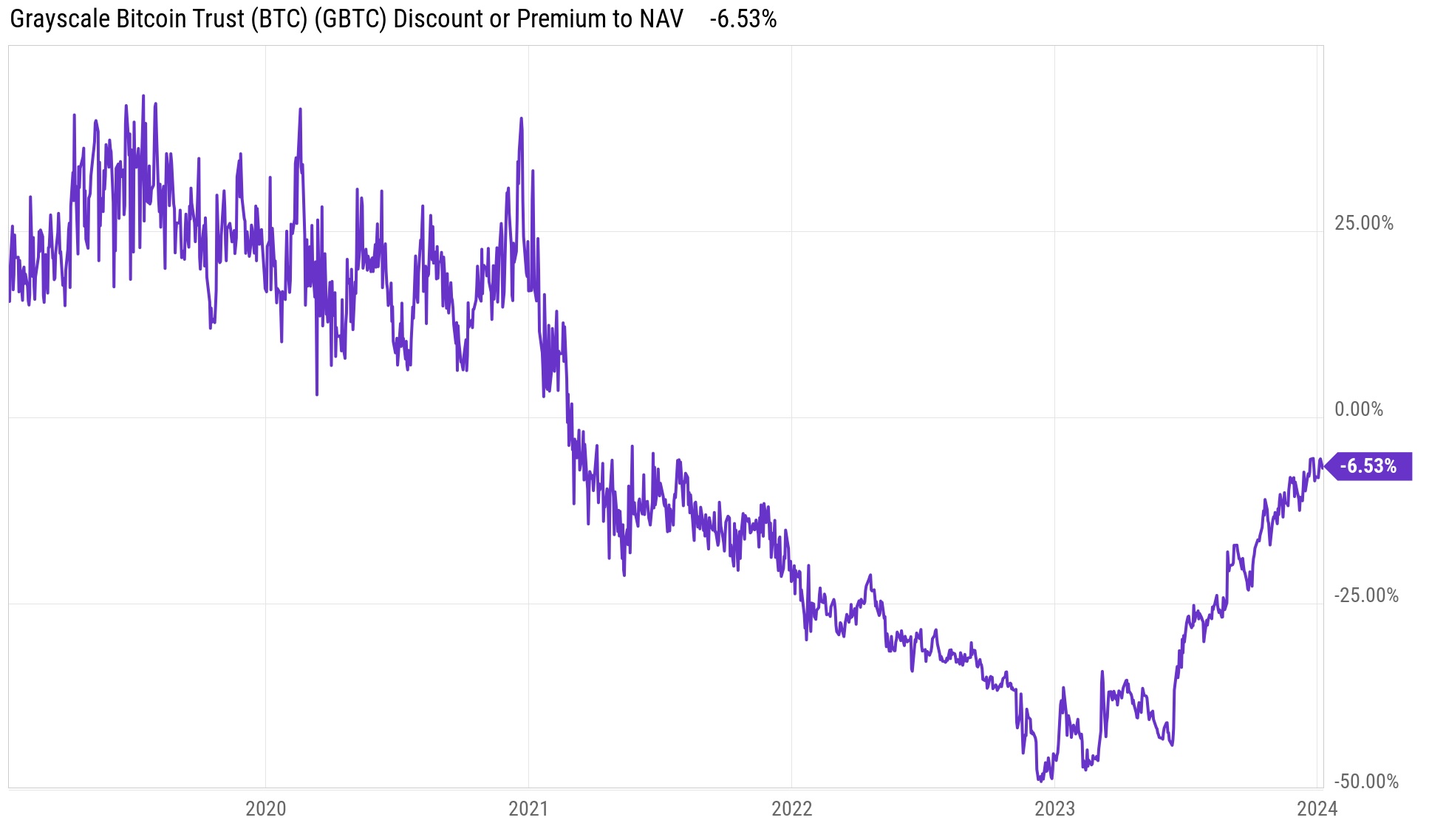

If there is real demand for Bitcoin ETFs, why wouldn't people have already bought Grayscale Bitcoin Trust (GBTC)? It was still trading at a 6.53% discount below NAV as of today's close.

When GBTC converts into an ETF tomorrow, we assume this discount will go away and GBTC owners will begin to finally dump their shares.

What if outflows from GBTC are much larger than inflows into newly created Bitcoin ETFs and the net effect of ETFs allows selling of Bitcoin previously locked up?

Grayscale is pretending to be happy that ETFs are approved, but they secretly wanted to remain a trust with all of their Bitcoin stuck inside of it!