When NIA's President co-founded Elite Daily in 2012 with two of his interns, one of his interns was the son of the owner of Jacob & Co the watch company. Currently, Jacob is building the world's tallest residential tower in Dubai, but back in 2007 before Jacob & Co became a billion dollar company, one of the largest Real Estate developers in NYC was trying to purchase his building on 57 Street in NYC to knock it down and consolidate it with all of the surrounding properties that the developer had already purchased to build a new office tower that was going to have a new flagship Nordstrom location on the street level. Nordstrom needed a 57th Street entry point at the point of Jacob's store.

After paying only $12 million for his town house style building in 2004 the developer in 2007 offered him $20 million, then $30 million, then $40 million, then $50 million, and Jacob turned it all down saying he would only sell it for $100 million. The developer said he couldn't pay $100 million so Jacob said okay well my store is staying here then. The developer was forced to change the entire project to what became known as 432 Park, a super skinny skyscraper that at the time of its completion was the world's tallest residential tower (Jacob now lives in the tower and walks outside to go to work feet away). After the success of 432 Park many other developers copied the project and built their own super skinny skyscraper residential towers and it became known as billionaires row.

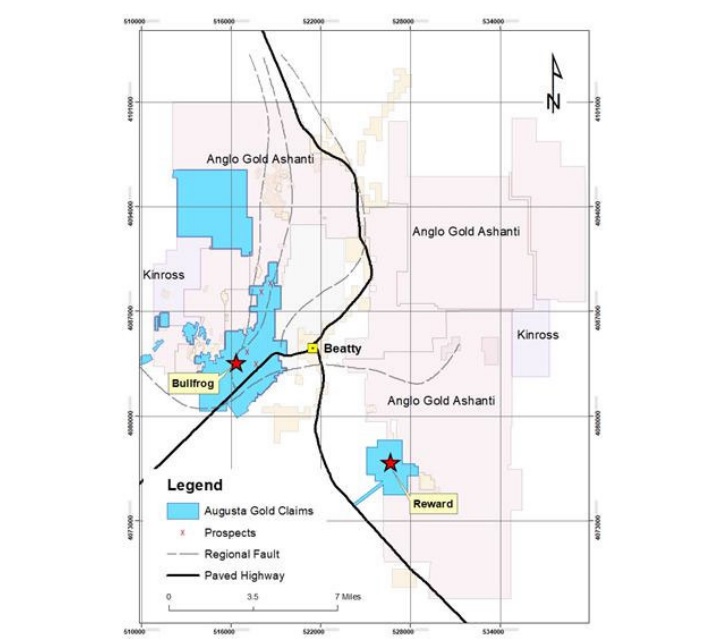

This same exact concept applies to Augusta Gold (TSX: G) and this is why we made it our #1 overall pick. They not only have resources of 1.92 million oz of gold, but just like how Jacob has his store in the world's #1 most valuable location (billionaires row), G has its oxide gold projects at the center of a new 10 million oz gold district that is about to be developed by the world's 4th largest gold miner AngloGold Ashanti (AU) a company that is entering Nevada for the first time and desperately needs G's oxide gold projects!

G's oxide gold projects alone are the size of the entire island of Manhattan so buying G at a market cap of less than US$100 million is a no-brainer before AU begins offering $500 million, then $600 million, then $700 million, and G will probably demand $1 billion.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA's President has purchased 194,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.