BigBear.ai (BBAI) gained by 44.81% today to $7.11 per share on record volume of 267.44 million shares and has 251,554,378 shares outstanding for a market cap of $1.789 billion with net debt of $140.56 million for an enterprise value of $1.93 billion or 12.45x revenue of $154.97 million. BBAI has negative free cash flow of -$32.171 million and will have severe dilution as it issues up to 161,676,020 shares to make interest payments on its convertible notes and pay them off upon conversion.

One Stop Systems (OSS) is the closest publicly traded comparison to BBAI, and despite BBAI's significantly higher valuation... OSS is a far higher quality company in every way! At some point within the next 12-18 months, OSS will likely have a significantly higher market cap/enterprise value than BBAI... we are 100% sure of it!

NIA's President doesn't own OSS because he is most bullish on gold/silver exploration stocks and Augusta Gold (TSX: G) is highly likely to be acquired in the very near-future at a massive premium. Over the last two years, NIA's President has slowly accumulated a large stake in a Western South American high-grade silver/gold exploration company. We won't be discussing the Western South American company publicly because NIA's President is already up big on paper and if the Western South American high-grade silver/gold company reaches a certain price on high enough volume during the explosive gold/silver exploration stock rally that is about to occur in the upcoming weeks... he intends to take profits on the Western South American high-grade silver/gold company and roll the proceeds into Augusta Gold (TSX: G) assuming it is still trading below $3 per share. In our opinion, Augusta Gold (TSX: G) is the #1 biggest sure thing winner in the market at any price below $3 per share and if a buyout occurs this month, it will most likely be for $5+ per share.

Based on OSS likely to report 4Q 2024 revenue next month of $15 million or $60 million annualized, an enterprise value of 12.45x $60 million = $747 million + $11.47 million in net cash = potential market cap of $758.47 million divided by 21.11 million shares outstanding = potential price for OSS of $35.93 per share! Based on where BBAI closed today... OSS has potential to gain by 735.58% from today's close of $4.30 per share!

Click here to read BBAI's press release from its 2021 SPAC merger. BBAI said in this press release, "Revenue is projected to grow from $182 million in 2021 to $764 million in 2025, a 43% compound annual growth rate." BBAI totally lied to investors and everybody who entered at the initial SPAC offering price of $10 per share got screwed over as the SPAC sponsors dumped their position that they most likely purchased for only $2 per share.

The cause of BBAI's gain today was the announcement of a contract with the Department of Defense's Chief Digital and Artificial Intelligence Office to advance its Virtual Anticipation Network prototype (whatever that means). There were no dollar amounts given, which is a red flag! Even BBAI's previously announced "strategic partnership" with Palantir (PLTR) had no dollar amounts!

Imagine where OSS would already be trading today if they were allowed to use Palantir (PLTR)'s name in their December 3rd press release regarding OSS's rugged AI servers being used in the autonomous unmanned surface vessel (USV) Tenebris being developed by HD Hyundai and PLTR! Click here to see for yourself! Although the initial order was small at $200,000 because they are only developing the first prototype, we have a feeling OSS's initial December 3rd $200,000 order was larger than whatever amount BBAI is receiving for their contract announced today!

OSS's first customer funded development program with the U.S. Navy resulted in a long-term production contract after an initial two-year development period... and has already generated over $40 million in revenue!

OSS's first customer funded development program with the U.S. Army was announced on February 14, 2023: click here to see for yourself! It was expanded on March 28, 2024: click here to see for yourself! From our experience, these programs only get expanded if the U.S. Army is planning to move forward!

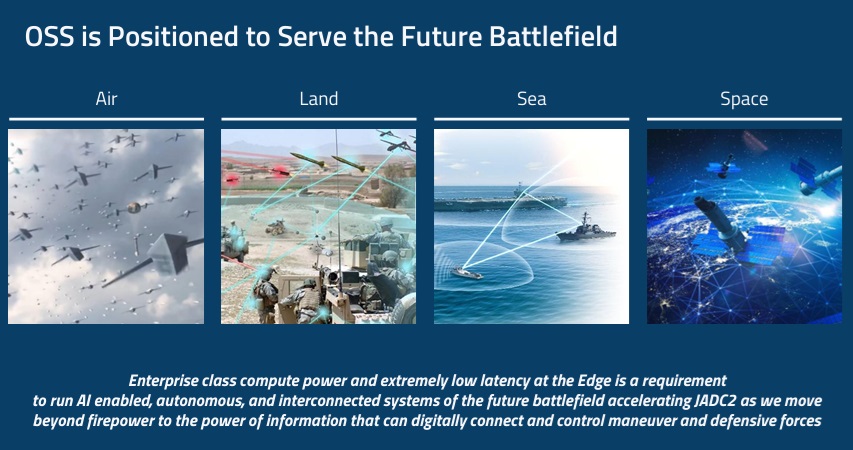

We are nine days away from the two-year anniversary of the launch of this U.S. Army customer funded development program! OSS expects to win a contract to upgrade 5,000+ U.S. Army tanks! Click here to see for yourself in OSS's investor presentation!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA's President has purchased 224,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.