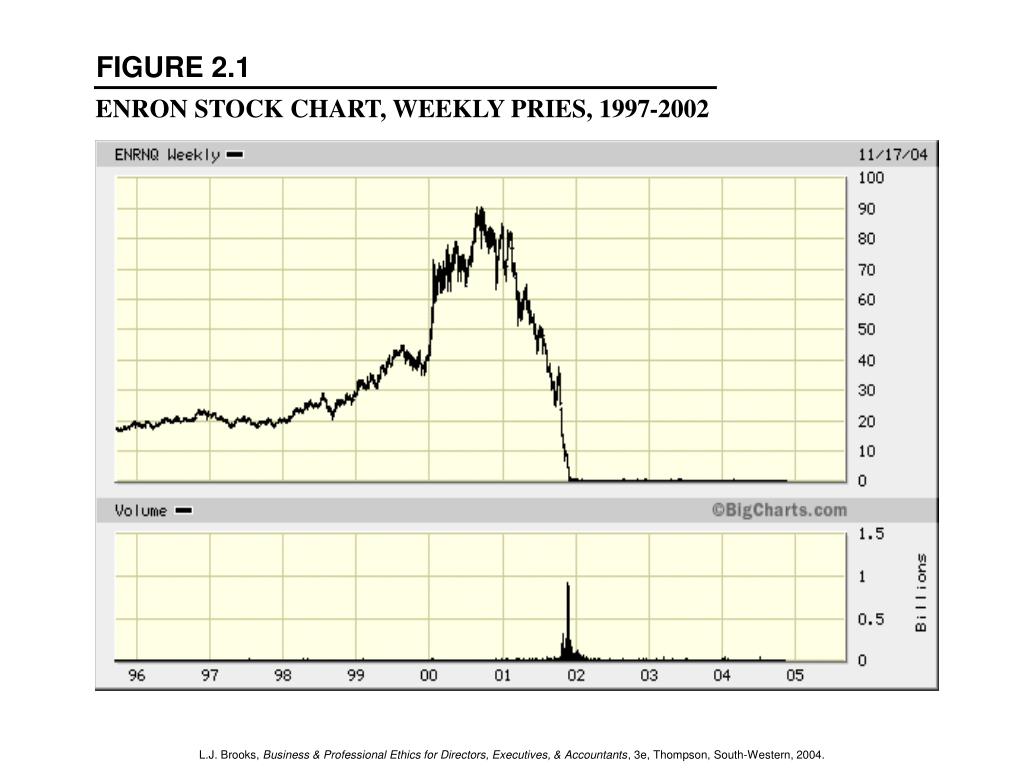

Nobody believed Enron was a fraud until after it went bust. After the collapse of Enron, it was replaced in the S&P 500 by Nvidia (NVDA).

NVDA was most likely a legit company prior to 2017 when they started selling GPUs to Ethereum miners while claiming those sales to be from gaming.

After Ethereum announced they were switching from Proof of Work to Proof of Stake, NVDA was about to lose its #1 revenue stream and needed a new way to replace it. NVDA invented a new concept of using GPUs in data centers and turned their most loyal Crypto client Atlantic Crypto Corporation into CoreWeave. It is laughable that CoreWeave thinks it is worth $8 billion because NVDA CEO Jensen Huang has endorsed it! What kind of CEO of a trillion-dollar company has time to hang out at the tech expos of a client company like CoreWeave? Why would he do that?

By doing so it convinces Magnetar Capital and Blackstone to loan CoreWeave $2.3 billion to buy NVDA GPUs to artificially boost NVDA's earnings. All Magnetar Capital and Blackstone care about is exit liquidity!

Magnetar Capital is the same firm that was responsible for the housing bubble.

If CoreWeave went public today there would be plenty of stupid people buying it despite the collapse of Birkenstock stock after its IPO this week.

Guess who else is buying Nvidia GPUs besides CoreWeave, which sells them to pennystock scam companies like Sysorex (SYSX) for shares that they liquidate before those companies collapse?

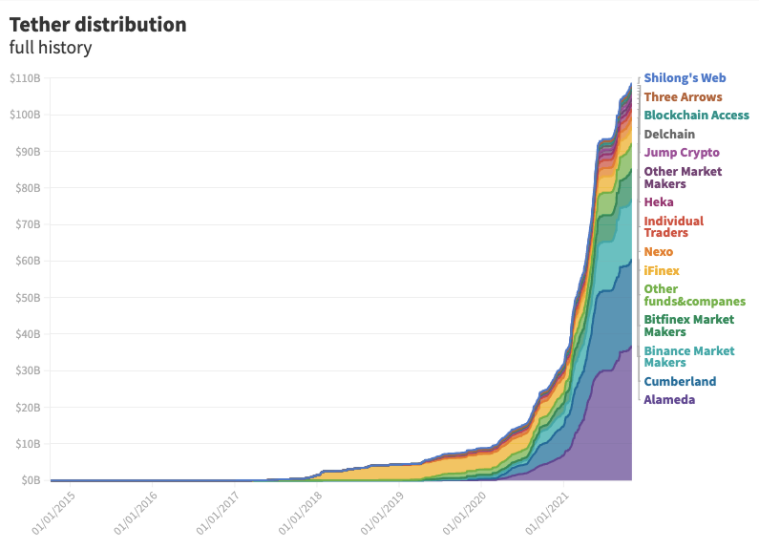

One of the largest new buyers of NVDA GPUs is Tether (USDT), which is the single largest fraud in the Crypto market and laundered $35 billion USDT through SBF's Alameda Research!