Less than one year ago on Saturday, August 25, 2018, NIA sent out an alert entitled: 'An Epic Gold Short Squeeze Began on Friday'. Click here to read this alert.

NIA said the following in its alert predicting the beginning of an Epic Gold Short Squeeze...

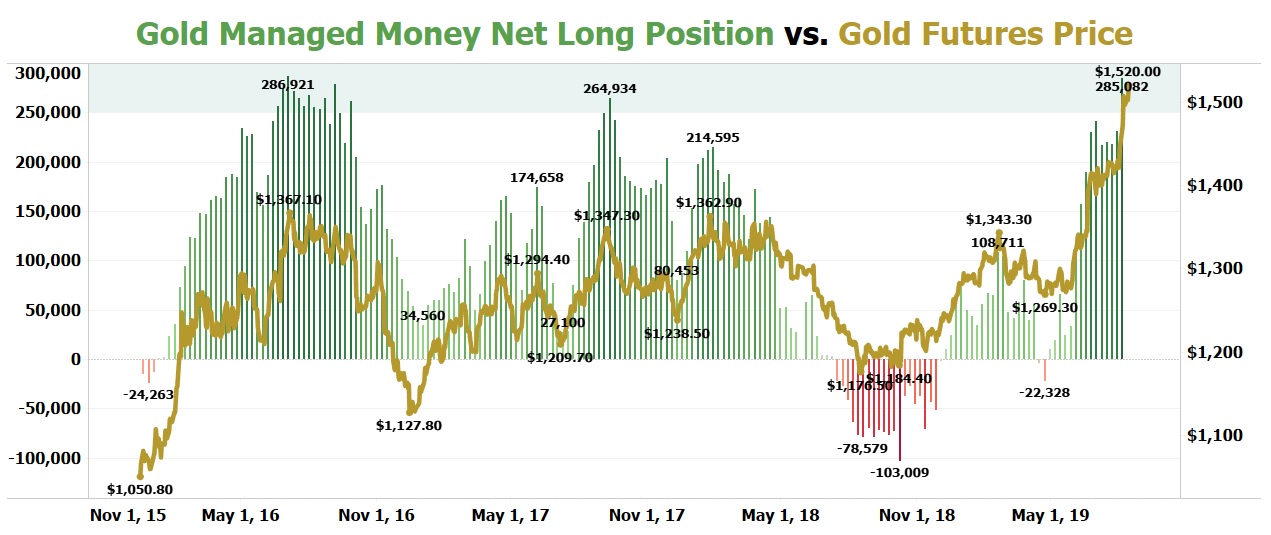

"Gold is in a new cyclical bull market that began in December 2015 when gold bottomed at $1,050.80 per oz. It's amazing that despite the negative net long position becoming 3.24X larger than December 2015, gold's lowest settlement price last week (on August 16, 2018) was $1,176.20 per oz ($125.40 per oz above gold's December 2015 bottom)."

NIA then explained why this continuing trend was proof that an upward explosion for gold was imminent...

"When gold reached a medium-term peak on January 25, 2018 of $1,362.90 per oz (its highest settlement price of 2018) its managed money net long position was only 214,595 contracts. When gold's previous short-term peak was reached on September 8, 2017, gold needed a 23.46% larger managed money net long position of 264,934 contracts just to reach a gold price of $1,347.30 per oz, which was $15.60 per oz below its latest medium-term peak."

NIA then made the following prediction for 2019...

"Based on this ongoing trend, when gold's managed money net long position once again returns to between 200,000 and 300,000 contracts, we could be looking at a gold price of between $1,500 and $1,600 per oz."

The accuracy of NIA's very specific gold prediction for 2019 has been absolutely stunning!

Over the past twelve months, gold's managed money net long position has swung from negative -78,579 contracts to positive 285,082 contracts for an improvement of 363,661 contracts. When gold's managed money net long position last reached an even higher 286,921 contracts, gold peaked on July 6, 2016 at a settlement price of $1,367.10 per oz. NIA is the only organization in the world to accurately predict that when gold's managed money net long position returned to between 200,000 and 300,000 contracts, it would be enough to drive gold to at least $1,500 per oz and today we have gold trading for $1,520 per oz!

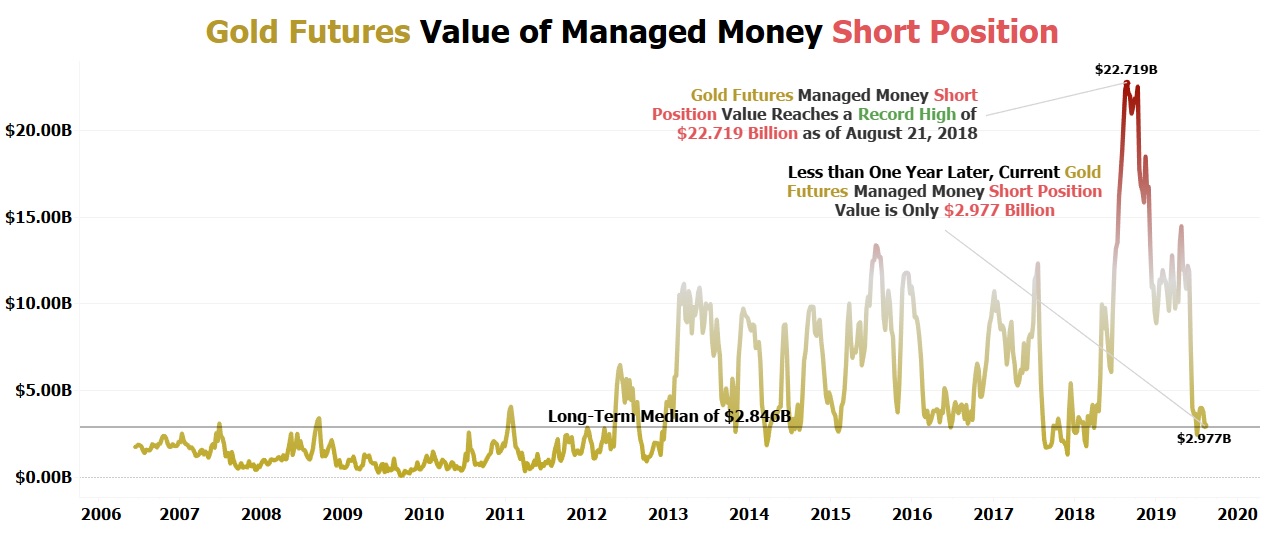

NIA also accurately called the exact peak of gold's managed money short position and the HUGE short squeeze that would occur afterwards! Since August 25, 2018, a stunning 89.39% of gold contracts that were sold short by hedge funds have gotten squeezed and were forced to cover! Currently, only $2.977 billion worth of gold is sold short by hedge funds, down from $22.72 billion one year ago!