Minaurum Gold (TSXV: MGG) Gains 8.97% to $0.425 Per Share

Minaurum Gold (TSXV: MGG) gained by 8.97% today to a new 42-month high of $0.425…

NIA’s First Mining Gold (TSX: FF) Strategy Confirmed Successful Once Again Today

NIA's First Mining Gold (TSX: FF) strategy was once again confirmed successful today. The Crypto…

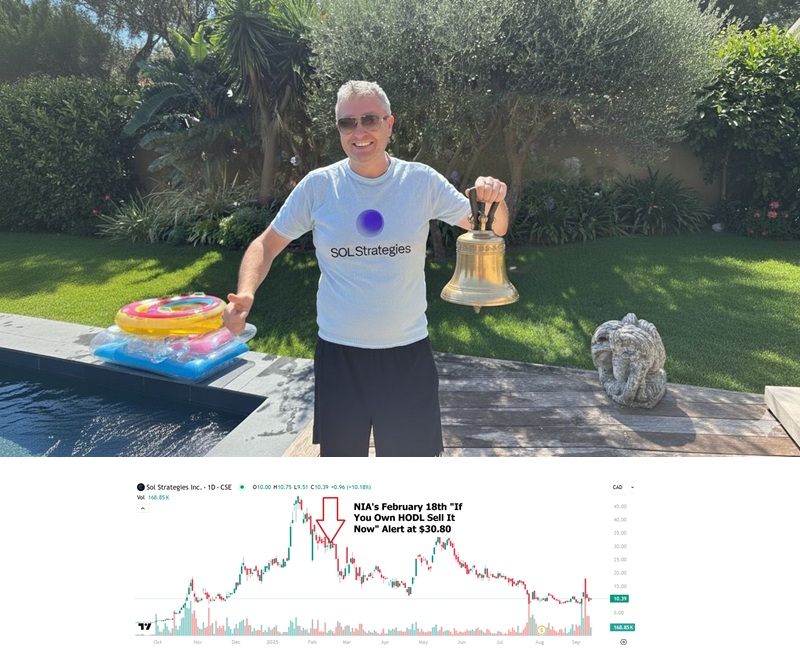

Read NIA’s February 18th HODL Warning

On the morning of February 18th, NIA issued a warning about Sol Strategies (CSE: HODL)…

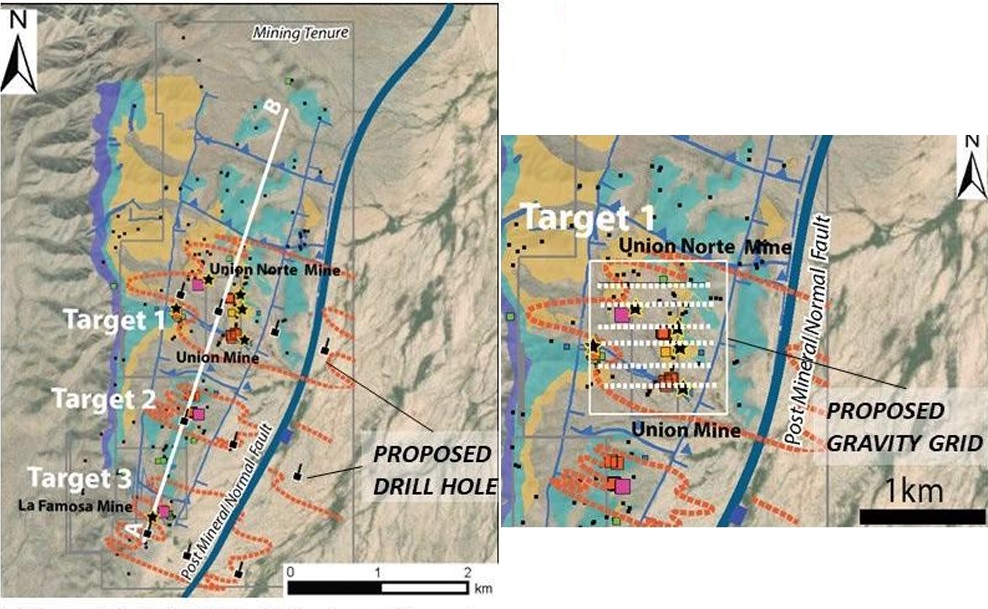

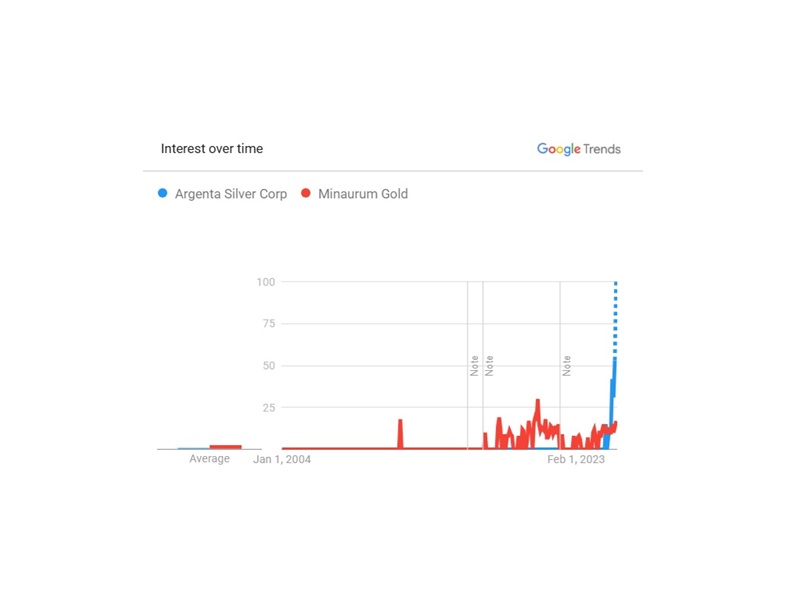

Almost Nobody Knows Minaurum Gold (TSXV: MGG) Exists

Current Google search interest in Frank Giustra's Argenta Silver (TSXV: AGAG) is 6.25x higher than…

Silver Hits New 14-Year High of $42 Per Oz

Silver has just hit a new 14-year high this morning of $42 per oz. SilverCrest…

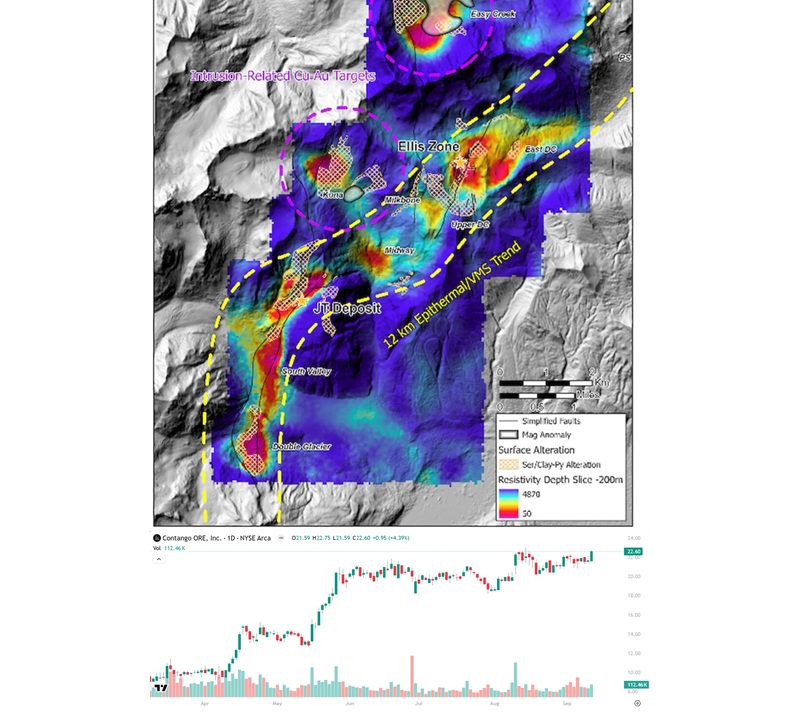

Contango ORE (CTGO) Gains 4.39% to $22.60 Per Share, Highest Close Since NIA’s Suggestion

Contango ORE (CTGO) gained by 4.39% today to $22.60 per share its highest closing price…

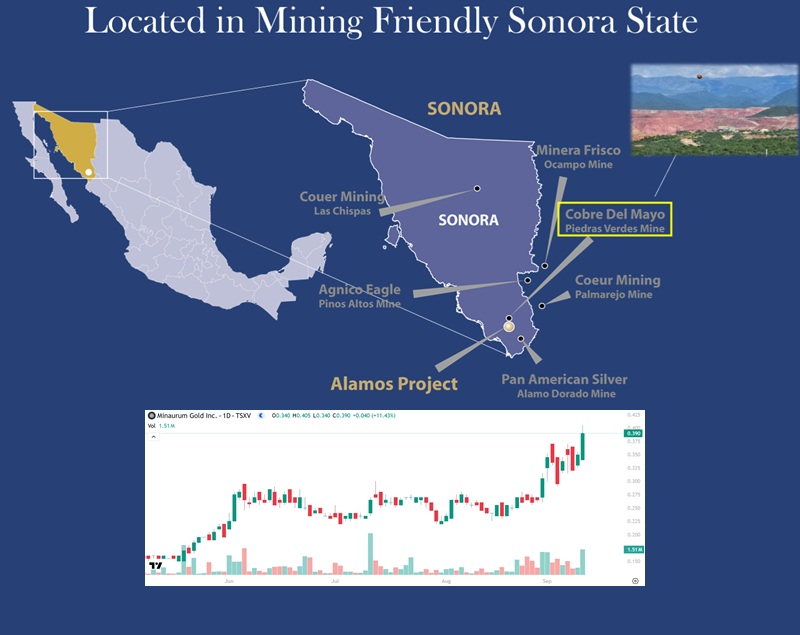

Minaurum Gold (TSXV: MGG) Gains 11.43% to $0.39 Per Share

Minaurum Gold (TSXV: MGG) gained by 11.43% today to a new 42-month high of $0.39…

From $0.14 to $14.63: Ruben Molina’s Track Record at SilverCrest

When Ruben Molina joined SilverCrest Metals in October 2015 to manage the exploration and resource…

NIA’s #1 Silver Pick Minaurum Gold (TSXV: MGG) Gains 9.37% to $0.35 Per Share

NIA's #1 favorite silver stock suggestion Minaurum Gold (TSXV: MGG) gained by 9.37% yesterday to…

Excellent Analysis of Shooter Caught on Tape

Somebody shared with NIA's President an excellent analysis of the shooter caught on tape on…