Historically, some of NIA’s biggest winners have been royalty companies with Wheaton Precious Metals (WPM) gaining by 758.9% from NIA’s suggestion price and Ely Gold Royalties gaining by 596.67% from NIA’s suggestion price prior to it being acquired at a huge premium. Another NIA royalty stock suggestion Coral Gold gained by 243.59% from NIA’s suggestion price prior to it being acquired at a huge premium. NIA’s most recently announced royalty play Morien Resources (TSXV: MOX) gained from NIA’s initial suggestion price of $0.185 per share up to a high of $0.64 per share for a gain of 245.95%.

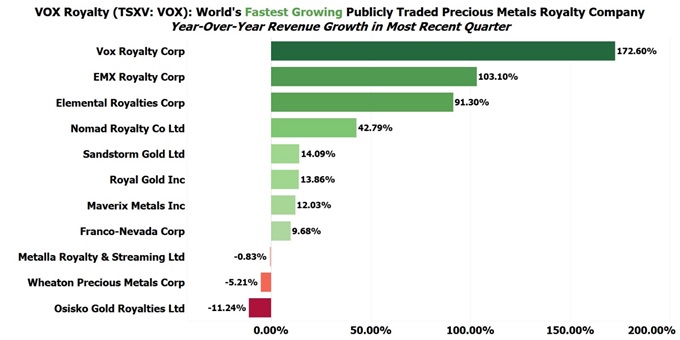

Vox Royalty (TSXV: VOX, OTCQX: VOXCF) is a returns focused precious metals royalty company with year-over-year revenue growth in its most recent quarter of 172%. Vox is positioned for continued revenue growth in the upcoming quarters.

The majority of Vox’s royalties cover properties located in Australia, which is a region that U.S. investors are underexposed to because most U.S. investors don’t have access to Australian Stock Exchange trading. Australia is the world’s second largest gold producer after China, but while China is a very poorly ranked mining jurisdiction for investors, Western Australia ranks alongside Nevada at the very top of the world’s strongest mining jurisdictions. 70% of Vox’s metals royalties are in precious metals properties with 30% in non-precious metals properties.

When Vox first went public in May 2020 it had only one producing royalty, but today Vox has 6 producing royalties plus 5 royalties in projects that are expected to come online between now and the end of 2023. Vox owns royalties in 5 additional projects that are expected to come online in 2024/2025. Vox owns 4 additional development stage royalties that are expected to come online after 2025. Vox also owns 30+ exploration-stage royalties.

At the end of last month, Vox acquired a royalty that will generate immediate revenue for Vox in the upcoming quarters. Vox acquired a 1.25%-1.50% sliding scale Gross Revenue Royalty over the Wonmunna mine. Wonmunna is an iron ore mine owned by AUD$11.42 billion market cap ASX-listed Mineral Resources Limited (ASX: MIN). This newly acquired royalty provides exposure to a substantial 84.3Mt Indicated & Inferred iron ore resource located in the world’s largest iron ore exporting region. Wonmunna commenced production in April 2021 and is currently producing at a rate of ~5Mtpa of iron ore, with all approvals received to expand production up to 10Mtpa. All royalty payments due and payable to the holder of the royalty will be for the benefit of Vox as of April 1, 2022.

Very important short-term catalysts are ahead for Vox. One of Vox’s currently producing royalties is an uncapped A$0.50/tonne production gold royalty over the Janet Ivy Gold Mine in Western Australia controlled by a subsidiary of Zijin Mining Group Co., a US$39.5 billion market cap company. Janet Ivy forms the core of Zijin’s Binduli North heap leaching expansion project, with an expansion budget of AUD$462 million, which is about to be completed in the upcoming months. This will significantly increase Vox’s Janet Ivy royalty revenue.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA expects to receive total compensation from VOX of USD$100,000 cash for a twelve-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.