When DroneShield (ASX: DRO) was $0.50 in January and we said to look for a buyout in the $1-$2 range before year-end that was us saying that on our own. The company has never said it is for sale. We were obviously right about companies having a need to acquire anti-drone technology with DRO's competitor DeDrone getting acquired by Axon Enterprise (AXON) and AXON has soared to new record highs as a result of its acquisition of DeDrone. DRO did rise to a high of $2.72 per share, and we said DRO was overvalued at $2.72 and that was likely its peak. DRO is now $0.68 per share because they simply do not want to sell themselves to anybody. DRO has a lot of cash and wants to remain an independent company. Is DRO undervalued here at $0.68 per share? We much rather buy DRO at an enterprise value of 7.09X revenue than BigBear.ai (BBAI) at an enterprise value of 5.13X revenue or Apple (AAPL) at an enterprise value of 9.51X revenue or Nvidia (NVDA) at an enterprise value of 31.13X revenue. Yes, DRO is undervalued, but they have a lot of cash and want to remain independent. Prior to AXON buying DeDrone they went to DRO first, but DRO didn't consider any of their offers.

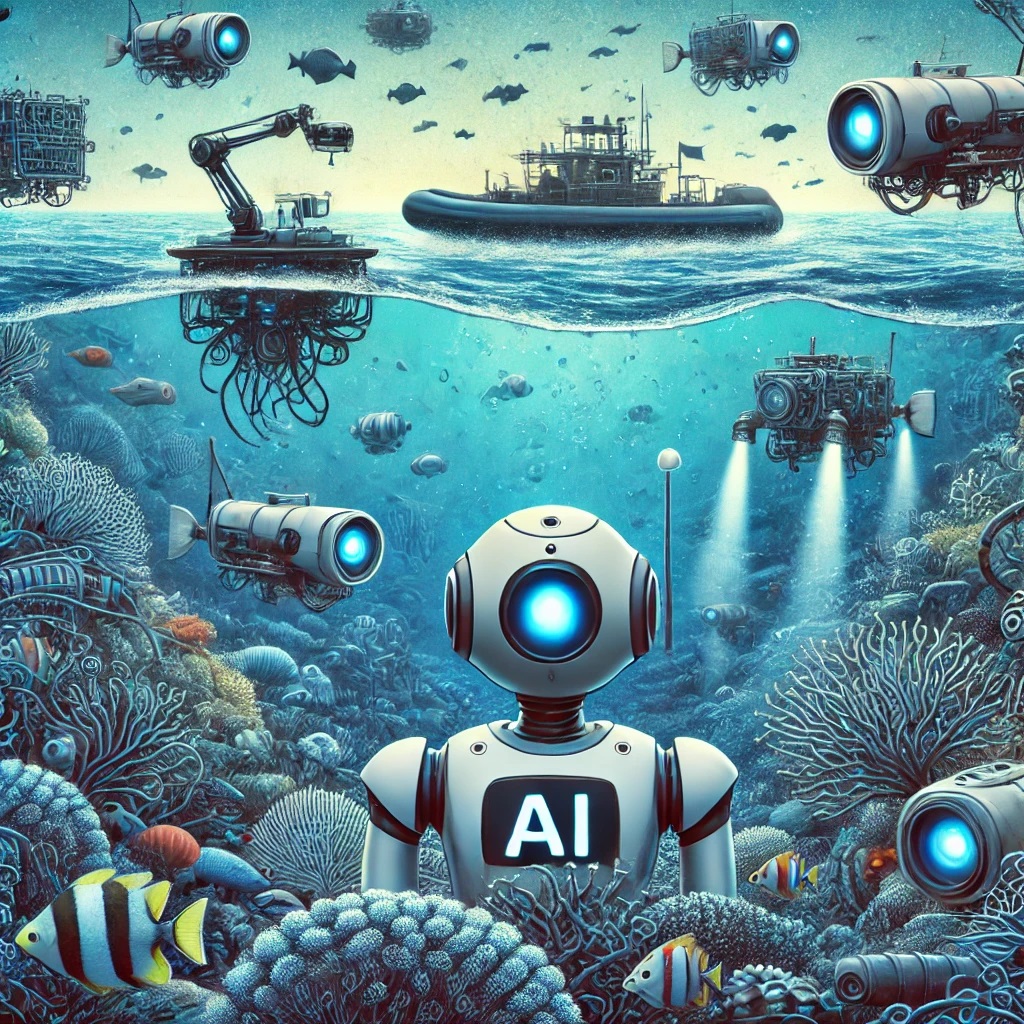

One Stop Systems (OSS) by powering autonomous military robots on the ocean is likely to gain many times more than DRO in the upcoming weeks. Although Trio-Tech (TRT) has a lower enterprise value/revenue ratio than OSS, we see OSS as having a much higher chance of "catching on fire" due to its AI aspects. It could easily gain by 50% or more before the end of 2024.

Augusta Gold (TSX: G) is in the process of being sold to the highest bidder. It is not speculative that it may get sold. Considering that Richard Warke added US$4 million worth of shares last year at $1.33 per share it is absolutely mind-boggling to us it closed today at only $1.38 per share. Do you think Richard Warke ran this company for four years to sell it for $1.38 per share?!?! He paid $1.20 per share for his initial position in 2020!

Yes, Richard Warke's Solaris Resources (TSX: SLS) will also get acquired soon, but probably not until 1Q or 2Q 2025.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA's President has purchased 224,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.