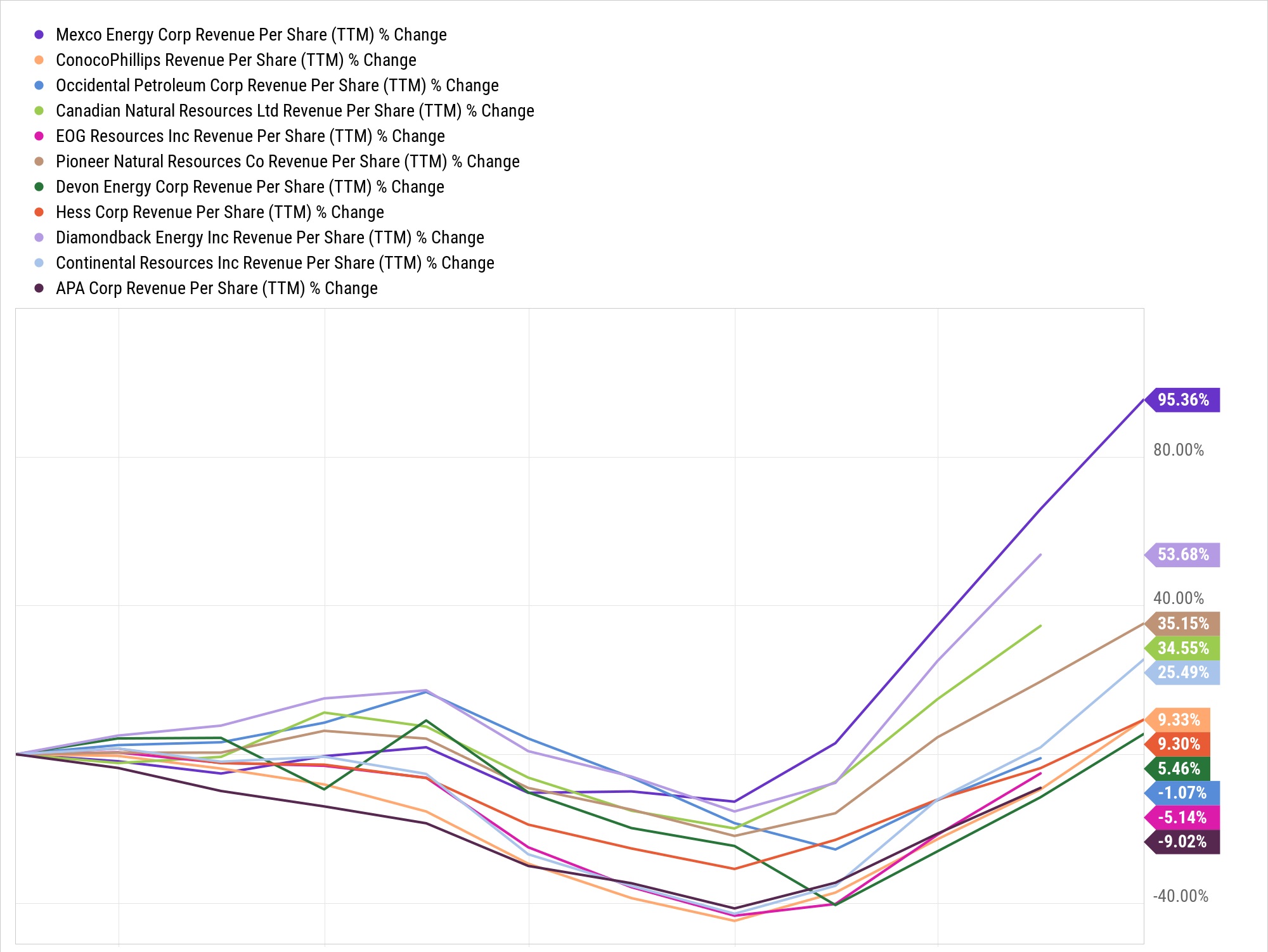

Over the last three years, Mexco Energy (MXC) has increased its revenue per share by 95.36%, which is much stronger than all of the world's high market cap oil producers.

During this same time period:

Diamondback Energy (FANG)'s revenue per share has grown by 53.68%.

Pioneer Natural Resources (PXD)'s revenue per share has grown by 35.15%.

Canadian Natural Resources (CNQ)'s revenue per share has grown by 34.55%.

Continental Resources (CLR)'s revenue per share has grown by 25.49%.

ConocoPhillips (COP)'s revenue per share has grown by 9.33%.

Hess (HES)'s revenue per share has grown by 9.30%.

Devon Energy (DVN)'s revenue per share has grown by 5.46%.

Occidental Petroleum (OXY)'s revenue per share has declined by 1.07%.

EOG Resources (EOG)'s revenue per share has declined by 5.14%.

APA Corp (APA)'s revenue per share has declined by 9.02%.

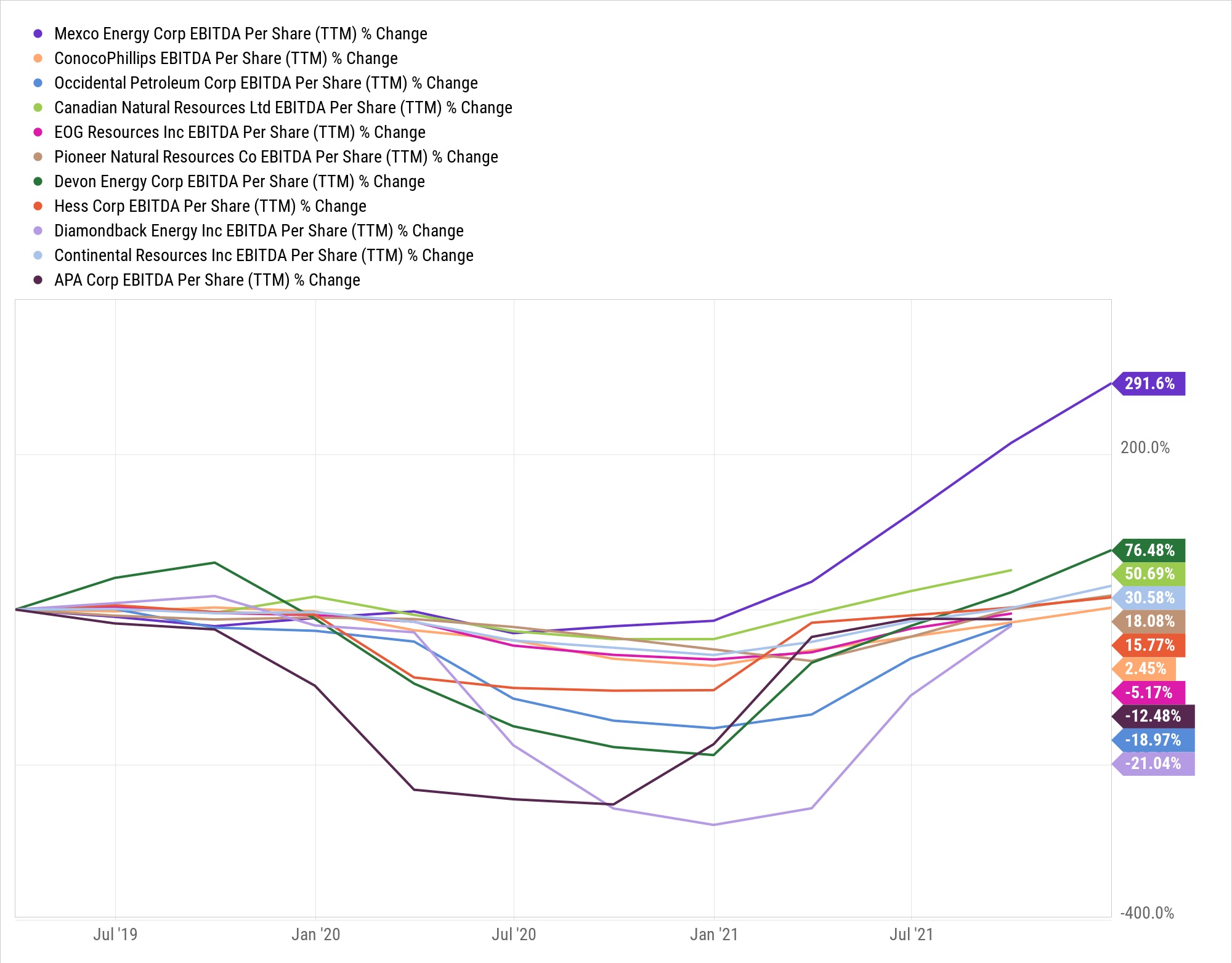

Over the last three years, Mexco Energy (MXC) has increased its EBITDA per share by 291.6%, which is much stronger than all of the world's high market cap oil producers.

During this same time period:

Devon Energy (DVN)'s EBITDA per share has grown by 76.48%.

Canadian Natural Resources (CNQ)'s EBITDA per share has grown by 50.69%.

Continental Resources (CLR)'s EBITDA per share has grown by 30.58%.

Pioneer Natural Resources (PXD)'s EBITDA per share has grown by 18.08%.

Hess Corp (HES)'s EBITDA per share has grown by 15.77%.

ConocoPhillips (COP)'s EBITDA per share has grown by 2.45%.

EOG Resources (EOG)'s EBITDA per share has declined by 5.17%.

APA Corp (APA)'s EBITDA per share has declined by 12.48%.

Occidental Petroleum (OXY)'s EBITDA per share has declined by 18.97%.

Diamondback Energy (FANG)'s EBITDA per share has declined by 21.04%.

MXC is extremely undervalued and will breakout big into the $15-$20 per share range.

MXC won't gain nearly as much as North Peak Resources (TSXV: NPR), but huge gains are ahead for MXC.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA's President has purchased 201,000 shares of NPR in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.