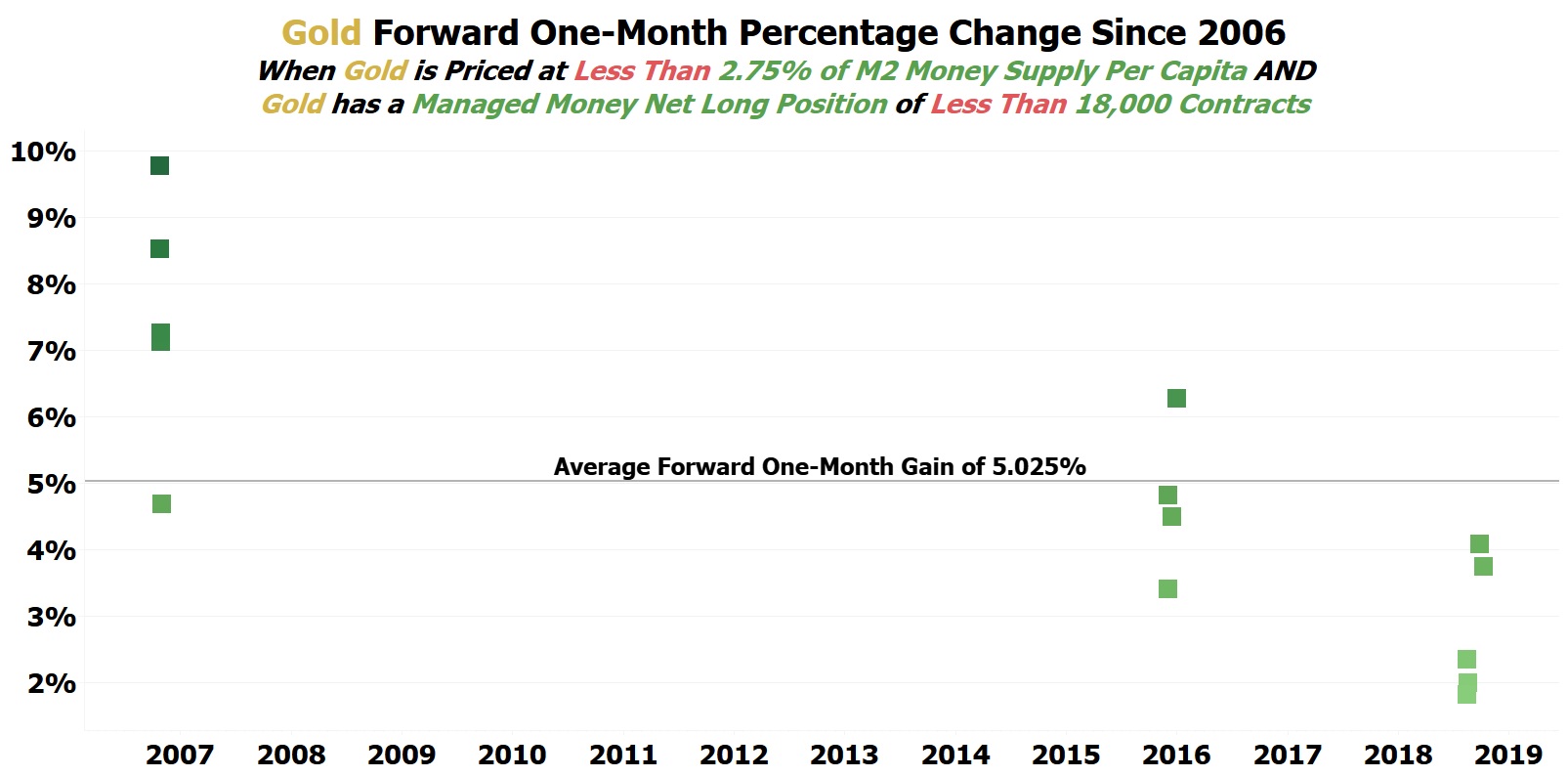

Since 2006, when gold is priced at less than 2.75% of M2 Money Supply Per Capita at the same time as gold having a managed money net long position of less than 18,000 contracts, gold achieves an average forward one-month gain of 5.025%. Not once since 2006 has gold declined over the following one-month period under these conditions. Note: Commitment of Traders Data is Only Available Since 2006.

A 5%+ increase in the price of gold will likely result in Augusta Gold (TSX: G) gaining by 50%-100% over the next month.

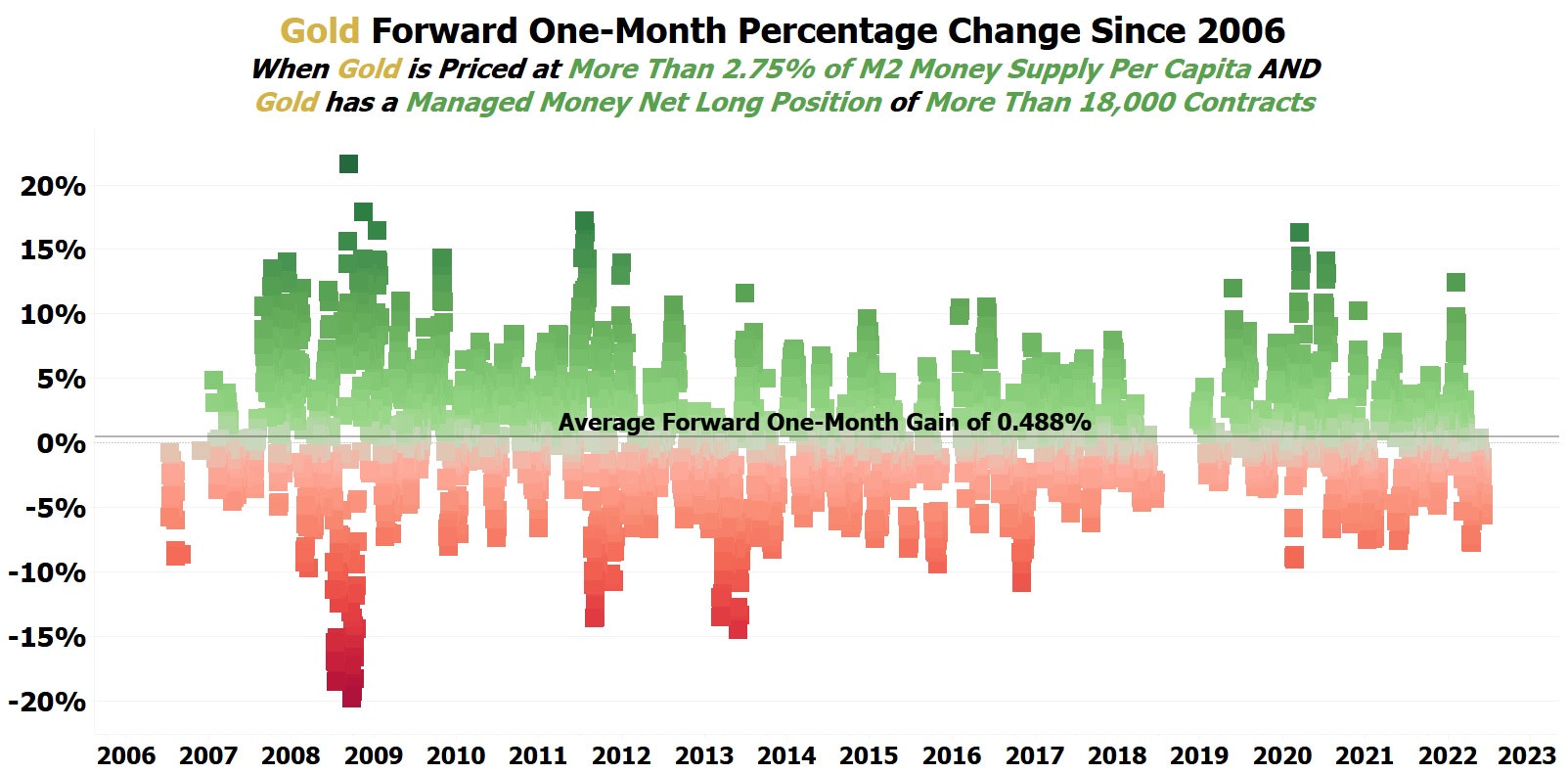

In comparison, under the opposite conditions...

Since 2006, when gold is priced at more than 2.75% of M2 Money Supply Per Capita at the same time as gold having a managed money net long position of more than 18,000 contracts, gold achieves an average forward one-month gain of 0.488%. Note: Our initial post said 0.265% by mistake we have corrected the chart and updated this post.

Gold under its current conditions is likely to perform 10.30X better over the next 30 days compared to when gold has the opposite conditions! Note: Our initial post said 18.96X by mistake we have corrected the chart and updated this post.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA's President has purchased 174,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.