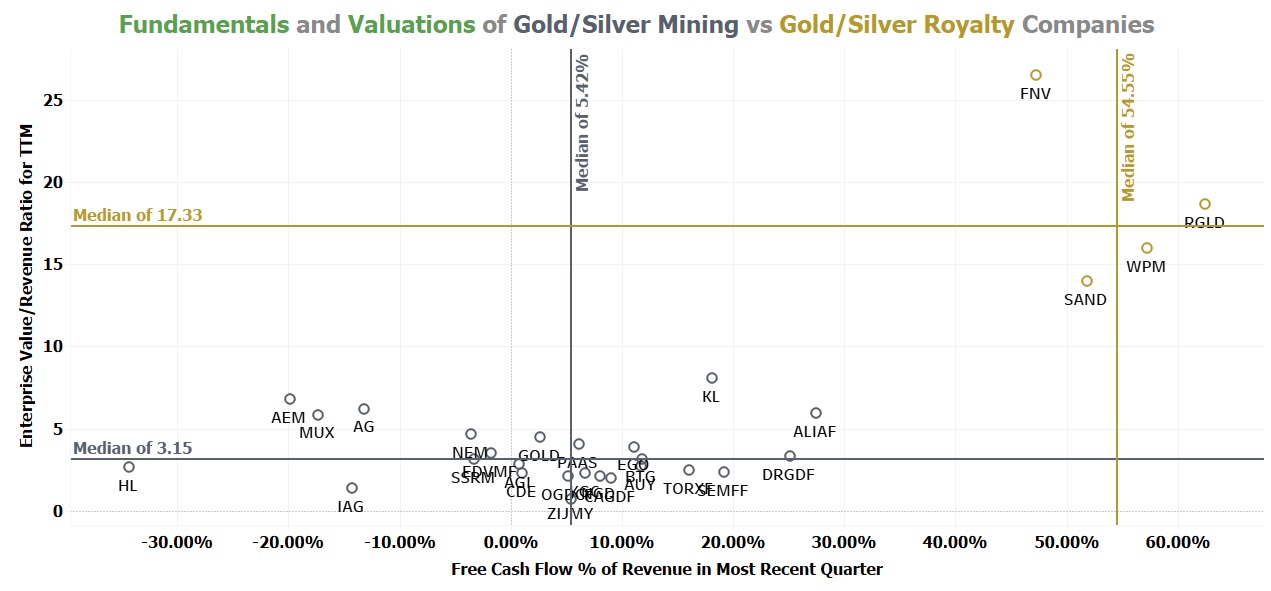

NIA has put together a chart showing how the median gold royalty company owned by VanEck Vectors Gold Miners ETF (GDX) is trading with an enterprise value/revenue ratio of 17.33, which is 5.50X higher than the median gold mining company owned by GDX. Why are gold royalty companies worth so much more than gold mining companies? The median gold royalty company generated free cash flow last quarter equal to 54.55% of revenue vs. the median gold mining company generating free cash flow equal to only 5.42% of revenue!

Wallbridge Mining (TSX: WM) is up another 12% today to $0.56 per share making it by far the #1 best performing mid/large-cap gold stock in the entire market! WM's market cap is now CAD$279.22 million and after subtracting its cash position of CAD$14.6 million it has an enterprise value of CAD$264.62 million. NIA's Ely Gold Royalties (TSXV: ELY) holds a 2% NSR royalty in WM's Fenelon project!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA has received compensation from ELY of USD$30,000 cash for a six-month marketing contract. Never make investment decisions based on anything NIA says. This message is meant for informational and educational purposes only and does not provide investment advice.