It would be impossible for NIA to imagine a more perfect chart than what Arianne Phosphate (TSXV: DAN) has today after finishing Friday at its high of day, week, month, and year! DAN rallied for a third consecutive day on Friday by gaining another 5.26% to a new 52-week closing high of $0.60 per share!

On the morning of Tuesday, March 23rd, NIA announced DAN at $0.265 per share as its #1 favorite agriculture stock suggestion. DAN closed Friday, March 26th at $0.38 per share and gapped up on Monday, March 29th to an opening price of $0.41 per share before closing March 29th up to $0.47 per share. During the initial five trading day rally of Tuesday, March 23rd through Monday, March 29th, DAN traded its strongest 5-day volume of the year totaling 2,079,310 million shares or 5.46X above average.

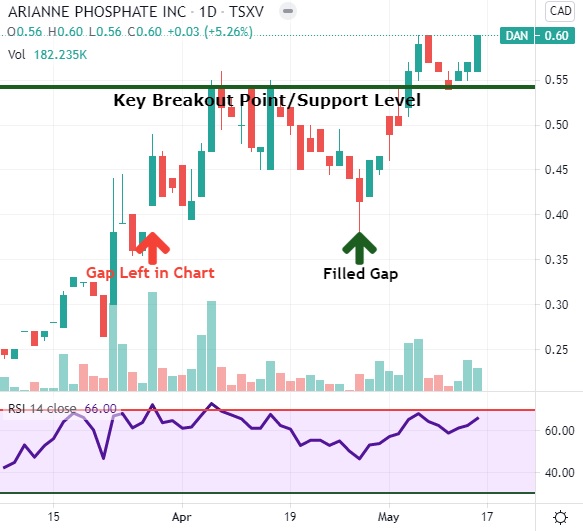

On the following day of Tuesday, March 30th, NIA warned, "Please be aware that because DAN gapped up yesterday morning we may see a brief dip to $0.38 per share prior to DAN resuming its rally." Between Tuesday, March 30th and Monday, April 5th, DAN dipped to a low of $0.40 per share, but did not fill in the gap. During this four trading day dip, DAN traded relatively light volume totaling 583,440 shares or 145,860 shares per day.

Between Tuesday, April 6th and Wednesday, April 7th, DAN bounced strongly from its short-term bottom of $0.40 per share and rallied to a new 52-week closing high of $0.54 per share! DAN traded its strongest 2-day volume of the year totaling 1,167,800 shares or 7.67X above average. This rally was fueled by breaking news out of Central Florida that the Piney Point phosphate plant's phosphogypsum stack containing 480 million gallons of radioactive water was failing putting over 300 homes at risk of being hit by a 20 foot high radioactive tsunami.

DAN's Lac à Paul project in Quebec, Canada contains one of North America's largest reserves of igneous phosphate rock, which is a rare type of "green" phosphate rock that is low in contaminants and typically sells for a large premium above the sedimentary phosphate rock produced in Central Florida. World phosphate rock resources are estimated by the U.S. Geological Survey to be 95% sedimentary and 5% igneous. Unfortunately, sedimentary phosphate rock is high in toxic heavy metals and responsible for arsenic, lead, cadmium and mercury being found throughout much of America's food supply including baby food!

DAN had resistance at $0.54 per share and dipped to a low one week later on Wednesday, April 14th of $0.45 per share. During this five trading day decline, DAN traded light volume totaling 504,865 shares or 100,973 shares per day.

On Thursday, April 15th, DAN exploded back up to a closing price of $0.54 per share in a single day on strong volume of 237,365 shares. DAN announced major news on April 15th about a 50-year agreement with the Port of Saguenay to construct a maritime loading facility on the north shore of the Saguenay River from which DAN will be shipping its high grade igneous phosphate concentrate globally.

DAN once again had resistance at $0.54 per share and declined over the following nine trading days to a low on Wednesday, April 28th of $0.38 per share thereby successfully filling in its March 29th gap up! During this nine trading day decline, DAN traded very light volume totaling 745,344 shares or 82,816 shares per day.

Immediately after bottoming at $0.38 per share to successfully fill in its March 29th gap up... DAN began to bounce big! Between Thursday, April 29th and Thursday, May 6th, DAN gained on six straight trading days while trading strong 6-day volume totaling 1,403,478 shares or 3.07X above average! On Wednesday, May 5th, DAN successfully surpassed its key breakout point of $0.54 per share! On Thursday, May 6th, DAN exploded to a new 52-week closing high of $0.59 per share!

Between Friday, May 7th and Tuesday, May 11th, DAN experienced a healthy three trading day dip down to $0.54 per share on very light volume totaling 253,605 shares or 84,535 shares per day. By bottoming on Tuesday, May 11th at a closing price of $0.54 per share, DAN's previous key breakout point has now become a key support level!

Since bottoming this past Tuesday at its key support level, DAN has rallied for the last three straight trading days on much stronger 3-day volume totaling 501,015 shares or nearly double its volume during the prior three trading day dip! DAN finished last week at a 52-week high of $0.60 per share!

DAN's 14-day relative strength index (RSI) is at a healthy level of 66 meaning that DAN has much more upside prior to its RSI entering overbought territory! When DAN first closed at $0.54 per share on April 7th it had an RSI of 73.09! When DAN gapped up on March 29th and closed that day at $0.47 per share it had an RSI of 72.52!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA has received compensation from DAN of USD$30,000 cash and expects to receive options to purchase 100,000 shares of DAN stock with an exercise price based on the closing price of the stock on the day before the options get issued for a six-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.