Yesterday at 3PMEST, NIA suggested Blink Charging (BLNK) February 26th $50 put options. The first trade for this contract following NIA's alert was at $9.80 so we are going to use that price as our official suggestion price. NIA's BLNK put option suggestion rallied to a closing price of $10.50 after trading a total of 210 contracts during yesterday's final hour of trading.

The market share leader of the EV charging industry is ChargePoint, which is currently in the process of merging into a SPAC called Switchback Energy Acquisition (SBE). The deal will close on February 11th and ChargePoint will begin trading that day under a new symbol. ChargePoint post merger will have 306 million shares outstanding. Based on SBE's closing price yesterday of $42.51 per share, ChargePoint will have a market cap of $13 BILLION. In 2020, ChargePoint generated revenue of $144.515 million for growth of 57% over 2019 revenue of $92.03 million. ChargePoint will be worth an estimated 90X revenue.

BLNK has current trailing twelve month revenue of $4.478 million. Exactly five years ago, BLNK had trailing twelve month revenue of $3.842 million. BLNK has only managed to achieve total revenue growth over a period of FIVE YEARS of 16.55% vs. ChargePoint's revenue growth of 57% last year alone!

On Google Play, ChargePoint's mobile app has a very positive average rating of 4.6 stars: click here to see.

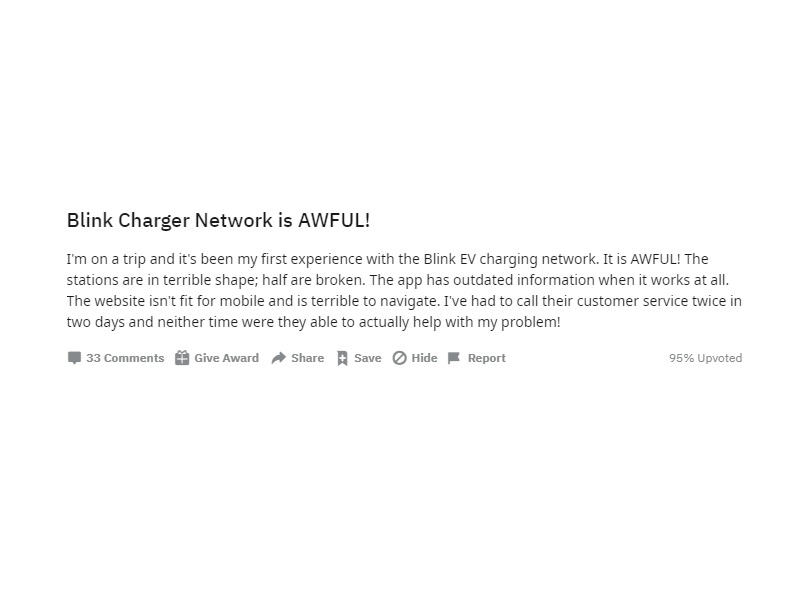

On Google Play, BLNK's mobile app has an extremely negative average rating of 2.3 stars: click here to see.

BLNK's average rating is HALF the average rating of ChargePoint, because everybody says that BLNK's chargers are extremely slow and many of them are completely broken!

If we IGNORE all of these facts and pretend that BLNK deserves to trade at the same multiple as ChargePoint of 90X revenue, this would only value BLNK at $405 million. Prior to BLNK's registered public offering announced on Friday, it had 35.95 million shares outstanding. A $405 million market cap would value BLNK at $11.27 per share. This means BLNK needs to crash by 78.32% for it to match the same multiple that ChargePoint will trade at!

Today, BLNK will be closing on its registered public offering, selling 5.4 million shares at $41 per share or a 21.15% discount to yesterday's closing price. The company will receive net proceeds of $211.2 million in cash, but its shares outstanding will increase to 41,610,025. BLNK's CEO is personally selling 540,000 of his own shares in this offering!

BLNK's post offering market cap at $52 per share will be $2.164 BILLION or 483X revenue! We have never encountered a bigger put option opportunity in our lives!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. This message is meant for informational and educational purposes only and does not provide investment advice.