Austin Gold (AUST) has no resources of gold and at best has maybe found 1m of 8 g/t gold in a drill hole on one of its properties, yet it is up by 336% year-to-date.

The largest gaining gold stocks so far this cycle, won't be the largest gaining gold stocks a few months from now. People are buying random stocks without doing any research.

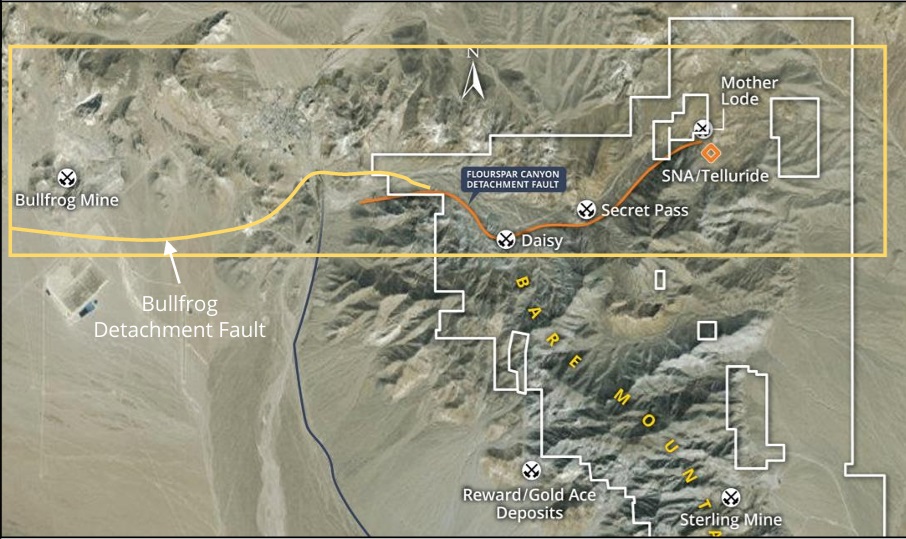

If you do research, you will see that AngloGold Ashanti (AU) paid $150 million for the Sterling Gold Project in September 2022 when gold was $1,700 per oz (gold is about to hit $2,800 per oz). Today, Sterling would be worth $250 million.

Although Sterling has infrastructure that AU is fully permitted to restart, most of the gold on its property is located in the "crown block" to the north, which isn't fully permitted and is much further away from its infrastructure than Augusta Gold (TSX: G)'s Reward+Gold Ace gold deposits. Augusta Gold (TSX: G)'s fully permitted Reward+Gold Ace gold deposits are directly adjacent to AngloGold Ashanti (AU)'s fully permitted Sterling Gold Project infrastructure!

It will be so obvious in hindsight after Augusta Gold (TSX: G) gets acquired very soon. Nobody will give us any credit for discovering it.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA's President has purchased 224,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.