First of all, Dakota Gold (DC) is trading at a market cap of US$205.12 million. For Augusta Gold (TSX: G) to reach the same valuation even after the repayment of debt that its Executive Chairman loaned to the company to buy the Reward Gold Project because he knew AngloGold Ashanti (AU) would need it and it would cause G to get acquired at a much higher share price after gold prices surpass $2,600 per oz... a US$205.12 million enterprise value would value G at $2.85 per share.

Both DC and G deserve to be worth much more than US$205.12 million, but the upside for G is much more because it is currently trading at such an insanely low valuation.

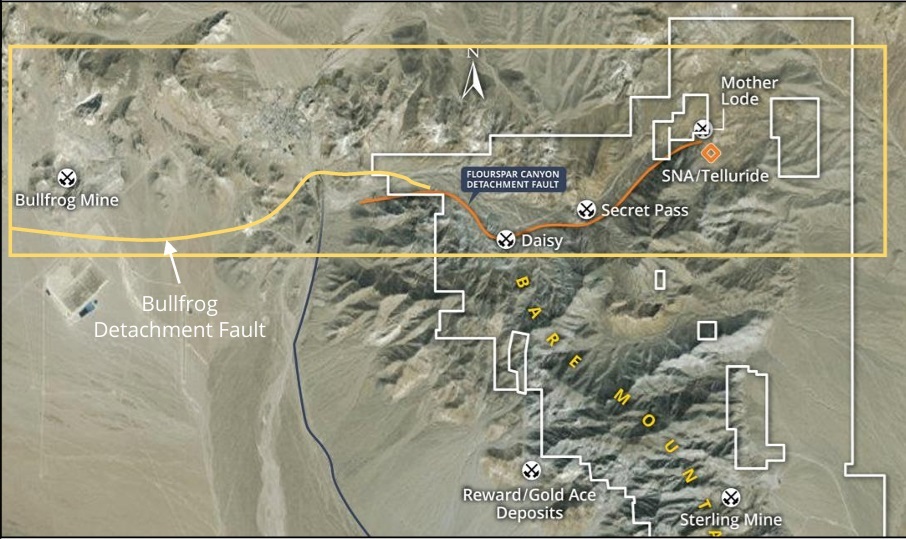

The Beatty Gold District where Augusta Gold (TSX: G)'s gold projects are located is a 19.5 million oz gold district today. Not in the future. The Beatty Gold District has 19.5 million oz of gold today. Only Newmont/Barrick's Nevada Gold Mines have a U.S. gold district with more gold than this, but it is already in production. AngloGold Ashanti (AU) needs Augusta Gold (TSX: G)'s assets for both its North Bullfrog development project and to bring Sterling back into production.

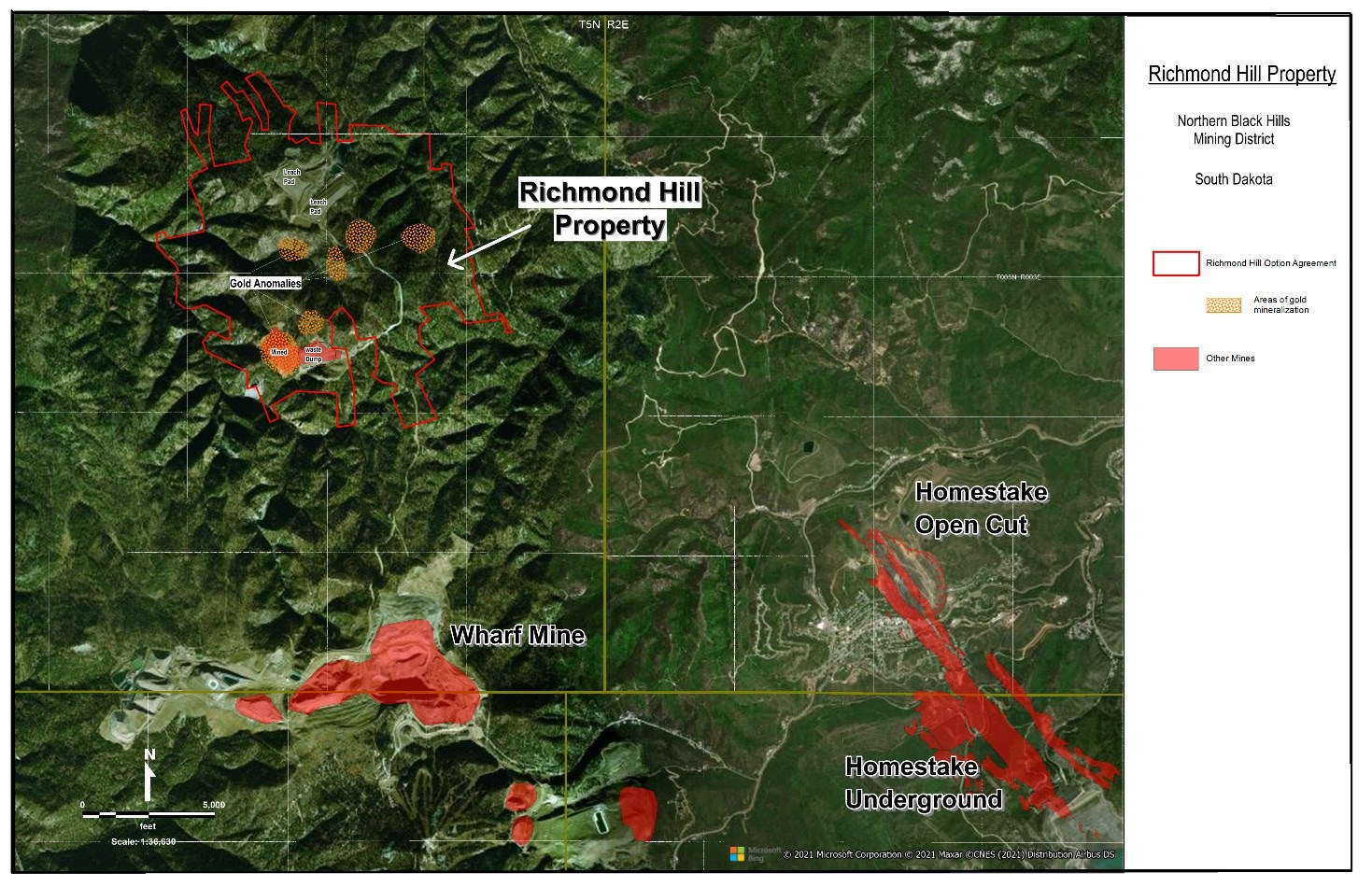

The Homestake Gold District where Dakota Gold (DC)'s gold projects are located historically produced over 40 million oz of gold. Where gold has been found in the past you are likely to find more gold there in the future. There is potential for new discoveries in the Homestake Gold District that turns it into another Beatty Gold District in the future. Today, the Homestake Gold District doesn't have anywhere close to the gold the Beatty Gold District has.

DC's Richmond Hill Gold Project definitely has development potential in the future and after DC completes a Feasibility Study 12-24 months from now, it's possible DC could get bought out then, perhaps by Coeur Mining (CDE).

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA's President has purchased 224,200 shares of G in the open market and intends to buy more shares. NIA received compensation from DC of US$30,000 cash for a three-month marketing contract which has since expired. This message is meant for informational and educational purposes only and does not provide investment advice.