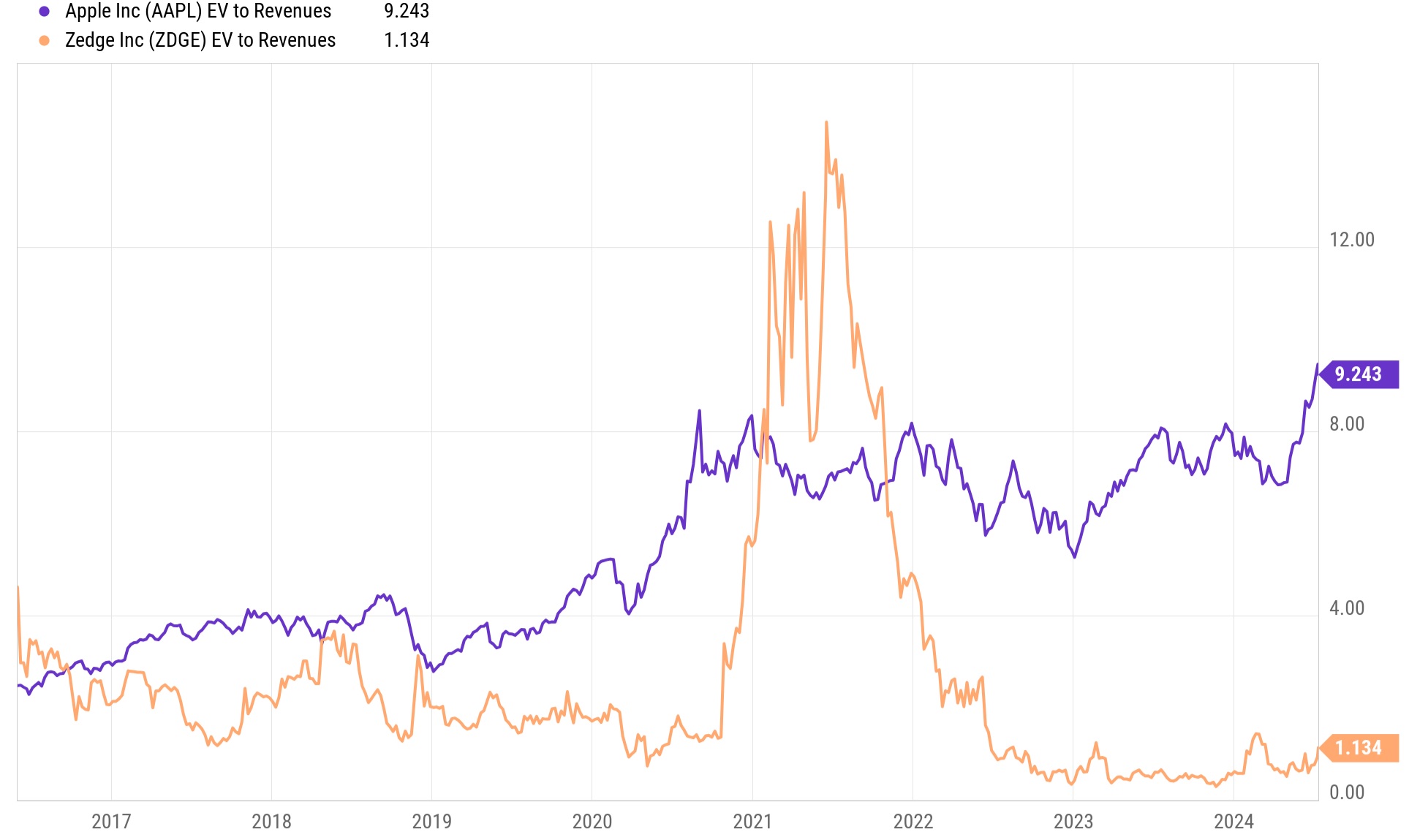

Apple (AAPL) closed yesterday with an enterprise value/revenue ratio of 9.243 vs. Zedge (ZDGE) having an enterprise value/revenue ratio of 1.134.

AAPL's enterprise value/revenue ratio is 8.15X higher than ZDGE.

Three years ago, ZDGE had an enterprise value/revenue ratio of more than double the enterprise value/revenue ratio of AAPL.

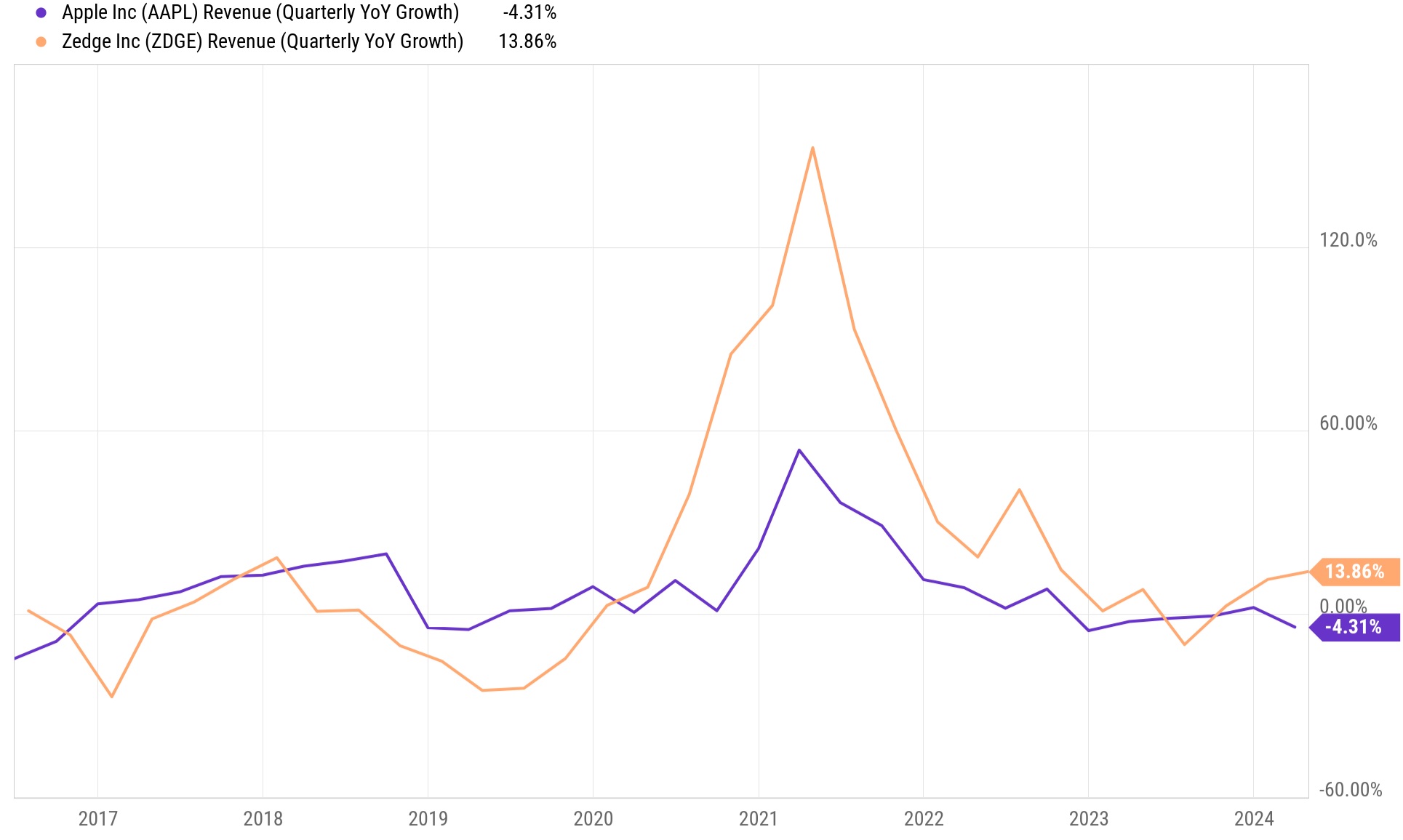

AAPL's enterprise value/revenue ratio hit a new all-time high this week, despite AAPL's revenue last quarter declining by -4.31% year-over-year.

ZDGE's enterprise value/revenue ratio is near its lowest in history, despite ZDGE's revenue last quarter growing by 13.86% year-over-year.

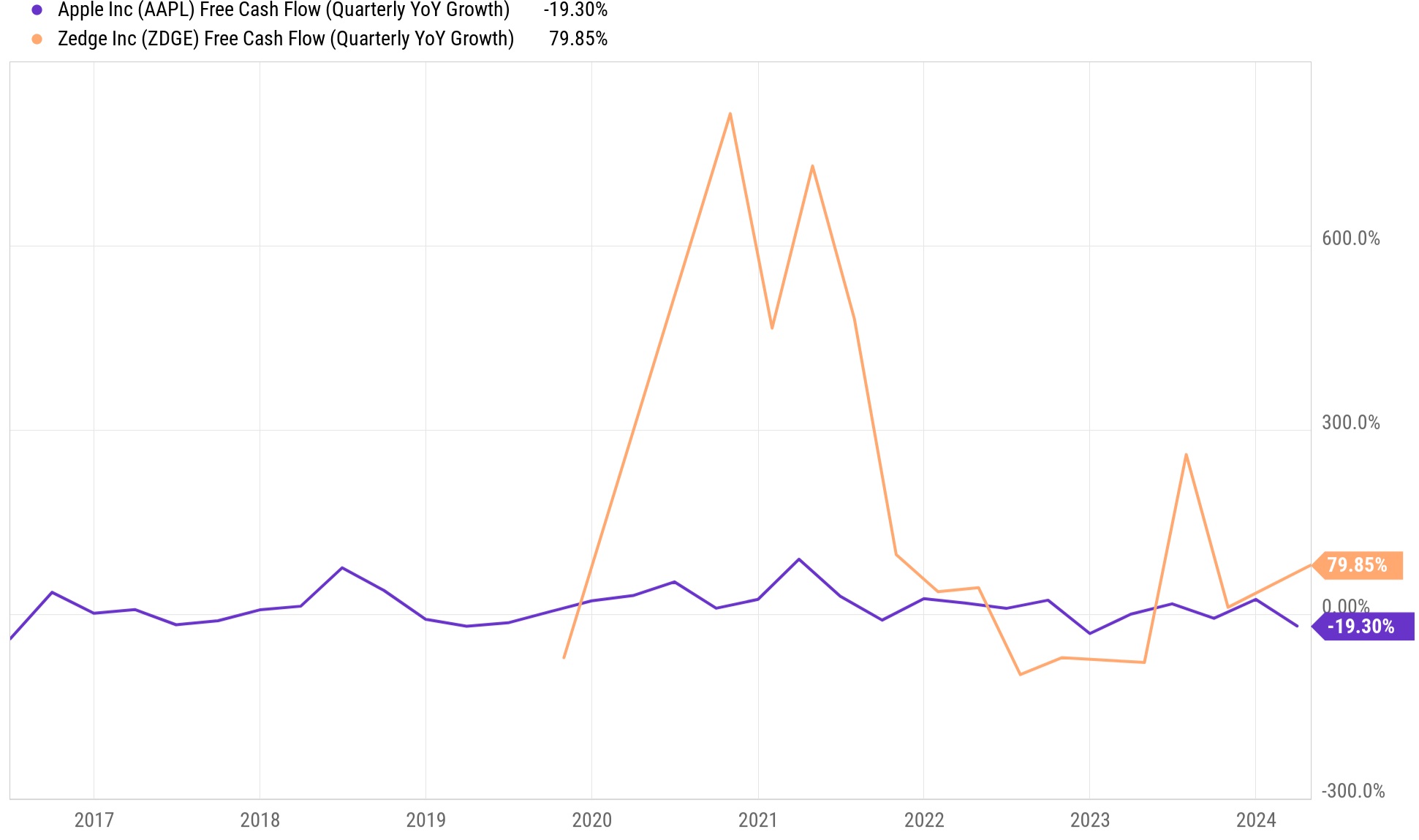

ZDGE's free cash flow last quarter grew by 79.85% year-over-year vs. AAPL's free cash flow last quarter declining by -19.30% year-over-year.

Americans have become too lazy to research their own stocks. They simply pour money into U.S. Index Funds week after week with a large portion of the proceeds getting invested into the most overvalued stocks of all, which combined with unethical share buybacks causes them to become even more overvalued. As soon as these flows into U.S. Index Funds begin to reverse, America's largest technology stocks including AAPL and Nvidia (NVDA) will decline by 70%-80%. As AAPL and NVDA crash by 70%-80%, fundamentally undervalued small-cap technology stocks like ZDGE along with the highest quality gold exploration stocks, recession proof international football stocks, and rapidly growing AI healthcare stocks will gain by 100%-10,000%.

At some point in the not-too-distant future, ZDGE will once again trade at a higher enterprise value/revenue ratio than AAPL.

As long as people use smartphones and both Apple and Samsung remain in business, people will have a need for ringtones/wallpapers, and ZDGE with 500 million+ users is the market share leader and will continue to generate massive free cash flow.

ZDGE is using AI technology to help fuel its growth in real life vs. AAPL making plenty of false promises of using AI in the future to potentially return to growth, but in all likelihood AAPL's "AI-enabled iPhone" will be just as successful as the Apple Vision Pro (nobody talks about the Apple Vision Pro only months after its launch).

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is meant for informational and educational purposes only and does not provide investment advice.