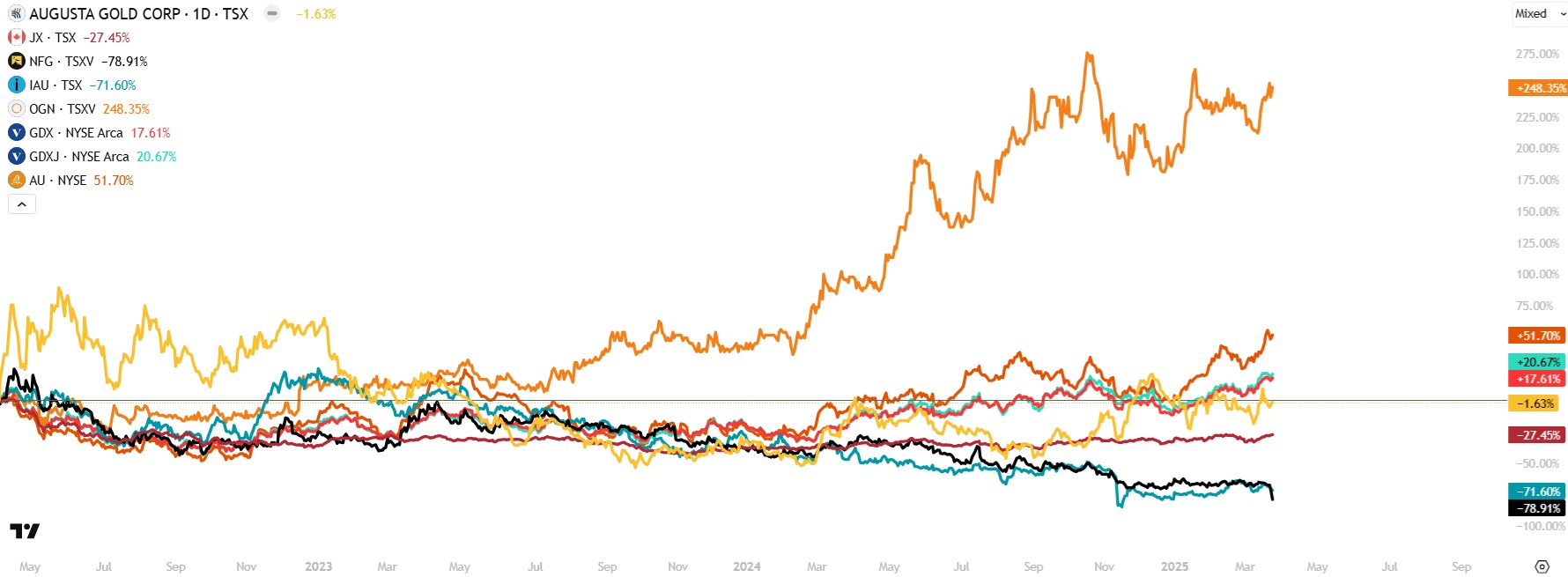

Back when NIA suggested Augusta Gold (TSX: G) on April 6, 2022, the #1 most popular gold exploration stock was New Found Gold (TSXV: NFG). The #1 most popular Nevada based gold exploration stock was i-80 Gold (TSX: IAU).

Click here to read NIA's November 9, 2021 alert entitled 'New Found Gold = Bre-X?'. Click here to read NIA's November 20, 2021 alert entitled 'New Found Gold is NOT Worth the Risk'.

Following NIA's suggestion, Augusta Gold (TSX: G) was initially the world's #1 largest gaining gold stock, rising by 95% during a period when almost all other gold stocks declined.

At some point, everybody either took profits or gave up on Augusta Gold (TSX: G) because gold explorers were in a bear market. Augusta at one point was down by 53.66% from NIA's suggestion price.

While Augusta Gold (TSX: G) Executive Chairman Richard Warke began funding the company out of his own pocket, both NFG and IAU did the opposite. They did ATM offerings the absolute worst thing any company can do (Michael Saylor loves them for Strategy and so does MARA Holdings).

As of today, Augusta Gold (TSX: G) is down by 1.63% from NIA's suggestion price and in good position to breakout to new all-time highs in the weeks/months ahead.

In comparison, New Found Gold (TSXV: NFG) is down by 78.91% and i-80 Gold (TSX: IAU) is down by 71.60%. NFG and IAU have seen so much dilution without anything to show for it that neither have any chance of ever returning to breakeven.

The TSX Venture Composite Index during this time period has declined by 27.45%, but it is about to surpass its key breakout point. As the TSX Venture rallies back to April 2022 levels, Augusta Gold (TSX: G) will rally to prices 500% above NIA's suggestion price.

Both GDX and GDXJ are up by 17.61% and 20.67% respectively since April 2022. What gold miner has strongly outperformed them both? AngloGold Ashanti (AU) with a gain of 51.70% due to its upcoming development of the Beatty Gold District.

What company has strongly outperformed AngloGold Ashanti (AU)? Orogen Royalties (TSXV: OGN) with a gain of 248.35% because it owns a 1% royalty in AU's Expanded Silicon Gold Project in the Beatty Gold District!

Gold miners and gold royalty companies always rally first every cycle, but when the gold explorers/developers begin to rally the miners and royalty companies begin to underperform.

OGN is close to being fully priced and Augusta Gold (TSX: G) will soon catch up to it and surpass it due to its Beatty Gold District properties!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA's President has purchased 224,200 shares of G and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.