The #1 largest newly discovered undeveloped gold district in the U.S. today is the Beatty Gold District. It is about to be developed by Augusta Gold (TSX: G) and AngloGold Ashanti (AU).

After the Beatty Gold District gets developed there isn't going to be any remaining large-scale U.S. gold districts left to be developed.

The question becomes... does any company have the potential to establish a new U.S. gold district similar in size to the Beatty Gold District?

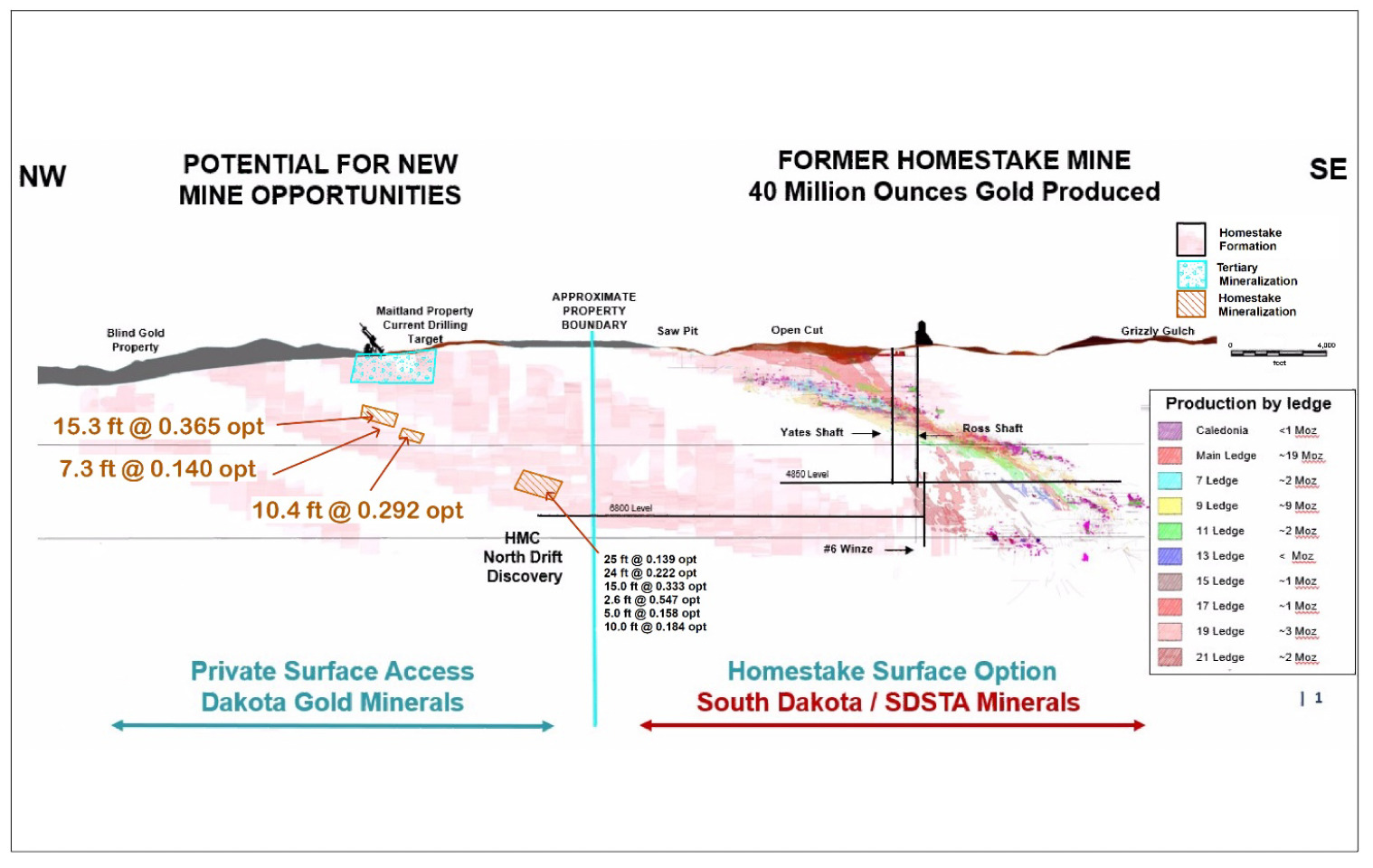

Dakota Gold (DC) is the only company we know of with this type of potential because they are on trend and directly adjacent to the Homestake Mine the #1 largest past producing gold mine in U.S. history that produced $100 billion+ worth of gold at today's prices.

At the Homestake Mine, the main ledge produced 19 million oz of gold, but there were many additional ledges of which seven of them each individually produced anywhere from approximately 1 million oz of gold up to 9 million oz of gold. DC has already discovered multiple high grade gold ledges at its directly adjacent on trend Maitland Gold Project.

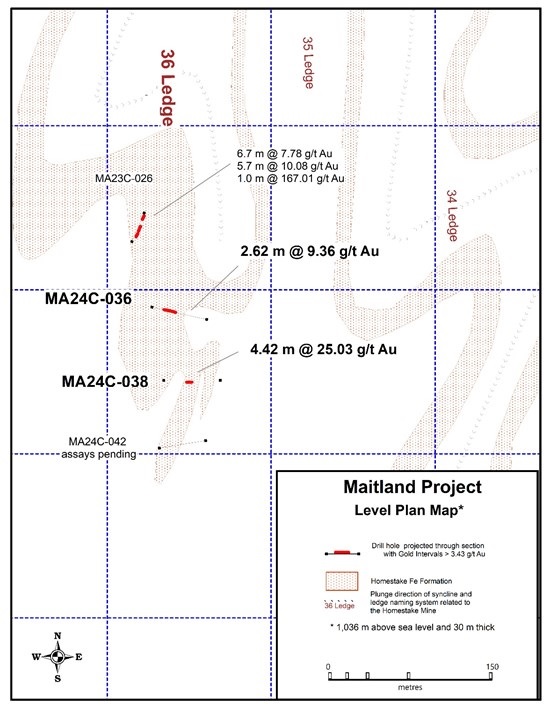

DC discovered 25.03 g/t gold over 4.42 meters last week at 36 Ledge within the JB Gold Zone at Maitland and another drill hole is already pending approximately 100m to the south of this brand new extremely high-grade gold discovery. We will be sending out the results of this pending drill hole as soon as DC announces it. DC has four drills on site and is conducting one of America's largest 2024 gold exploration drilling programs.

Already, DC has intercepted high grade gold in two additional drill holes to the north of this brand new extremely high-grade gold discovery at 36 Ledge! These are all widely spaced drill holes intercepting high grade gold at 36 Ledge!

Normally, a gold explorer would expand upon a discovery like this with closely spaced holes, but DC knows based on the Homestake Mine-style gold mineralization that these high-grade gold discoveries have potential to expand far/wide, so they have been trying to outline the ledge first before seeing exactly how much high-grade gold exists in between these initial widely spaced drill holes. When you are discovering extremely high gold grades like this, even a small amount of high-grade material could result in a large high-grade gold resource that is economically viable to mine.

DC is discovering high-grade gold in many locations across its Homestake District properties. DC expects gold grades to increase significantly as they begin drilling at greater depths later this year.

Coeur Mining generated record cash flow at their Wharf Mine last quarter with average grades of only 0.92 g/t gold. Coeur Mining has received approval to expand their Wharf Mine in the Homestake District and Agnico Eagle has been actively drilling at Gilt Edge a past producing gold mine it may seek to reopen in the Homestake District.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA's President has purchased 224,200 shares of G in the open market and intends to buy more shares. NIA has received compensation from DC of US$30,000 cash for a three-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.