Highlander Silver (CSE: HSLV)’s San Luis gold/silver project in Peru represents a high-potential asset due to its bonanza-grade historical resources and district-scale exploration upside. The project’s Ayelén and Inés vein systems host a historical measured and indicated resource of: 348,000 ounces of gold (22.4 g/t Au) and 9.0 million ounces of silver (578.1 g/t Ag). These grades rank among the highest globally for unmined deposits.

San Luis is among the top 1% of gold grades and top 5% of silver grades worldwide — but no other known project has both.

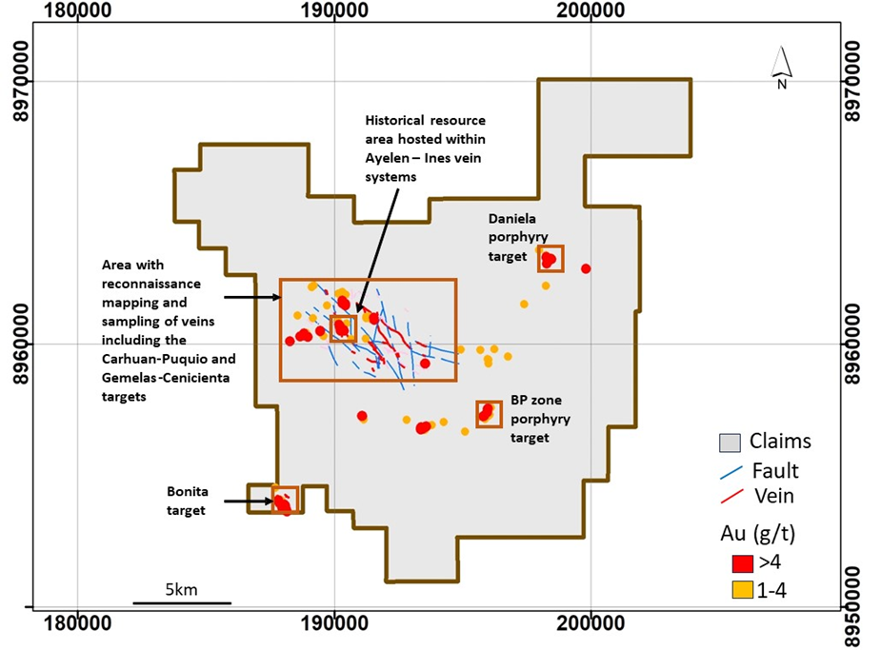

Spanning 230 km², San Luis includes multiple underexplored targets. Ayelén-Inés remains open at depth and along strike. Targets include low-intermediate sulfidation epithermal veins, copper-molybdenum porphyries, hydrothermal breccias, and replacement mantos. Rock samples have shown silver grades up to 15,000 g/t, with historical metallurgical testwork showing gold and silver recoveries of ≥90%.

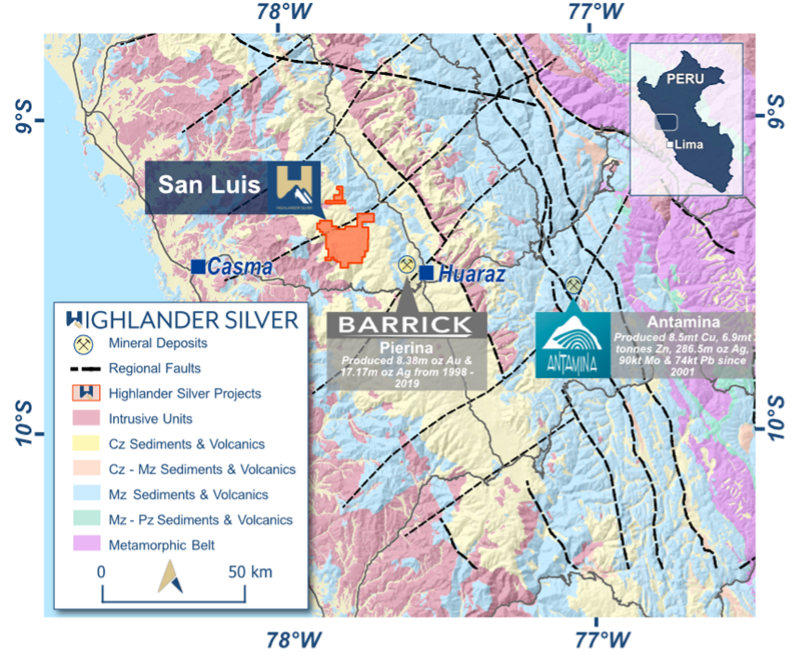

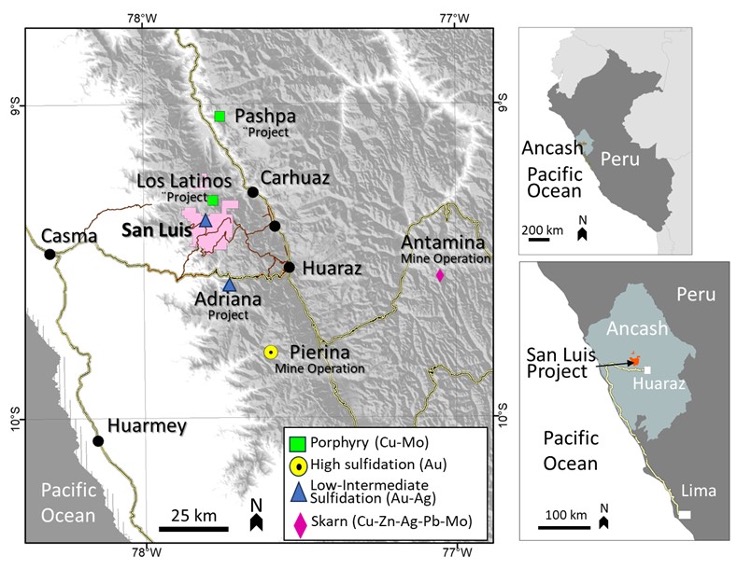

Located near Barrick’s Pierina (5M oz Au produced) and Antamina (world’s largest copper/zinc mine), HSLV benefits from robust infrastructure including roads, power, and water.

Based on 96 trenches and 136 drill holes, the Ayelén-Inés system shows 348,000 oz Au (22.4 g/t) and 9,003,300 oz Ag (578.1 g/t). These historical figures are not NI 43-101 compliant, but they establish a remarkable base for future validation.

Targets like Bonita show incredible promise, with intercepts like 35.25m @ 5.54 g/t Au & 25.43 g/t Ag from 19.1 m downhole in drill hole BOD-001 (but never followed up on with only two historical drill holes at Bonita). Seven additional undrilled gold-silver vein targets have been defined including Carhuan-Puquio and Gemelas-Cenicienta, within 2 km of the historic resource area. The 2025 drill program is expected to dramatically expand known resources.

In 2025, HSLV raised C$32.3 million through a bought-deal financing led by the Lundin family and Richard Warke. Proceeds will support exploration and resource validation.

The team is trained by legendary explorer David Lowell and backed by the Augusta Group. CEO Daniel Earle previously led Solaris Resources from $1.38 to $17.17 in 18 months. Other key executives include:

Insiders own 40.7%. Major holders include:

Solaris Resources surged from $1.38 to $17.17 in 18 months under the same CEO, Daniel Earle.

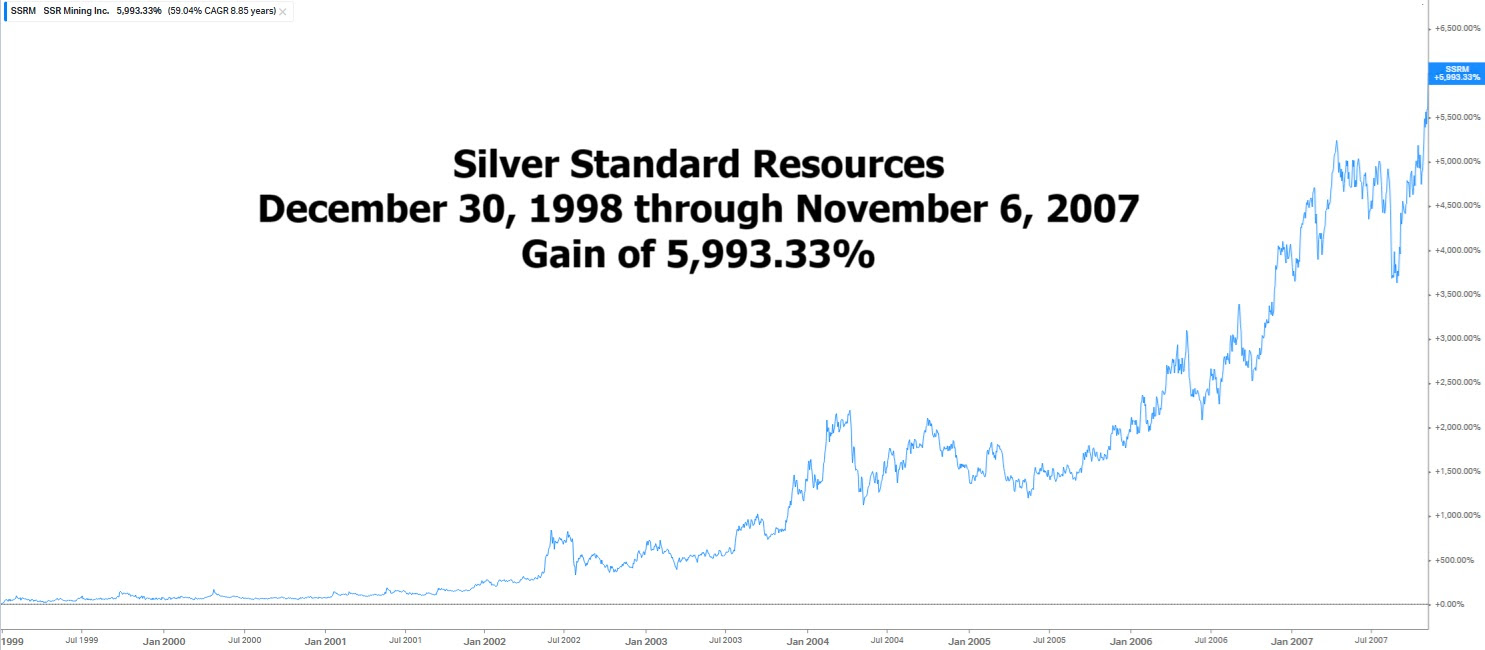

Silver Standard Resources went from $11.88M to $2.83B market cap (5,993% share price increase) between 1998 and 2007 — by expanding its silver resource base without production.

Their #2 principal project at the time? San Luis. And today it belongs to Highlander Silver.

With world-class grades, seasoned leadership, and an aggressive exploration strategy, Highlander Silver (CSE: HSLV) is positioned to become a top-tier gold/silver explorer. HSLV may soon deliver the highest-grade drill results of the decade, and this could be your chance to get in before the next resource boom. A $1–2 billion market cap is not just possible — it may be inevitable.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA's President has purchased 125,000 shares of HSLV and can buy or sell shares at any time. This message is meant for informational and educational purposes only and does not provide investment advice.