Gold is up by $32.57 this morning to $2,924 per oz!

NIA's President has been accumulating gold stocks and nothing else. Outside of gold stocks, Trio-Tech International (TRT) will gain big in the upcoming months, but very little else!

The current HUI Gold Miners Index/Gold Price Ratio of 0.107 is among the lowest in history and near the January 2016 all-time low of 0.0916 and March 2020 low of 0.0928 .

From those previous two lows, gold miners rallied by 156.37% in 8 months in 2016 and rallied by 182.94% in 5 months in 2020. During these previous two gold miner rallies, the highest quality small-cap gold exploration/development stocks gained by 500%-5,000%.

Today's trailing 24-month HUI Gold Miners Index/Gold Price Ratio of 0.116 is the lowest in history despite soaring gold prices! When the HUI Gold Miners Index/Gold Price Ratio bottomed in January 2016 and March 2020 the trailing 24-month ratios were 0.1397 and 0.1337 respectively.

All gold mining/exploration/development stocks are more undervalued today than at any other time in history!

If you are looking to develop a new gold mine to capitalize on what is about to become the #1 largest bull market for gold and gold stocks in history... the lowest risk and most profitable gold projects to develop are oxide gold heap leach projects in Nevada due to low initial CAPEX and low production costs.

Unfortunately, there are only three publicly traded small-cap gold exploration/development companies that own fully permitted oxide gold projects in Nevada with near-term production potential. NIA's two favorites are: Augusta Gold (TSX: G) and Borealis Mining (TSXV: BOGO).

Augusta Gold (TSX: G) owns the fully permitted Reward Gold Project and adjacent 3x larger past producing Bullfrog Gold Project in North America's #1 largest new gold district that is about to be developed by AngloGold Ashanti (AU). It is likely to be the first gold explorer/developer to be acquired at a massive premium.

Borealis Mining (TSXV: BOGO) owns the fully permitted Borealis Mine with full infrastructure to launch heap leach gold mining operations!

Read this huge BOGO news from yesterday:

Borealis Mining Drills 4.48 g/t Gold over 30.5 Metres Including 15.16 g/t Gold over 6.1 Metres in Oxides at Historical Cerro Duro Deposit in Nevada

Vancouver, British Columbia--(Newsfile Corp. - March 3, 2025) - Borealis Mining Company Limited (TSXV: BOGO) (FSE: L4B0) (the " Company " or " Borealis ") is pleased to announce the assay results from several drillholes at the Cerro Duro and Jaime's Ridge (" JRCD ") deposit areas completed as part of its ongoing drill program at its Borealis Gold Project in the Walker Lane trend of Nevada.

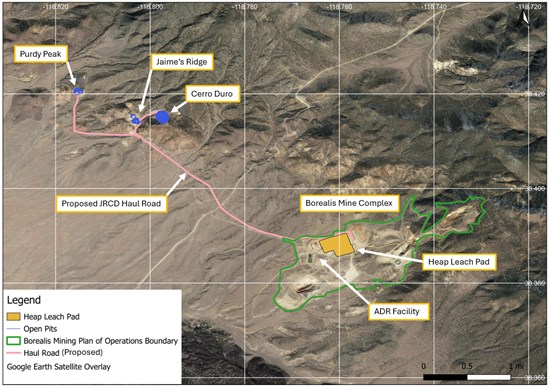

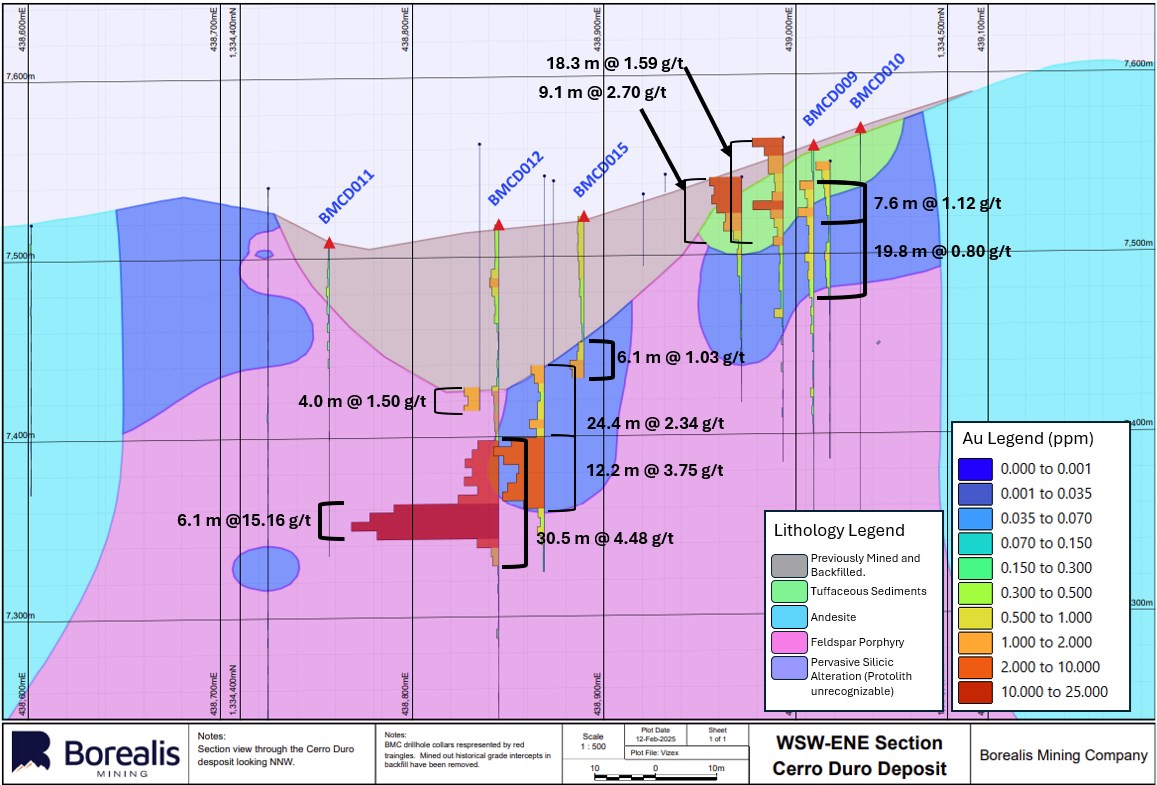

Drilling at the Cerro Duro and Jaimie's Ridge historical gold deposits has demonstrated large widths of highly consistent oxidized gold and silver epithermal mineralization within an extremely silicified and altered body of volcanic rock. Please see Figure 1 for a map of the Cerro Duro and Jaime's Ridge historical deposits relative to the current mine infrastructure, Figure 2 for a map of the drillhole collar locations, Figure 3 for a longitudinal section of several of the holes released, Table 1 for composites of significant Au & Ag assay results from bedrock, Table 2 for composites of significant Au & Ag assay results from historical dump and backfill materials, and Table 3 for drillhole coordinates.

Highlights of bedrock oxide intercepts, located directly below or adjacent to historic open pits, include:

BMCD012 which returned 30.5 m of 4.48 g/t Au & 20.5 g/t Ag including 6.1 m of 15.16 g/t Au & 42.18 g/t Ag of oxide mineralization beginning at 27.4 metres;

BMCD009 which returned 25.9 m of 0.67 g/t Au & 81.81 g/t Ag including 7.6 m of 1.12 g/t Au & 106.28 g/t Ag of oxide mineralization beginning at 6.1 metres;

BMCD015 which returned 21.3 m of 0.58 g/t Au & 14.18 g/t Ag including 6.1 m of 1.03 g/t Au & 20.14 g/t Ag of oxide mineralization beginning at 6.1 metres; and

DHBM001 which returned 8.1 m of 1.89 g/t Au & 13.30 g/t Ag of oxide mineralization beginning at 11.7 metres.

Iain Campbell, VP Exploration of Borealis, comments, "We're very pleased to see the drilling at the historical Cerro Duro gold deposit confirm, and, in some holes, dramatically exceed historical assay results in both grade and width, directly below and adjacent to the historic open pits. Of particular interest is hole BMCD012, which was drilled to increase the strike length adjacent to a historical intercept of 12.2 m of 3.75 g/t Au, which significantly improved upon the expected grade and width, returning 30.5 m of 4.48 g/t Au. In addition to the oxidized bedrock mineralization, drilling has confirmed that the historic backfill overburden and dumps contain appreciable gold mineralization that may provide additional heap-leachable material and minimize stripping costs in future mining scenarios. Results thus far suggest further drilling in and around the historical deposits and open pits at Borealis may lead to near-term expansion of the historically identified mineralization."

Highlights of historical backfill and dump intercepts, located above historic open pits, include:

BMCD012 which returned 16.8 m of 0.54 g/t Au & 20.14 g/t Ag beginning at surface;

BMCD015 which returned 6.1 m of 0.67 g/t Au & 15.00 g/t Ag beginning at surface; and

BMJR001 which returned 9.1 m of 0.80 g/t Au & 11.72 g/t Ag beginning at surface.

The results in this release are largely related to the Cerro Duro historical gold deposit (documented in the current Borealis NI 43-101 Technical Status Report, filed on SEDAR+). The Cerro Duro historical gold deposit is classified as a high-sulfidation epithermal system. It occurs within Miocene andesite volcanics and tuffaceous rocks from surface. Gold is closely associated with oxide mineralization, multi-phase hydrothermal breccias and intense silica alteration. The Cerro Duro deposit is situated on the western side of the Borealis property, west of Lucky Boy Pass ( Figure 1 ). The focus of the drilling reported in today's release is confirmation and testing expansion and/or exploration targets around the western historical deposits on the Borealis project, as suggested by the authors of the current NI 43-101 Technical Report on the project in order to complete an updated resource statement. Borealis intends to continue this effort throughout 2025, focusing on the western portion of the project but also in and around the historical deposits at Borealis within the current permitted footprint.

The JRCD area, comprised of the Cerro Duro, Jaime's Ridge, and Purdy Peak historical deposits, is situated approximately two miles from the Borealis mine plan of operations and related infrastructure. The deposits were discovered in the 1980s and briefly mined towards the end of that decade. As identified in historical mineral resource statements and economic studies, including the 2011 pre-feasibility study completed by Gryphon Gold Corporation, there are indications that significant oxide mineralization remains in place for future extraction. Within the JRCD area, the 2011 historical (and non-current under NI 43-101 standards) resource statement identified 95,600 ounces of gold and 476,500 ounces of silver in the Measured and Indicated categories at a grade of 0.87 g/t Au and 4.35 g/t Ag of oxide and transition material in bedrock at a cutoff grade of 0.22 g/t Au. Today's results confirm and expand upon that previously identified mineralization. Borealis is currently conducting baseline and engineering works with an aim to submit a permit application in early 2026 to the Bureau of Land Management.

Note: A Qualified Person has not completed sufficient work to classify the historical mineral deposits as current mineral resources or mineral reserves under NI 43-101. Borealis cautions that these estimates should not be considered as current and should not be relied upon but have been provided to show context on the potential size of the deposit. Borealis is not treating these estimates as current, and further exploration, drilling, and validation are required before they can be upgraded to current NI 43-101 standards.

Borealis will continue exploration drilling throughout 2025, focusing on expanding known mineralization and unlocking new high-grade zones within and around the permitted footprint. The confirmation of strong oxide gold intercepts, combined with the project's fully permitted infrastructure, positions Borealis for significant near-term growth.

"These results reinforce our belief that Cerro Duro, and the entirety of the Borealis Project, hold substantial untapped potential," added Kelly Malcolm, CEO of Borealis. "With further drilling planned and well-established mining infrastructure in place, we are excited about what's to come. We look forward to updating shareholders on additional pending drillholes and operational updates as we advance toward unlocking even greater value at the Borealis Project."

Figure 1: Plan map showing the locations of the Jaime's Ridge and Cerro Duro historic pit areas (in blue) relative to the Borealis Mine Complex, along with the proposed upgraded haul road (in pink).

Figure 2: Plan map showing the locations of reported drillholes and the historical Jaime's Ridge and Cerro Duro pits.

Figure 3: Longitudinal section of a portion of today's results displayed with historical drill results. Section shown is 24 metres wide. Current drillholes are shown with wider red triangles at the collars. Previously mined historical drill intercepts have been removed.

Table 1: Composite Au & Ag assay results of significant intercepts of the reported drillholes within bedrock. True widths are estimated to be between 75 and 100% of reported widths, as determined by historical drill results and historical modelling, but accurate true widths are not known at this time.

| BHID | From (m) | To (m) | Interval (m) | Au (ppm) | Ag (ppm) | Material |

| BMCD009 | 6.1 | 32.0 | 25.9 | 0.67 | 81.81 | Oxide bedrock |

| including | 6.1 | 13.7 | 7.6 | 1.12 | 106.28 | Oxide bedrock |

| BMCD012 | 27.4 | 57.9 | 30.5 | 4.48 | 20.5 | Oxide bedrock |

| including | 47.2 | 53.3 | 6.1 | 15.16 | 42.18 | Oxide bedrock |

| BMCD015 | 6.1 | 27.4 | 21.3 | 0.58 | 14.18 | Oxide bedrock |

| including | 21.3 | 27.4 | 6.1 | 1.03 | 20.14 | Oxide bedrock |

| BMJR001 | 9.1 | 16.8 | 7.6 | 0.77 | 3.48 | Oxide bedrock |

| DHBM001 | 11.7 | 19.8 | 8.1 | 1.89 | 13.30 | Oxide bedrock |

Table 2: Composite Au & Ag assay results of significant intercepts of the reported drillholes within dump and fill material from historical mining activities. True widths are estimated to be approximately 100% of reported widths.

| BHID | From (m) | To (m) | Interval (m) | Au (ppm) | Ag (ppm) | Material |

| BMCD002 | 3.0 | 10.7 | 7.6 | 0.39 | 1.94 | Dump |

| BMCD004 | 1.5 | 19.8 | 18.3 | 0.38 | 1.48 | Dump |

| BMCD012 | 0.0 | 16.8 | 16.8 | 0.54 | 20.14 | Backfill |

| BMCD015 | 0.0 | 6.1 | 6.1 | 0.67 | 15.00 | Backfill |

| BMJR001 | 0.0 | 9.1 | 9.1 | 0.80 | 11.72 | Backfill |

Table 3: Coordinates and details of today's reported drill results

| BHID | X | Y | Z | Length (m) |

Azimuth | Dip | Target | Comment |

| DHBM001 | 437418 | 1333993 | 7312 | 1000 | 303.35 | -62.61 | Jaimie's Ridge confirmation | Re-drill of DHBM002. |

| DHBM002 | 437403 | 1334005 | 7311 | 167 | 301 | -75 | Jaimie's Ridge confirmation | Poor recovery in mineralized zone. |

| DHBM003 | 436875 | 1334768 | 7447 | 367 | 157 | -54 | Jaimie's Ridge step-out | Prospective alteration profile. No anomalous Au or Ag. |

| BMCD001 | 437495 | 1334272 | 7356 | 1000 | 158.49 | -50.54 | Exploration - JRCD NE Structure | Anomalous mineralization and silicic alteration. |

| BMCD002 | 437112 | 1333208 | 7298 | 620 | 349.67 | -64.11 | Exploration - CSAMT anomaly | Anomalous mineralization and silicic alteration. Gold in dump material. |

| BMCD003 | 437990 | 1334453 | 7383 | 580 | 155.6 | -45 | Exploration - JRCD NE Structure | Anomalous mineralization and silicic alteration. |

| BMCD004 | 437179 | 1333156 | 7298 | 1180 | 342.24 | -60.55 | Exploration - CSAMT anomaly | Anomalous mineralization and silicic alteration. Gold in dump material. |

| BMCD005 | 439180 | 1334382 | 7642 | 330 | 235 | -75 | Cerro Duro step-out | Prospective alteration profile. |

| BMCD006 | 43171 | 1334377 | 7643 | 300 | 0 | -90 | Cerro Duro step-out | Prospective alteration profile. |

| BMCD007 | 439195 | 1334405 | 7642 | 300 | 310 | -76 | Cerro Duro step-out | Prospective alteration profile. |

| BMCD008 | 439223 | 1334402 | 7642 | 300 | 25 | -75 | Cerro Duro step-out | Prospective alteration profile. |

| BMCD009 | 439013 | 1334464 | 7564 | 300 | 0 | -90 | Cerro Duro confirmation | Au in oxides. |

| BMCD010 | 439030 | 1334507 | 7565 | 300 | 0 | -90 | Cerro Duro step-out | Prospective alteration profile. |

| BMCD011 | 438759 | 1334405 | 7511 | 175 | 0 | -90 | Cerro Duro step-out | Prospective alteration profile, anomalous gold up to 0.20 g/t over 12.2 m. |

| BMCD012 | 438845 | 1334440 | 7517 | 350 | 0 | -90 | Cerro Duro confirmation | Au in oxides. Au in backfill. |

| BMCD013 | 438887 | 1334545 | 7510 | 200 | 0 | -90 | Cerro Duro step-out | Prospective alteration profile. Anomalous gold in bedrock and dumps up to 0.15 g/t over 7.62 m |

| BMCD014 | 438764 | 1334550 | 7476 | 200 | 0 | -90 | Cerro Duro step-out | Prospective alteration profile. |

| BMCD015 | 438886 | 1334467 | 7517 | 90 | 0 | -90 | Cerro Duro confirmation | Au in backfill. Au in oxides. Casing issue at bedrock interface. Hole abandoned before final target. |

| BMJR001 | 437420 | 1333974 | 7311 | 310 | 304.9 | -80 | Jaimie's Ridge | Au in oxides. |

Qualified Person and QA&QC

The scientific and technical content of this news release was reviewed, verified, and approved by Iain Campbell, P.Geo., VP Exploration of the Company, and a Qualified Person as defined by Canadian Securities Administrators' National Instrument 43-101 - Standards of Disclosure for Mineral Projects. However, certain data presented here, including historical resources and certain drill results, are pre-NI 43-101 estimates and should not be relied upon as current mineral resources or reserves.

The quality assurance and quality control protocols in place at Borealis include insertion of blank or standard samples every 10 samples on average, in addition to the regular insertion of blank, duplicate, and standard samples by the analytical laboratory during the assay process. The assay results presented herein are derived from both diamond drill core and RC drill chips. For diamond drill core, geologists mark out samples for geology technicians to saw in half, from which one half is retained at the Borealis mine site and the other half is submitted for assay. For RC drilling, geologists supervise riffle splitting of RC return at the drill site. Samples were submitted to both ALS Global's Reno, NV laboratory and Paragon Geochemical's Sparks, NV laboratory. At ALS, samples were treated with a 30 gram fire assay with an AA finish, along with a four-acid multi-element analysis (MS-MS61). At Paragon, samples were treated with a 30 gram fire assay with an AA finish for Au, and four-acid multi-element analysis (48MA-MS).

Borealis Mine

The Borealis mine property, located close to the town of Hawthorne, NV, is fully permitted and equipped for present mine operations and future expansion, with existing open pits, heap leach pads, modern infrastructure, and a functional ADR facility which produces doré bars. The project has historically produced over 600,000 ounces of gold from an open pit heap leach operation. It is an under-explored property and has not been drilled since 2011, aside from Borealis' efforts in 2024 and 2025. The property possesses high grade expansion potential with excellent historical drilling results, along with a number of untested regional targets.

The Borealis Project holds existing federal and state permits for mining and processing operations. However, certain permit modifications may be required for expanded production, and the timeline for such approvals is subject to regulatory review. The Company cannot guarantee the timing or success of any permit modifications that may be required for future expansions.

About Borealis

Borealis is a gold mining and exploration company focused on exploration and resumption of production of the Borealis Mine in Nevada. The Borealis Mine is a fully permitted mine site, equipped with active heap leach pads, an ADR facility, and all necessary infrastructure to support a heap leach gold mining operation. In addition to the mine, the property, comprised of 815 unpatented mining claims of approximately 20 acres each totaling approximately 16,300 acres and one unpatented mill site claim of about five acres located in western Nevada, is highly prospective for additional high-sulfidation gold mineralization. Borealis is led by a strong board and management team, many of whom have founded, managed, and sold highly successful mining and exploration companies.

For further information, please contact:

Kelly Malcolm

President and Chief Executive Officer

info@BorealisMining.com

Office: (289) 371-3371

This news release may contain certain "forward-looking information" within the meaning of applicable securities law. Forward Looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "may", "will", "would", "potential", "proposed" and other similar words, or statements that certain events or conditions "may" or "will" occur. These statements are only predictions. Forward-Looking information is based on the opinions and estimates of management at the date the information is provided, and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. For a description of the risks and uncertainties facing the Company and its business and affairs, readers should refer to the Company's Management's Discussion and Analysis. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change, unless required by law. The reader is cautioned not to place undue reliance on forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA's President has purchased 224,200 shares of G and intends to buy more shares. NIA has received compensation from BOGO of US $100,000 cash for a twelve-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.