Copper is gaining for its 7th straight day and about to surpass its 200-day moving average.

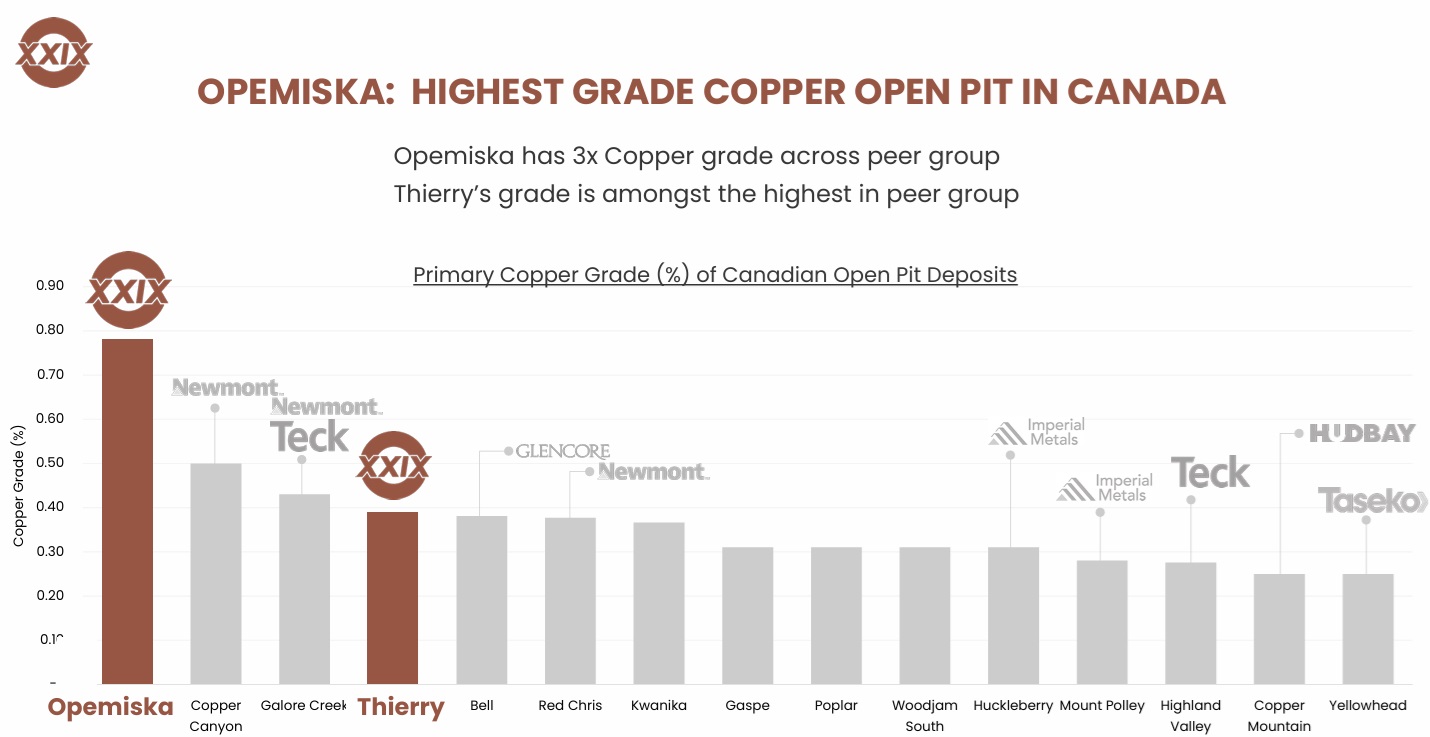

Canadian Critical Minerals Inc (TSXV: CCMI) in addition to owning 100% of the Bull River Mine copper/gold project also owns 26,837,388 shares in XXIX Metal Corp (TSXV: XXIX) a company that owns Canada's #1 highest grade open pit copper project at Opemiska and #4 highest grade open pit copper project at Thierry.

CCMI's Bull River has higher copper grades than both Opemiska and Thierry, but Bull River is a past producing underground copper/gold mine. You typically need underground mines to have higher grades than open pit mines to be economically viable, but a large part of the extra expenditures for an underground mine is the initial development work and CCMI already has 22,000 metres of underground workings going directly to the copper/gold resource.

When CCMI in 2021 tested the down dip extension of the copper/gold vein systems at the Bull River Mine project under the current workings to demonstrate the potential that the current resource can be extended on strike and to depth the results were promising including the discovery of their highest gold grades to date in Drill Hole BRU 21-05:

Drill Hole BRU 21-01 intercepted 3.4m of 5.12% copper, 0.63 g/t gold, and 28.60 g/t silver beginning at 171.4m.

Drill Hole BRU 21-03 intercepted 3.5m of 2.39% copper, 0.29 g/t gold, and 12.50 g/t silver beginning at 190.9m.

Drill Hole BRU 21-05 intercepted 4.9m of 1.71% copper, 17.60 g/t gold, and 11.80 g/t silver beginning at 104.8m.

Drill Hole BRU 21-06 intercepted 5.9m of 2.10% copper, 0.30 g/t gold, and 9.50 g/t silver beginning at 103.7m.

When Pierre Poilievre promises to "rapidly green-light massive resource projects" we believe CCMI is positioned to play an important role particularly for copper.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA has received compensation from CCMI of US$30,000 cash for a three-month marketing contract and previously received US$30,000 cash for a marketing contract when it was known as Braveheart Resources. This message is meant for informational and educational purposes only and does not provide investment advice.