An NIA member asked us an interesting question about Trio-Tech International (TRT). They asked if we have any concerns that TRT's three largest customers AMD, NXP Semiconductors, and Infineon account for 49.5% of revenue.

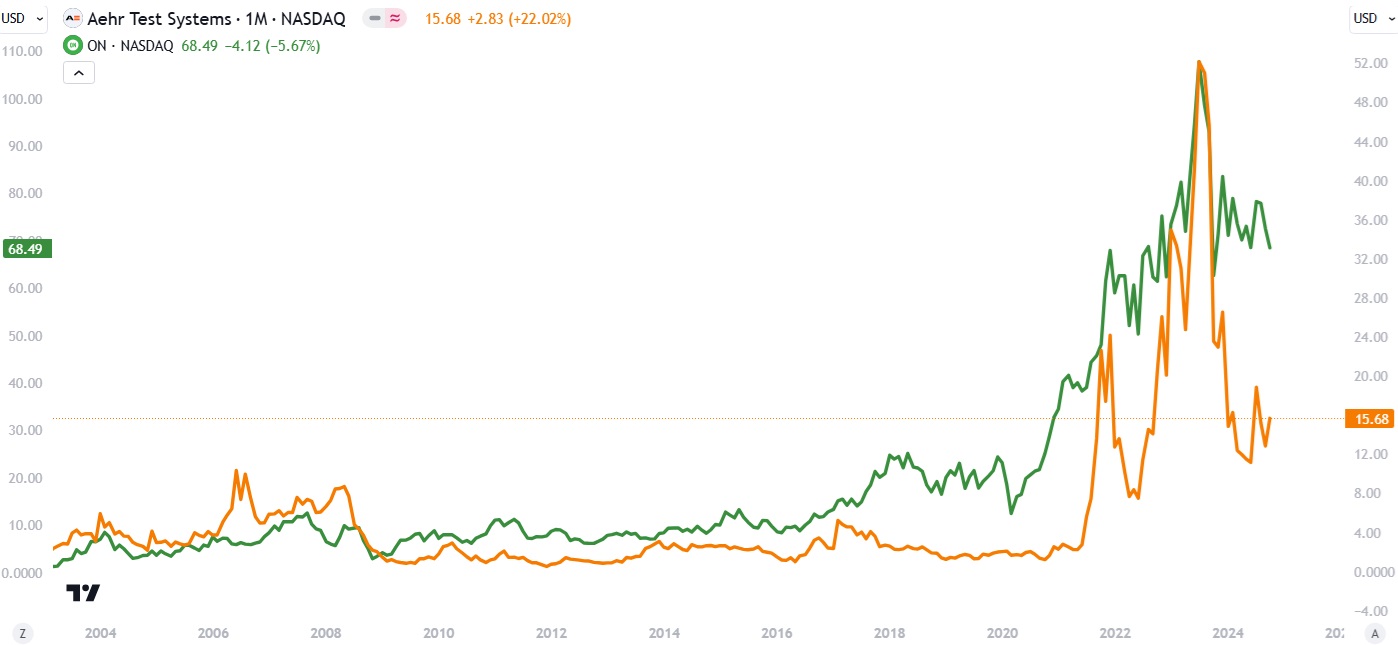

No, because AEHR Test Systems (AEHR)'s #1 largest customer On Semiconductor (ON) accounts for 67% of its revenue and AEHR at its current price of $15.68 per share is currently trading at an enterprise value of 7.26X revenue.

Take a look at a chart of AEHR vs. ON and how they both peaked at exactly the same time:

In fact, AEHR's two largest customers account for 84% of its revenue. TRT having 3 customers account for 49.5% of revenue is much better than AEHR having 2 customers account for 84% of revenue.

TRT's three largest customers AMD, NXP Semiconductors, and Infineon are all much higher quality customers to have than AEHR's ON Semiconductor.

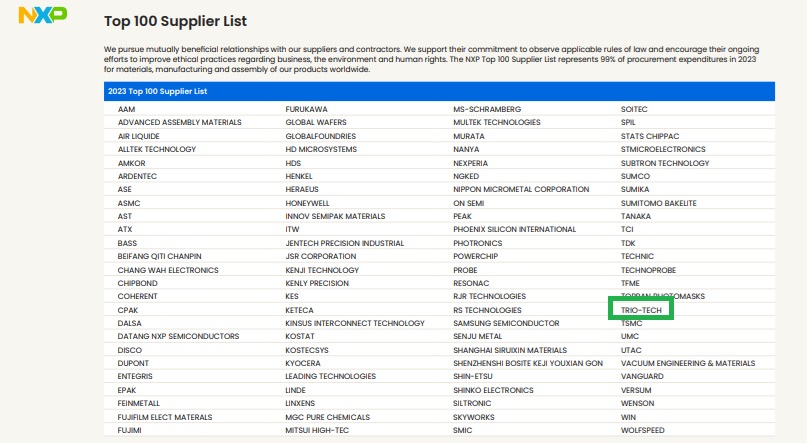

Trio-Tech International (TRT)'s 78,706 square foot building that it owns for its Malaysian operations is located literally feet away from the back gate of $59.47 billion market cap NXP Semiconductors (NXPI), one of the world's largest semiconductor companies that produces the Near Field Communication chips that are inside of the iPhone you are using at this very moment.

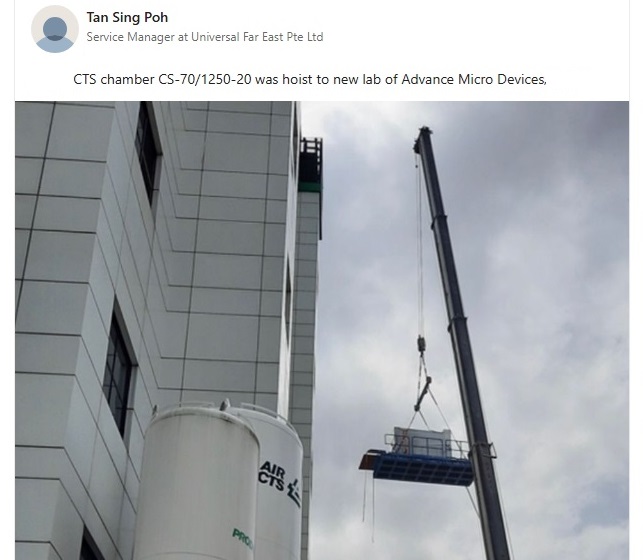

Trio-Tech International (TRT)'s 100% owned Universal Far East has been making new installations at the new Singapore lab of AMD where they conduct R&D for new GPU chips to be used for AI. AMD is a $252.434 billion market cap company.

Instead of investing into a real AI company like Trio-Tech International (TRT) that is highly profitable and currently has an enterprise value at $7.41 per share of only $15.83 million or 0.374X revenue of $42.31 million, investors are being suckered into buying a boiler room company POET Technologies Inc. (POET) that has total revenue of $116,000 yet is trading at a market cap of $286.32 million. POET has nothing to do with AI and has developed nothing innovative whatsoever!

We live in a world where people are incapable of doing any due diligence. They buy stocks based on tips they receive from incompetent losers on Reddit and YouTube. Anybody who does the slightest bit of research realizes that TRT is a much better company than AEHR and especially POET.

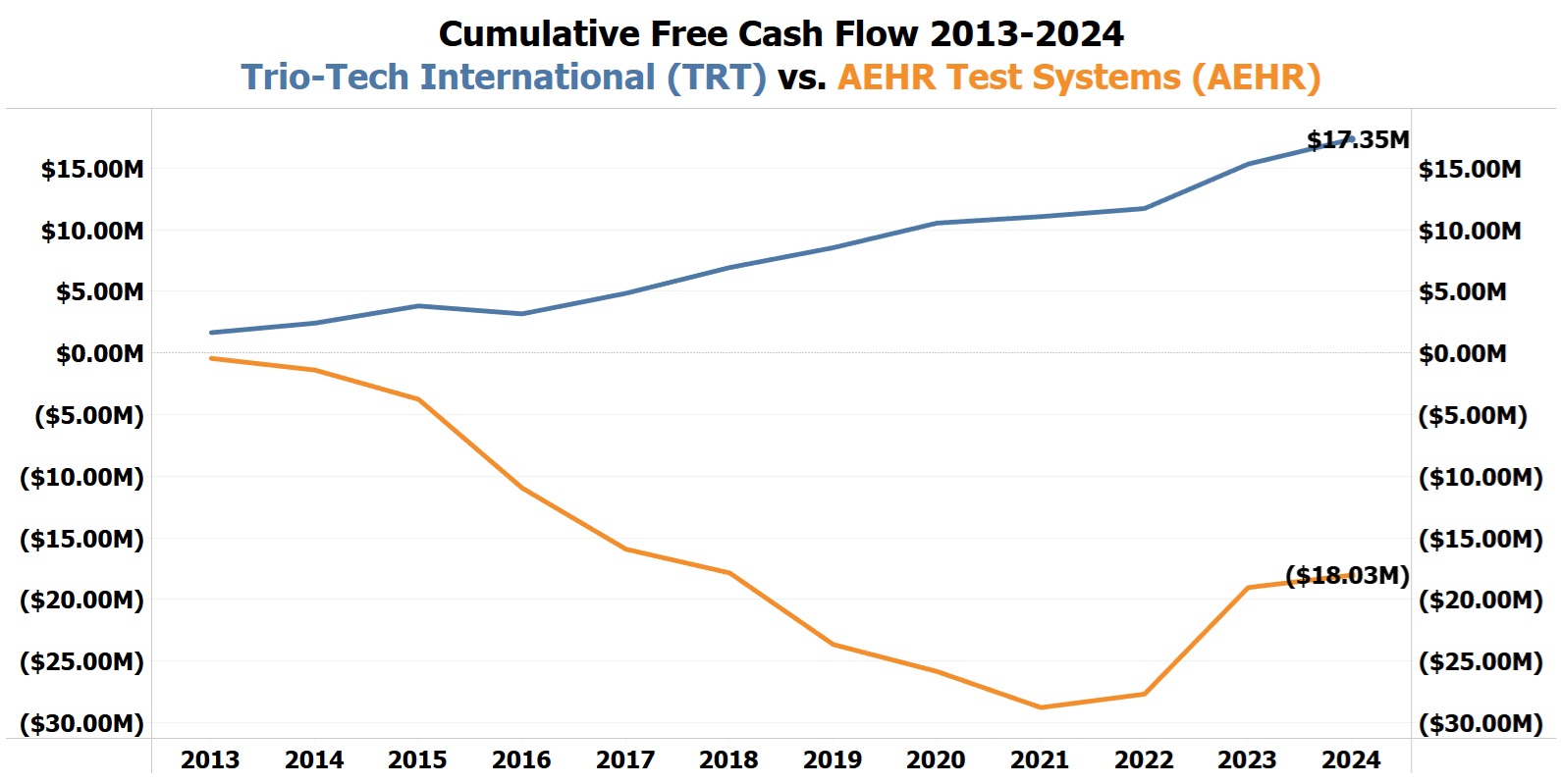

Take a look at the cumulative free cash flow of TRT vs. AEHR over the last 12 years:

Last year, Trio-Tech International (TRT) developed an innovative new Dynamic High Temperature Operating Life Test (HTOL) System for Silicon Carbide (SiC) / Gallium Nitride (GaN) Power Modules used in the electric vehicle (EV) market. TRT said in its latest press release that new product launches like this one are helping drive revenue growth, with TRT's manufacturing revenue growing by 60% last quarter.

On August 8th, long time TRT customer Infineon opened the first phase of the world’s largest and most efficient silicon carbide (SiC) power semiconductor fab located in Kulim, Malaysia. The Prime Minister of Malaysia was there to officially inaugurate the opening. The first phase is focused on the production of silicon carbide (SiC) power semiconductors and include gallium nitride (GaN) epitaxy. The second phase will create the world’s largest and most efficient 200-millimeter SiC power fab.

SiC is revolutionizing the future of electric vehicles (EVs) in three ways: enhancing power electronics, boosting vehicle efficiency and performance, and enabling faster charging. Gallium Nitride (GaN) is poised to play a crucial role in this transformation. By providing even higher efficiency in power conversion, GaN technology can further reduce energy losses, leading to improved battery life and extended driving ranges. Its compact size allows for lighter and smaller charging systems, facilitating more efficient onboard charging solutions. Together, SiC and GaN are setting the stage for a new era in EV technology, where vehicles not only perform better but also charge faster and more efficiently, ultimately accelerating the adoption of electric mobility.

The U.S. Chips Act gave a $750 million grant last week to Wolfspeed (WOLF) to build a Silicon Carbide (SiC) Power Module production plant in North Carolina causing its shares to gain by 40%+ on the news.

Silicon Carbide (SiC) / Gallium Nitride (GaN) power modules are about to become well-known as the #1 most important innovation in the history of EVs because it will make them fast and easy to charge! All companies that develop SiC / GaN power modules will need TRT's Dynamic High Temperature Operating Life Test (HTOL) System to test them!

The same enterprise value/revenue ratio that AEHR Test Systems (AEHR) is currently trading at would value Trio-Tech International (TRT) at $75.96 per share and TRT probably deserves a higher multiple than AEHR!

Trio-Tech International (TRT) does all of its manufacturing in Singapore and the TSX Venture Composite Index chart is very similar to iShares Singapore ETF (EWS).

At some point in the very near-future, not only will the TSX Venture Composite Index surpass its key breakout point, but EWS will surpass its key breakout point!

Here is a chart of Trio-Tech International (TRT) lined up against iShares Singapore ETF (EWS) so that you can get a good understanding of how high TRT will soon rise:

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is meant for informational and educational purposes only and does not provide investment advice.