Highlights:

LONDON, ON, May 23, 2024 /CNW/ - Abitibi Metals Corp. (CSE: AMQ) (OTCQB: AMQFF) (FSE: FW0) ("Abitibi" or the "Company") is pleased to announce results from the eastern extension target of the B26 Polymetallic Deposit ("B26", the "Project" or the "Deposit"). Abitibi Metals is fully funded with $17.5 million to complete the remaining 16,500 metres planned for the 2024 work program, as well as an additional 20,000 metres in 2025, which will be incorporated into a Preliminary Economic Assessment to complete the option. On November 16th, 2023, the Company entered into an option agreement on the B26 Deposit to earn 80% over 7 years from SOQUEM Inc. (see news release dated November 16, 2023).

Mr. Deluce continued: "With $17.5 million in our treasury, we remain in an excellent position as the copper market becomes very exciting. High-grade assets like the B26 project in Quebec, located in a world-class jurisdiction, represent an exceptional opportunity. We are very excited about today's news of successful extensional drilling, showcasing the growth potential of this exciting copper/gold project."

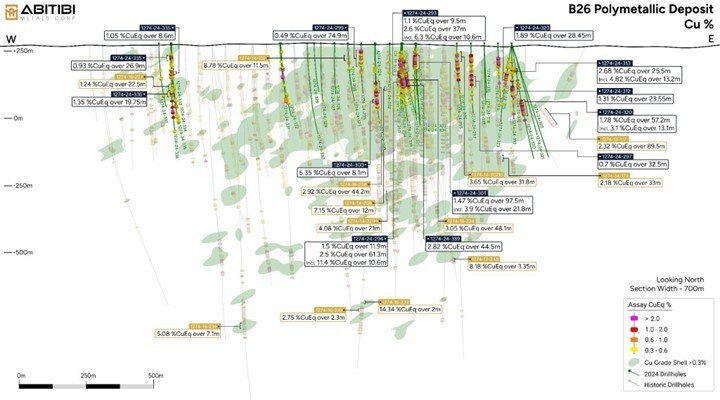

B26 Eastern Extension

The B26 Main Deposit has a continuous strike length of 1.0 kilometers and mineralization has been drilled to 850 metres in vertical depth with limited drill coverage below 500 metres. This batch of results focuses on four holes (see detailed below), all collared on section 653350, which is the easternmost drilled section of the Deposit.

Hole 1274-24-314 was drilled approximately 10 metres above historical hole 1274-13-91 with the objective to exceed the length by more than 100 metres and explore the deposit footwall area. Tabulated results are from the upper part of the hole. A weak anomaly detected from 183.5 to 194.5 metres could indicate a potential mineralized structure about 100 metres north of main sulfides lenses.

In the main sector, hole 1274-24-323 was drilled to the northwest to cross the mineralized structure in between sections. Drilling was successful to intercept a thick stacking of chalcopyrite lenses from 133 to 161.85 metres, returning 1.89% CuEq over 28.45 metres, beginning at 133.4 metres, including 6.48% CuEq over 5.25 metres. The main zone is followed by disseminated mineralization down to 281 metres well into the B26 footwall. Observations highlighted so far consist of a strong intensity of silicification and sericitization in the lower part of the hole, expanding northward as an exploration target.

The best intercept in drill hole 1274-24-320 was 1.78% CuEq over 57 metres, beginning at 235.8 metres, including higher grade intervals between 3 and 4.5% CuEq over 2 to 13 metres length. This hole was drilled following a north-to-north-east direction. The mineralization was intersected approximately 75 metres to the northeast of the known mineralization and at a vertical depth of about 200 metres.

Table 1: Significant Intercepts

|

Hole ID |

From (m) |

To (m) |

Length (m) |

CuEq (%) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

Zn (%) |

|

1274-24-314 |

67.0 |

77.0 |

10.0 |

1.33 |

0.96 |

0.48 |

8.70 |

0.14 |

|

Incl |

67.0 |

72.0 |

5.0 |

1.27 |

1.93 |

0.9 |

11.92 |

0.23 |

|

And |

86.0 |

99.0 |

13.0 |

1.24 |

1.16 |

0.11 |

5.05 |

0.01 |

|

1274-24-315 |

135.0 |

138.15 |

3.15 |

0.96 |

0.24 |

1.19 |

4.1 |

0.01 |

|

1274-24-320 |

108.85 |

111.65 |

2.80 |

1.04 |

0.01 |

0.01 |

21.8 |

2.55 |

|

And |

235.8 |

293.0 |

57.2 |

1.78 |

1.54 |

0.31 |

5.55 |

0.14 |

|

Incl |

240.6 |

243.1 |

2.5 |

4.59 |

4.19 |

0.58 |

14.80 |

0.13 |

|

Incl |

250.0 |

263.05 |

13.05 |

3.09 |

2.64 |

0.59 |

10.66 |

0.26 |

|

Incl |

266.9 |

269.25 |

2.35 |

3.55 |

3.14 |

0.58 |

10.18 |

0.18 |

|

Incl |

270.6 |

277.0 |

6.4 |

2.98 |

2.67 |

0.54 |

6.54 |

0.01 |

|

1274-24-323 |

133.40 |

161.85 |

28.45 |

1.89 |

1.44 |

0.32 |

10.04 |

1.4 |

|

133.40 |

138.65 |

5.25 |

6.48 |

4.30 |

1.37 |

38.25 |

3.47 |

|

|

Note 1: The intercepts above are not necessarily representative of the true width of mineralization. The local interpretation indicates core length corresponding generally to 70 to 80% of the mineralized lens' true width. True width of 1274-20 mineralization is unknown. Note 2: Copper equivalent values calculated using metal prices of $4.00/lb Cu, $1.50/lb Zn, $20.00/ounce Ag and $1,800/ounce Au. Recovery factors were applied according to SGS CACGS-P2017-047 metallurgical test: 98.3% for copper, 90% for gold, 96.1% for zinc, 72.1% for silver. Note 3: Intervals were calculated using a cut off grade of 0.1% Cu Eq, which represents the visual limit of the mineralized system. * Further assays are outstanding from this hole |

||||||||

|

Table 2: Drill Hole Information |

|||||||

|

Drill hole |

Target |

UTM East |

UTM |

Elevation |

Azimuth |

Dip |

Length (m) Drilled |

|

1274-24-314 |

B26 Main |

653300 |

5513338 |

276 |

360 |

-52 |

300 |

|

1274-24-315 |

B26 Main |

653350 |

5513390 |

276 |

360 |

-53 |

201 |

|

1274-24-320 |

Eastern Extension |

653350 |

5513275 |

276 |

20 |

-62 |

474 |

|

1274-24-323 |

B26 Main |

653350 |

5513314 |

276 |

345 |

-55 |

367.5 |

The core logging program is run by Explo-Logik in Val d'Or, Quebec. The drill core was split with half sent to AGAT Laboratories Ltd. and prepared in Val d'Or, Quebec. All samples are processed by fire assays on 50 gr with atomic absorption finish and by "four acids digestion" with ICP-OES finish, respectively, for gold and base metals. Samples returning a gold grade above 3 g/t are reprocessed by metallic screening with a cut at 106 µm. Material treated is split and assayed by fire assay with ICP-OES finish to extinction. A separate split is taken to assay separately mineralized intervals with target grades above 0.5% Cu using Na2O2 fusion and ICP-OES or ICP-MS finish.

Samples preparation duplicates, varied standards, and blanks are inserted into the sample stream.

In the 2018 resource estimate, SGS recommended the QAQC protocol to explain the replicability for the four metals (Au-Cu-Ag-Zn). The Company has set up for this program a series of assaying protocols with the objective to control QAQC issues from the beginning of the project. As a result, samples are crushed finer with 95% of particles passing 1.7 mm and a large split of 1 kg is pulverized down to 106 µm (150 mesh). Other measures put in place include the automatic re-assaying of gold results above 3 g/t by metallic screening and the use of sodium peroxide fusion in mineralized intervals interval corresponding to a target grade above 0.5% Cu.

Qualified Person

Information contained in this press release was reviewed and approved by Martin Demers, P.Geo., OGQ No. 770, a qualified person as defined under National Instrument 43-101, and responsible for the technical information provided in this news release.

About Abitibi Metals Corp:

Abitibi Metals Corp. is a Quebec-focused mineral acquisition and exploration company focused on the development of quality base and precious metal properties that are drill-ready with high-upside and expansion potential. Abitibi's portfolio of strategic properties provides target-rich diversification and includes the option to earn 80% of the high-grade B26 Polymetallic Deposit, which hosts a historical resource estimate1 of 7.0MT @ 2.94% Cu Eq (Ind) & 4.4MT @ 2.97% Cu Eq (Inf), and the Beschefer Gold Project, where historical drilling has identified 4 historical intercepts with a metal factor of over 100 g/t gold highlighted by 55.63 g/t gold over 5.57 metres and 13.07 g/t gold over 8.75 metres amongst four modeled zones.

About SOQUEM:

SOQUEM, a subsidiary of Investissement Québec, is dedicated to promoting the exploration, discovery and development of mining properties in Quebec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Quebec's mineral wealth, SOQUEM relies on innovation, research and strategic minerals to be well-positioned for the future.

ON BEHALF OF THE BOARD

Jonathon Deluce, Chief Executive Officer

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA has received compensation from LFG Equities Corp. of US$30,000 cash for a three-month AMQ marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.