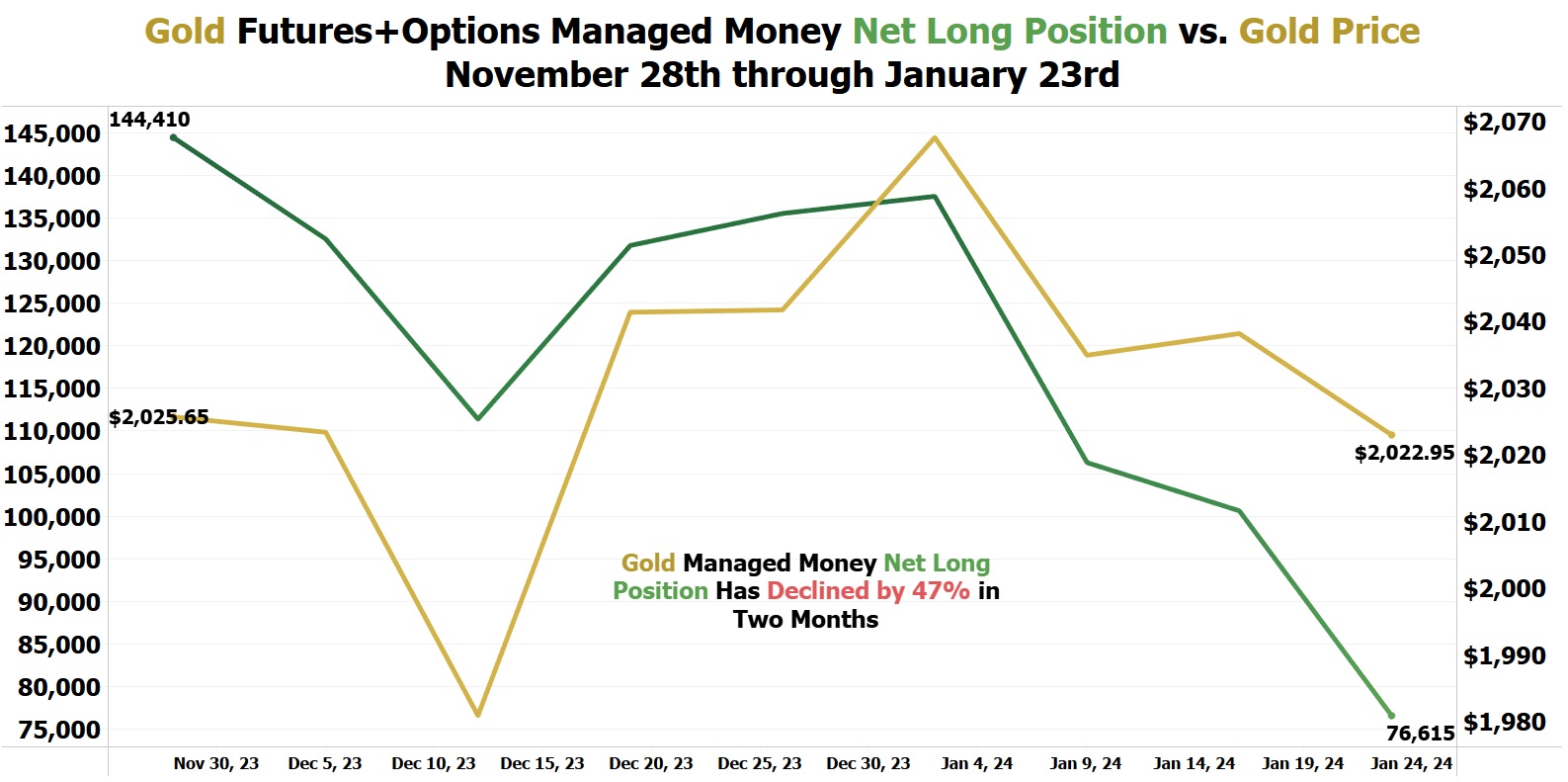

Between November 28th and January 23rd, gold's futures+options managed money net long position declined by 47% from 144,410 contracts down to 76,615 contracts.

This is the lowest ever gold managed money net long position for a gold price of above $2,000 per oz.

The only thing more bullish would be a negative net long position, but if we went into a net short position, it maybe could pull gold down as low as $1,950 per oz but stocks like our #1 overall pick for 2024 Augusta Gold (TSX: G) are already priced as if gold is only $1,400 per oz so there is no downside for most gold stocks. Stocks like G are likely to begin making massive gains regardless of what the price of gold does on a day-to-day basis.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA's President has purchased 224,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.