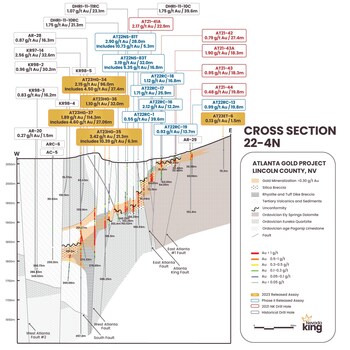

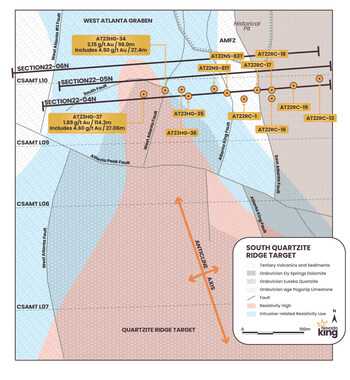

VANCOUVER, BC, Oct. 17, 2023 /CNW/ - Nevada King Gold Corp. (TSXV: NKG) (OTCQX: NKGFF) ("Nevada King" or the "Company") is pleased to announce assay results from five vertical reverse circulation ("RC") holes recently completed at its Atlanta Gold Mine Project located 264km northeast of Las Vegas, Nevada, in the prolific Battle Mountain Trend. Highlight holes reported today made a blind discovery 200m southwest of the Atlanta Pit in a previously untested area within the southern extension of the West Atlanta Graben Zone ("WAGZ") and are plotted in plan and along a new Section 22-4N, the southernmost section line released to date at Atlanta, (Figures 1-2).

Highlights:

|

Hole No. |

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Ag (g/t) |

|

|

AT23HG-37 |

170.7 |

285.1 |

114.3 |

1.89 |

2.8 |

|

|

Includes |

222.6 |

227.1 |

27.06 |

4.60 |

17.9 |

|

|

AT23HG-34 |

135.7 |

231.7 |

96.0 |

2.15 |

5.1 |

|

|

Includes |

202.7 |

231.7 |

27.4 |

4.50 |

13.3 |

|

|

AT23HG-35 |

134.1 |

155.5 |

21.3 |

3.42 |

9.3 |

|

|

Includes |

147.9 |

154.0 |

6.1 |

10.39 |

22.0 |

|

|

AT23HG-36 |

143.3 |

175.3 |

32.0 |

1.10 |

2.7 |

|

|

Table 1. Highlight holes released today. Mineralization occurs along near-horizontal horizons with true mineralized thicknesses in vertical holes estimated to be 85% to 100% of reported drill intercept length. |

Cal Herron, Exploration Manager of Nevada King, stated, "Nevada King's vertical holes released today (averaging 2.05 g/t AuEq. over 105.2m thickness) paint a much brighter picture of the potential of the SQRT than the historical angle holes (averaging 1.64 g/t AuEq. over 26.3m thickness) which mostly missed the mineralized horizon and reaffirmed the historical misconception that the South Fault terminated mineralization at Atlanta. Today's AT23HG-37 could prove a significant development for resource potential at Atlanta should mineralization ultimately continue southward along trend of the SQRT. Similar intersections of gold mineralization found south of Section 22-4N would have a marked impact on the resource potential at Atlanta by increasing mineralized tonnage and reducing the overall strip ratio in a potential future mining scenario. The Company is currently constructing drill pads south of Section 22-4N to test the southern extension of the 100m thick, high-grade oxidized replacement horizon found in today's drilling with an eye on tracing the mineralization down to and possibly beyond the Atlanta Peak Fault (Figure 3) along the axis of the Quartzite Ridge anticline. These new results mark a major departure from the historical interpretation at Atlanta, opening up the potential for a larger mineralized system."

Discussion of South Quartzite Ridge Target ("SQRT"):

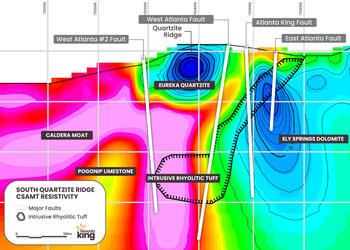

The overall north-south trend to mineralization at Atlanta was recognized long before the deposit was open-pitted, but exploration outside of the pit area largely concentrated on chasing a potential northern extension. Potential for a southern extension into the SQRT was considered to be very low, largely because the massive, barren quartzite bounding the southwestern side of the historical pit presented serious challenges, namely lack of obvious mineralization and poor access. Two historical angle holes about 350m deep drilled under the western flank of the ridge hit Eureka Quartzite and underlying Pogonip Limestone but no Au-Ag mineralization, so efforts to test the ridge ceased by 1998. The general consensus at that time was that mineralization at the southern end of the pit was cut off by the South Fault (Figure 3) and little if any potential existed for significant extension southward. However, Nevada King's 2021 drilling directly south of the pit showed that mineralization did indeed extend south of the South Fault, while the seven E-W oriented CSAMT lines crossing the Quartzite Ridge in 2022 indicated a prominent and persistent, sub-horizontal resistivity low underlying the ridge's massive quartzite cap starting about 200m below the ridge crest (Figure 4).

Hole AT23HG-37 along Section 22-4N was sited on the northern end of the SQRT in order to test for mineralization underneath the quartzite. The hole collared in massive quartzite and drilled out of largely barren quartzite and into mineralized felsic intrusive tuff and rhyolite at 175m depth, with mineralization continuing to 285m. The contact between intrusive tuff and unaltered Pogonip Limestone was hit at 430m depth. This stratigraphic sequence is seen reflected in the resistivity section shown in Figure 4 along CSAMT Line 09, which crosses the Quartzite Ridge about 25m south of drill line 22-04N. Projecting the hit in AT23HG-37 southward onto Line 09, the hole would penetrate the gold zone 40m west of the West Atlanta Fault. This same stratigraphic profile is repeated southward past CSAMT Line 07 more than 400m south of AT23HG-37, which now opens up a large area along the anticlinal axis in which to pursue the type of thick mineralization penetrated in holes AT23HG-37 and AT23HG-034, within a part of the property that has never been previously drill-tested.

|

Hole No. |

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Ag (g/t) |

|

AT23HG-37 |

170.7 |

285.1 |

114.3 |

1.89 |

2.8 |

|

Includes |

222.6 |

227.1 |

4.60 |

27.06 |

17.9 |

|

AT23HG-34 |

135.7 |

231.7 |

96.0 |

2.15 |

5.1 |

|

Includes |

202.7 |

231.7 |

4.50 |

27.4 |

13.3 |

|

AT23HG-35 |

134.1 |

155.5 |

21.3 |

3.42 |

9.3 |

|

Includes |

147.9 |

154.0 |

6.1 |

10.39 |

22.0 |

|

AT23HG-36 |

143.3 |

175.3 |

32.0 |

1.10 |

2.7 |

|

AT23ET-6 |

13.7 |

15.2 |

1.5 |

0.133 |

<0.5 |

|

Table 2. All holes released today. Mineralization occurs along sub-horizontal horizons generally dipping gently westward; true mineralized thickness in vertical holes is between 85% and 95% of reported drill intercept length. |

|

Hole No. |

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Ag (g/t) |

|

|

AT22NS-81T* |

101.8 |

129.9 |

28.0 |

2.90 |

8.1 |

|

|

Includes |

123.2 |

128.5 |

5.3 |

10.73 |

21.4 |

|

|

AT22NS-83T* |

96.6 |

128.7 |

32.0 |

3.19 |

14.6 |

|

|

Includes |

110.4 |

127.1 |

16.8 |

5.35 |

24.1 |

|

|

AT22RC-1 |

48.8 |

88.4 |

39.6 |

0.55 |

4.5 |

|

|

AT22RC-13 |

0.0 |

19.8 |

19.8 |

0.99 |

7.4 |

|

|

AT22RC-16+ |

6.1 |

18.3 |

12.2 |

2.12 |

10.5 |

|

|

AT22RC-17 |

33.5 |

59.5 |

25.9 |

1.71 |

20.7 |

|

|

AT22RC-18 |

9.1 |

25.9 |

16.8 |

1.12 |

10.3 |

|

|

AT22RC-19 |

9.1 |

22.9 |

13.7 |

0.93 |

11.3 |

|

|

AT21-41A |

38.1 |

61.0 |

22.9 |

2.17 |

33.7 |

|

|

AT21-42 |

9.1 |

36.6 |

27.4 |

0.79 |

3.3 |

|

|

AT21-43 |

10.7 |

29.0 |

18.3 |

0.95 |

10.0 |

|

|

AT21-43A |

10.7 |

29.0 |

18.3 |

1.90 |

18.6 |

|

|

AT21-44 |

4.6 |

24.4 |

19.8 |

0.48 |

4.1 |

|

|

Table 3. Previously reported holes used in previous releases along trace of Section 22-4N. AT22 series holes were drilled by Nevada King in 2022 and the AT21 series holes were drilled in 2021. True thickness of gold mineralization interpreted in today's release is 85% to 95% of the reported intercept length in vertical holes. +Denotes holes that bottomed in mineralization. *Denotes core hole. |

|

Hole No. |

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Ag (g/t) |

|

KR98-2^ |

201.7 |

231.8 |

30.2 |

0.96 |

6.82 |

|

KR98-3^ |

202.9 |

219.1 |

16.2 |

0.83 |

0.9 |

|

KR98-4^ |

0.0 |

99.1 |

99.1 |

<0.02 |

<0.8 |

|

KR98-5^ |

0.0 |

138.7 |

138.7 |

<0.035 |

<1.0 |

|

KR97-14^ |

177.9 |

210.5 |

32.6 |

2.56 |

2.1 |

|

AR-20 |

114.3 |

115.9 |

1.5 |

0.27 |

0.1 |

|

AR-28^ |

130.4 |

146.7 |

16.3 |

0.87 |

6.2 |

|

AR-29 |

0.0 |

152.4 |

152.4 |

<0.003 |

<0.1 |

|

ARC-6 |

0.0 |

230.2 |

230.2 |

<0.003 |

<1.0 |

|

AC-5* |

0.0 |

99.7 |

99.7 |

<0.003 |

<1.0 |

|

DHRI-11-10RC |

108.2 |

129.6 |

21.3 |

1.75 |

10.6 |

|

DHRI-11-11RC^ |

88.3 |

111.4 |

23.1 |

1.07 |

5.1 |

|

DHRI-11-10C* |

74.7 |

114.3 |

39.6 |

1.75 |

23.1 |

|

Table 4. Historical holes used in Section 22-4N. KR97 and KR98 series holes were drilled by Kinross in 1997 and 1998. AR, ARC, and AC series holes were drilled by Goldfields in 1991. DHRI-11 series holes were drilled by Meadow Bay in 2011. True thickness of gold mineralization interpreted in today's release is 85% to 95% of the reported intercept length in vertical holes. ^Denotes angle hole. *Denotes core hole. |

|

Operator |

West Atlanta Graben |

Atlanta Mine Fault Zone |

||||

|

No. of |

Average AuEq. |

Average |

No. of |

Average Au Eq |

Average |

|

|

Nevada King |

2 |

2.05 |

105.2 |

15 |

1.76 |

23.2 |

|

Historical |

3 |

1.64 |

26.3 |

4 |

1.61 |

25.0 |

|

Table 5. Comparison of Nevada King and historical drill results along section line 22-4N, using weighted averages. Gold equivalents calculated using Au/Ag prices of $1,833/oz and $21.59/oz, respectively, (Oct 7, 2023 $US spot prices). |

QA/QC Protocols

All Reverse Circulation (RC) samples from the Atlanta Project are split at the drill site and placed in cloth and plastic bags utilizing a nominal 2kg sample weight. CRF standards, blanks, and duplicates are inserted into the sample stream on-site on a one-in-twenty sample basis, meaning all three inserts are included in each 20-sample group. Samples are shipped by a local contractor in large sample shipping crates directly to American Assay Lab in Reno, Nevada, with full custody being maintained at all times. At American Assay Lab, samples were weighed then crushed to 75% passing 2mm and pulverized to 85% passing 75 microns in order to produce a 300g pulverized split. Prepared samples are initially run using a four acid + boric acid digestion process and conventional mutli-element ICP-OES analysis. Gold assays are initially run using 30-gram samples by lead fire assay with an OES finish to a 0.003 ppm detection limit, with samples greater than 10 ppm finished gravimetrically. Every sample is also run through a cyanide leach for gold with an ICP-OES finish. The QA/QC procedure involves regular submission of Certified Analytical Standards and property-specific duplicates.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Calvin R. Herron, P.Geo., who is a Qualified Person as defined by National Instrument 43-101 ("NI 43-101").

About Nevada King Gold Corp.

Nevada King is the third largest mineral claim holder in the State of Nevada, behind Nevada Gold Mines (Barrick/Newmont) and Kinross Gold. Starting in 2016 the Company has staked large project areas hosting significant historical exploration work along the Battle Mountain trend located close to current or former producing gold mines. These project areas were initially targeted based on their potential for hosting multi-million-ounce gold deposits and were subsequently staked following a detailed geological evaluation. District-scale projects in Nevada King's portfolio include (1) the 100% owned Atlanta Mine, located 100km southeast of Ely, (2) the Lewis and Horse Mountain-Mill Creek projects, both located between Nevada Gold Mines' large Phoenix and Pipeline mines, and (3) the Iron Point project, located 35km east of Winnemucca, Nevada.

The Atlanta Mine is a historical gold-silver producer with a NI 43-101 compliant pit-constrained resource of 460,000 oz Au in the measured and indicated category (11.0M tonnes at 1.3 g/t) plus an inferred resource of 142,000 oz Au (5.3M tonnes at 0.83 g/t). See the NI 43-101 Technical Report on Resources titled "Atlanta Property, Lincoln County, NV" with an effective date of October 6, 2020, and a report date of December 22, 2020, as prepared by Gustavson Associates and filed under the Company's profile on SEDAR+ (www.sedarplus.ca).

|

Resource Category |

Tonnes (000s) |

Au Grade (ppm) |

Contained Au |

Ag Grade (ppm) |

Contained Ag |

|

Measured |

4,130 |

1.51 |

200,000 |

14.0 |

1,860,000 |

|

Indicated |

6,910 |

1.17 |

260,000 |

10.6 |

2,360,000 |

|

Measured + Indicated |

11,000 |

1.30 |

460,000 |

11.9 |

4,220,000 |

|

Inferred |

5,310 |

0.83 |

142,000 |

7.3 |

1,240,000 |

|

Table 6. NI 43-101 Mineral Resources at the Atlanta Mine |

Please see the Company's website at www.nevadaking.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This news release contains certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable securities legislation. All statements, other than statements of historical fact, included herein, without limitation, statements relating the future operations and activities of Nevada King, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "intends", "estimates", "potential", "possible", and similar expressions, or statements that events, conditions, or results "will", "may", "could", or "should" occur or be achieved. Forward-looking statements in this news release relate to, among other things, the Company's exploration plans and the Company's ability to potentially expand mineral resources and the impact thereon. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by Nevada King, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability to complete proposed exploration work, the results of exploration, continued availability of capital, and changes in general economic, market and business conditions. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these items. Nevada King does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by applicable securities laws.

SOURCE Nevada King Gold Corp.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA has received compensation from NKG of US$60,000 cash for a twelve-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.