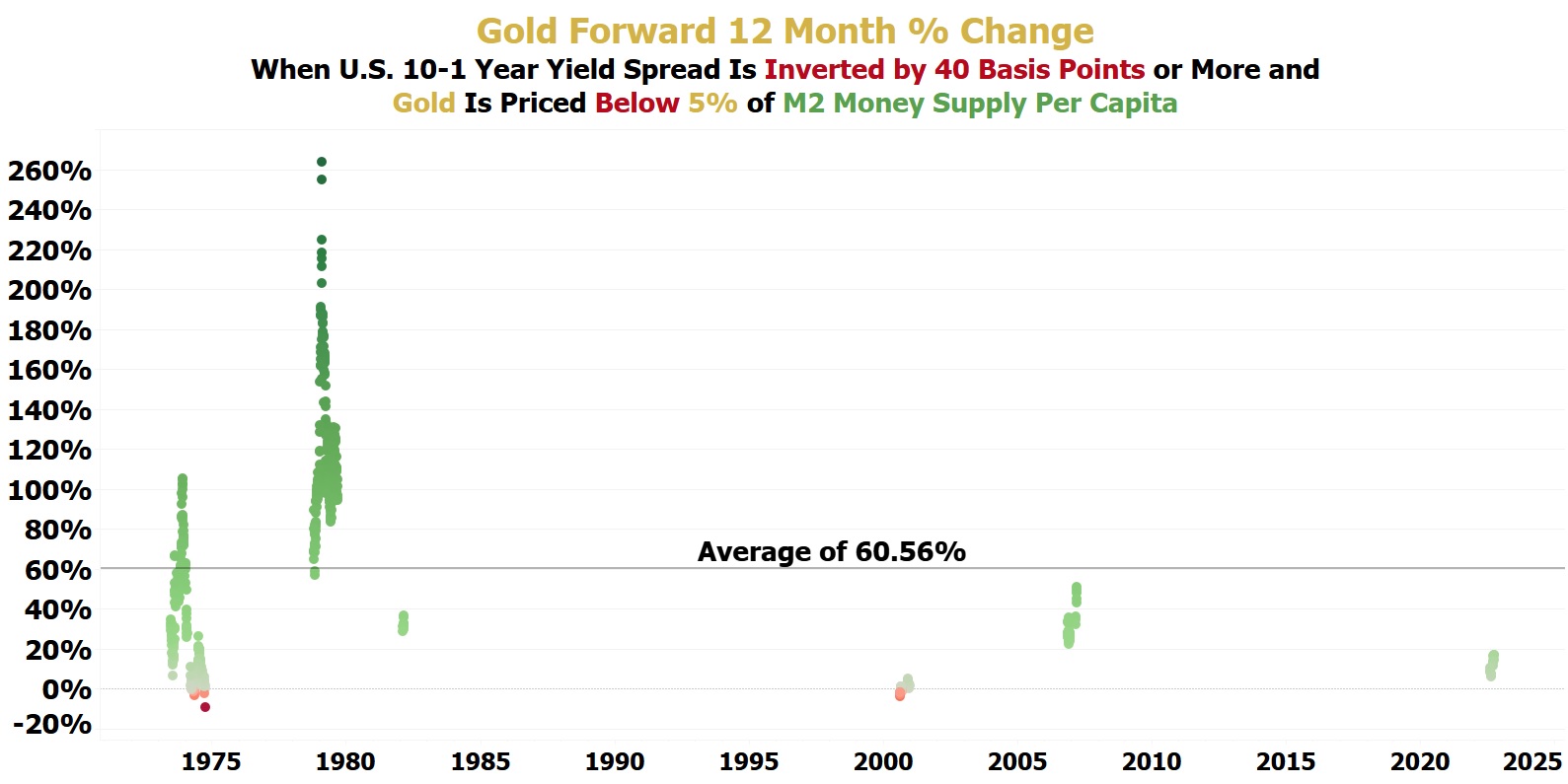

If you combine when the U.S. 10-1 year yield spread is inverted by 40 basis points or more with gold being priced at less than 5% of M2 money supply per capita, gold averages a gain of 60.56% over the following twelve months.

Most recently, these conditions came true for the first-time last year on August 3, 2022. The most recent date 12 months+ ago that had these conditions was on September 23, 2022. For this seven-week period, gold's forward 12-month gains were in a range of 5.96% up to 17.12%.

This is very similar to what occurred when these conditions came true on June 19, 1973. For the first seven weeks, gold's forward 12-month gains were in a range of 6.61% up to 34.51%.

By November 21, 1973, which was five months after these conditions first came true, gold began experiencing massive forward 12-month gains of 100%+!

The only time gold performed weakly over the forward 12-month period in 2000, gold mining/exploration stocks made massive gains over the forward 12-month period despite gold being flat!