Over the past year, NIA has written extensively about how many gold exploration companies have "given up on" gold to become lithium exploration companies and chase an Elon Musk bubble. NIA has been predicting that this will lead to a bust in the lithium exploration space due to a glut of new lithium discoveries that there is no demand for in real life. Nothing is better than an internal combustion engine. Ford has always survived through all challenges and is likely to be in business 100 years from now, but whether Tesla is still in business 20 years from now is much less certain. Elon Musk has done great with the help of government subsidies and with QE and 0% rates, but the tide is turning, and the odds are high that Tesla (TSLA) will one day be valued like a normal car company.

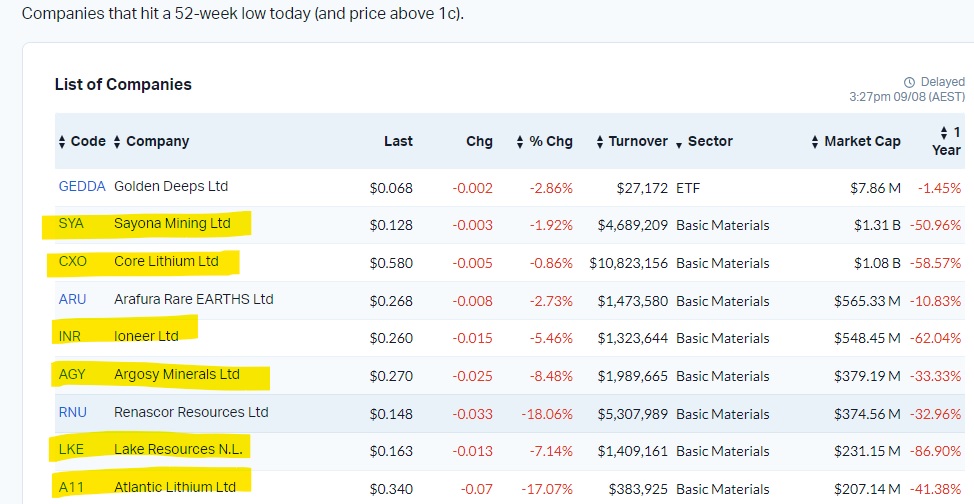

In this morning's Australian market, 6 of the 9 stocks hitting new 52-week lows are lithium stocks.

As lithium stocks decline by 90%, gold explorers will finally make the massive gains they deserve! During an uncertain economic environment where all remaining "economic strength" is a direct result of a large Federal deficit, owning large resources of gold in the ground in a top ranked jurisdiction like Nevada will become a very attractive investment in comparison to everything else!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. This message is meant for informational and educational purposes only and does not provide investment advice.