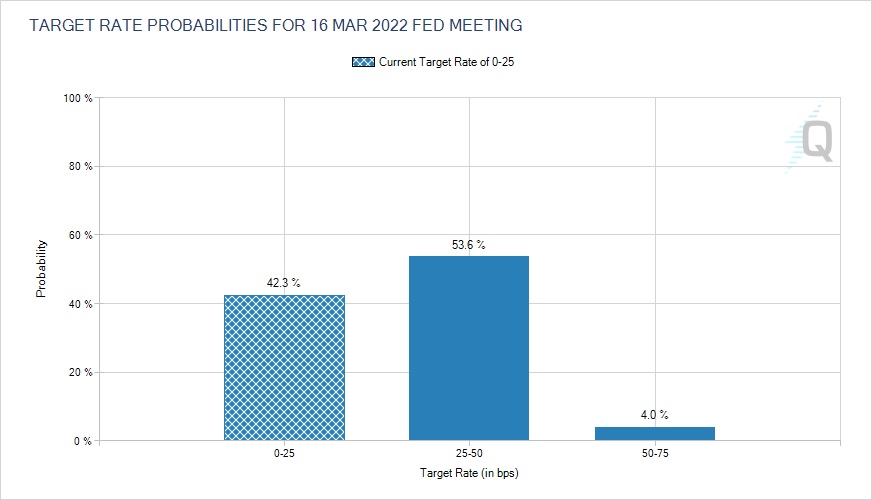

The odds of a March 2022 Fed Rate Hike have just hit a new record high of 57.6% up from 52.8% one day ago, 41.8% one week ago and 23.4% one month ago!

Historically, when the Federal Reserve raises rates from artificially low levels, gold rallies big 100% of the time. During the last five rate hike cycles from artificially low levels of less than 5%, gold on average has rallied by 195.25%!

February 1972-December 1974: Fed Funds Rate increased from 3.29% to 12.92% while gold rose from $48.40 per oz to $186.50 per oz for a gain of 285.33%.

January 1977-April 1980: Fed Funds Rate increased from 4.61% to 17.61% while gold rose from $132.10 per oz to $850 per oz for a gain of 543.45%.

December 1992-April 1995: Fed Funds Rate increased from 2.92% to 6.05% while gold rose from $332.90 per oz to $405.60 per oz for a gain of 21.84%.

May 2004-July 2006: Fed Funds Rate increased from 1% to 5.24% while gold rose from $387.30 per oz to $730 per oz for a gain of 88.48%.

December 2015-July 2019: Fed Funds Rate increased from 0.25% to 2.50% while gold rose from $1,050 per oz to $1,440 per oz for a gain of 37.14%.

The #1 way to capitalize on rising gold prices in 2022 is with North Peak Resources (TSXV: NPR).

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA's President has purchased 200,000 shares of NPR in the open market. This message is meant for informational and educational purposes only and does not provide investment advice.