GDX Ownership = Retail Interest in Gold Stocks

In our opinion, a chart of VanEck Gold Miners ETF (GDX) shares outstanding is equivalent…

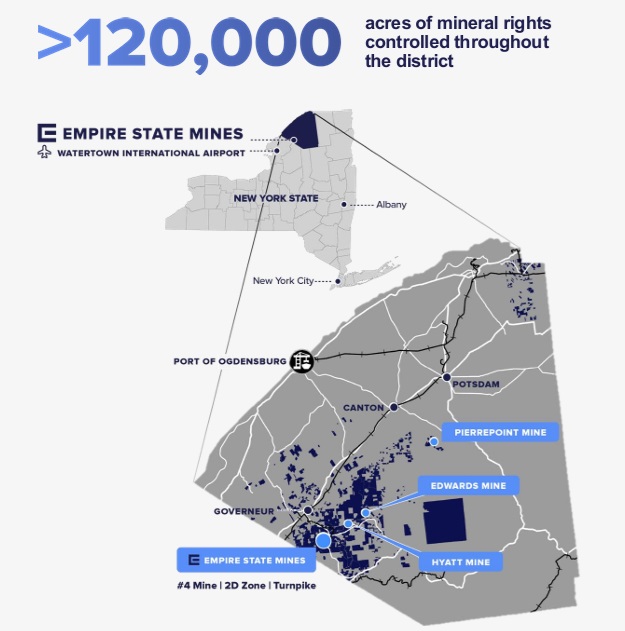

Titan Mining (TSX: TI) Gains by 5% to $0.63 Per Share

On April 17th, NIA suggested Titan Mining (TSX: TI) at $0.56 per share explaining that…

What Lundin Gold Hitting Record High Means for Highlander Silver and Augusta Gold

Lundin Gold (LUG) gained by 14.14% today to a new all-time high of $67.79 per…

Sibanye-Stillwater (SBSW) Reports Strong Earnings, NIA’s Call Option Is Rising Fast

Sibanye-Stillwater (SBSW) announced today that 1Q 2025 EBITDA increased by 89% year-over-year causing SBSW to…

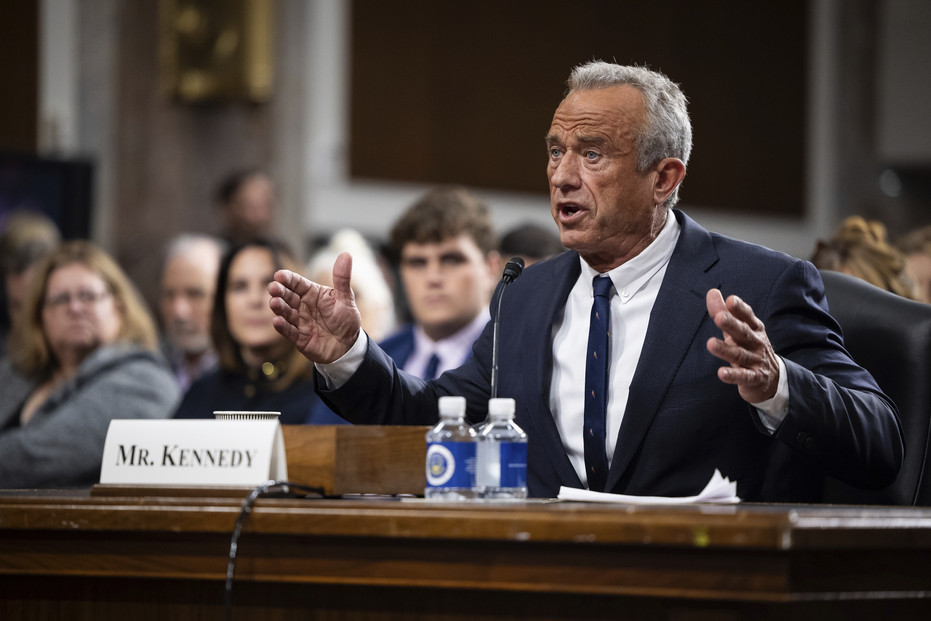

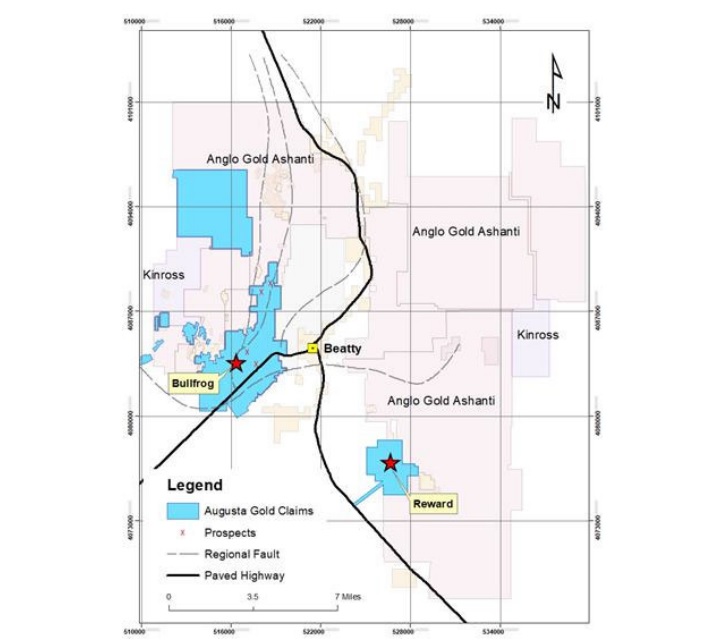

Somebody Like John Paulson Could Acquire Augusta Gold (TSX: G)

Although AngloGold Ashanti (NYSE: AU) acquiring Augusta Gold (TSX: G) remains the most logical and…

Augusta Gold (TSX: G) Gains by 2.59% to $1.19 Per Share

Augusta Gold (TSX: G) gained by 2.59% today to $1.19 per share. Augusta will become…

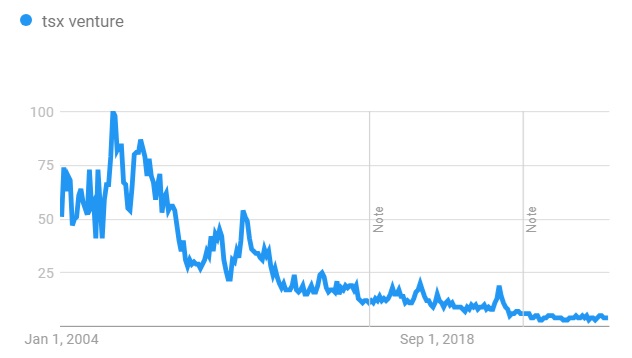

TSX Venture Continues to Hit New Highs

The TSX Venture Composite Index is up another 0.47% today to 682.21 and gaining massive…

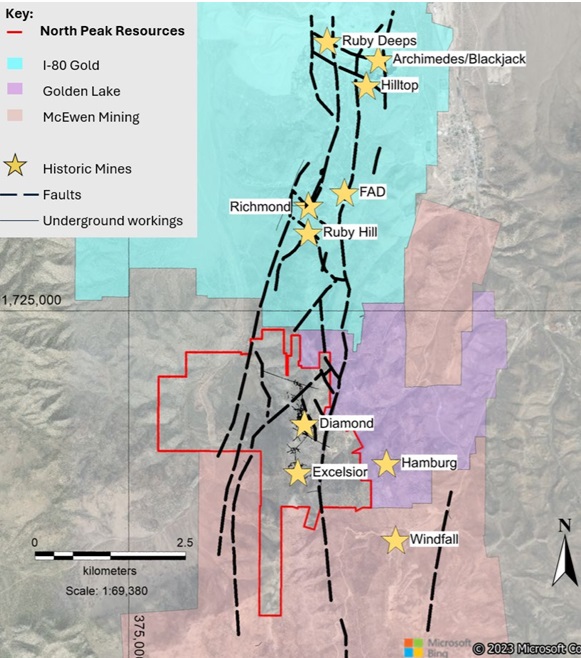

North Peak Resources (TSXV: NPR) Gains by 2.25% to New 2025 High of $0.91

North Peak Resources (TSXV: NPR) gained by 2.25% on Thursday to a new 2025 high…

Google Search Interest in TSX Venture

Here is a chart of Google Search Interest in TSX Venture. Every company with high…

TSX Venture Hits New 35-Month High, Many 5 and 10-Baggers Are Ahead

The TSX Venture Composite Index has just hit a new 35-month high of 676.43 and…