NIA has just analyzed the brand new gold futures Commitment of Traders (COT) report that was released after the close on Friday. We believe new record highs for gold could be imminent.

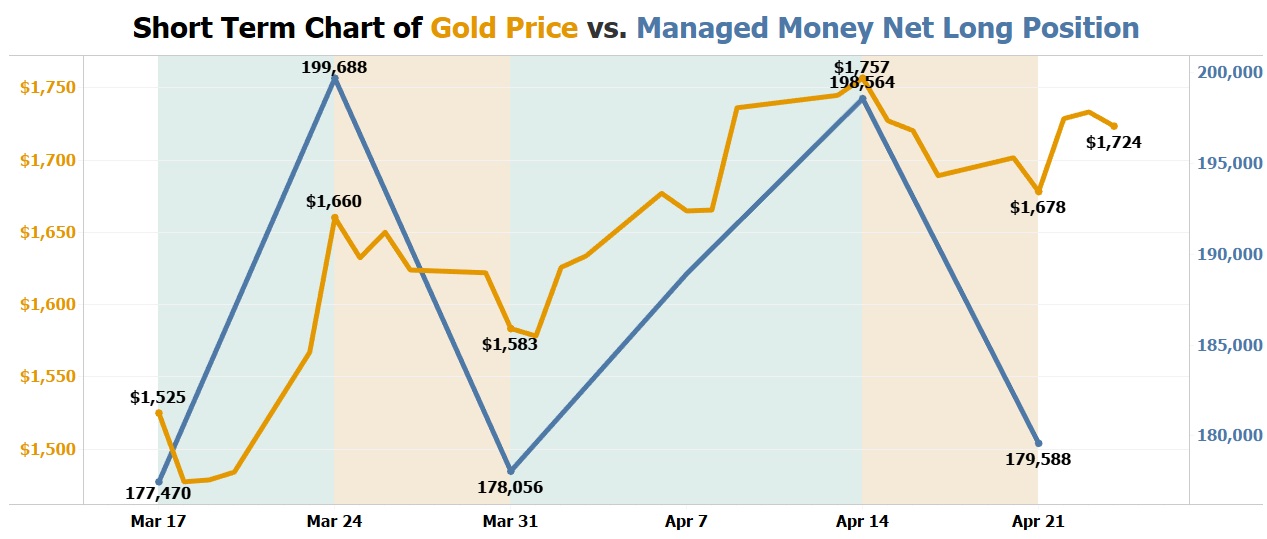

When gold settled on Tuesday, April 21st at $1,678 per oz, managed money positions in gold futures were net long a total of 179,588 contracts. On a percentile basis for the preceding 14 year period this ranks at 74.6%. In other words, for 25.4% of the last 14 years, hedge funds have been net long a larger amount of gold futures than they are today.

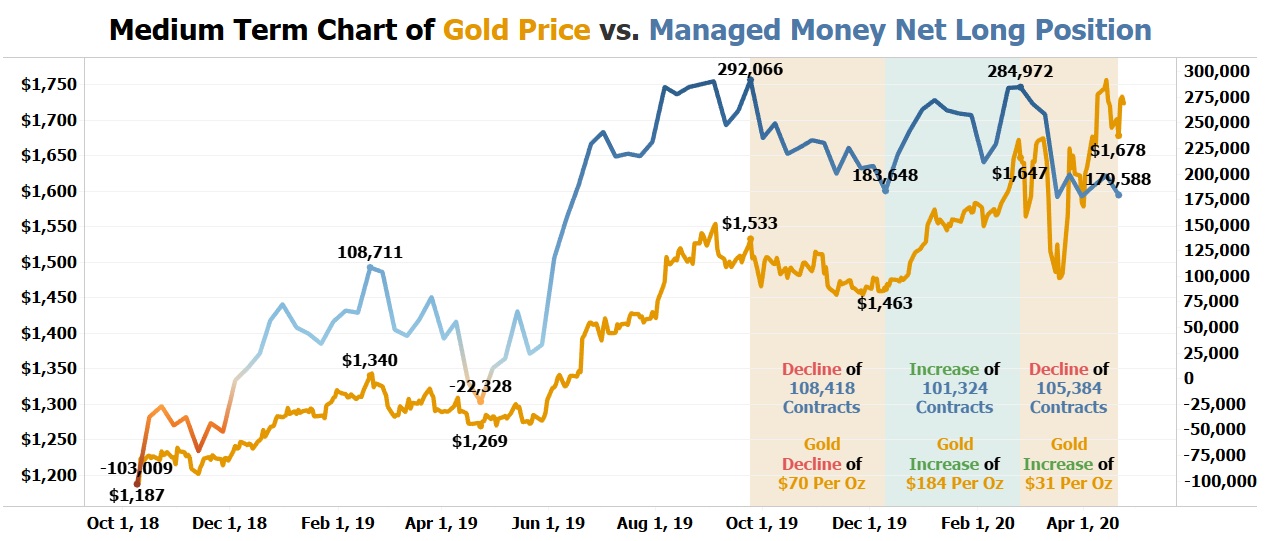

Back on October 9, 2018 with gold at $1,187 per oz, hedge funds were net short a record -103,009 gold futures contracts. At the time, NIA predicted that a large gold short squeeze was imminent and over the following twelve months the managed money position in gold futures contracts swung by 395,075 to a record net long position of 292,066 contracts.

When the managed money net long position peaked at a record high of 292,066 contracts on September 24, 2019, gold settled that day at $1,533 per oz. Over the following eleven weeks, the net long position declined by 108,418 to a level of 183,648 contracts as gold declined by $70 to a December 10, 2019 settlement price of $1,463 per oz.

Over the next eleven weeks, the managed money net long position rebounded by 101,324 to a level of 284,972 contracts as gold rallied by $184 to a February 25, 2020 settlement price of $1,647 per oz. Gold gained 2.63X more than its previous decline even though the net long position didn't rise back to the previous peak... an extremely bullish sign!

Between February 25th and April 21st, something really incredible happened! The managed money net long position declined by 105,384 to its current level of 179,588 contracts and during this eight week time period gold futures gained by $31! Normally if the managed money net long position declines by 105,384 contracts, gold futures simultaneously decline by $100+. For gold to rise by 1.88% during a 36.98% decline in the managed money net long position means that there is heavy accumulation of gold by retail investors and central banks. When institutional investors shift back to accumulating gold it will rapidly send gold futures to new all-time highs!

Amazingly, during the five week period ending April 21st, gold rallied by $153 or 10% to $1,678 per oz despite the managed money net long position rising by only 2,118 contracts for a miniscule increase of 1.19%! Gold is underowned by institutional investors and there is room for them to rapidly add 100,000 or more contracts to their net long position over the next few weeks. The way gold has been trading in recent weeks, if fund managers accumulate an additional 100,000 gold futures contracts over the next month or two it could be enough to immediately send gold as high as $1,950 per oz!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. This message is meant for informational and educational purposes only and does not provide investment advice.