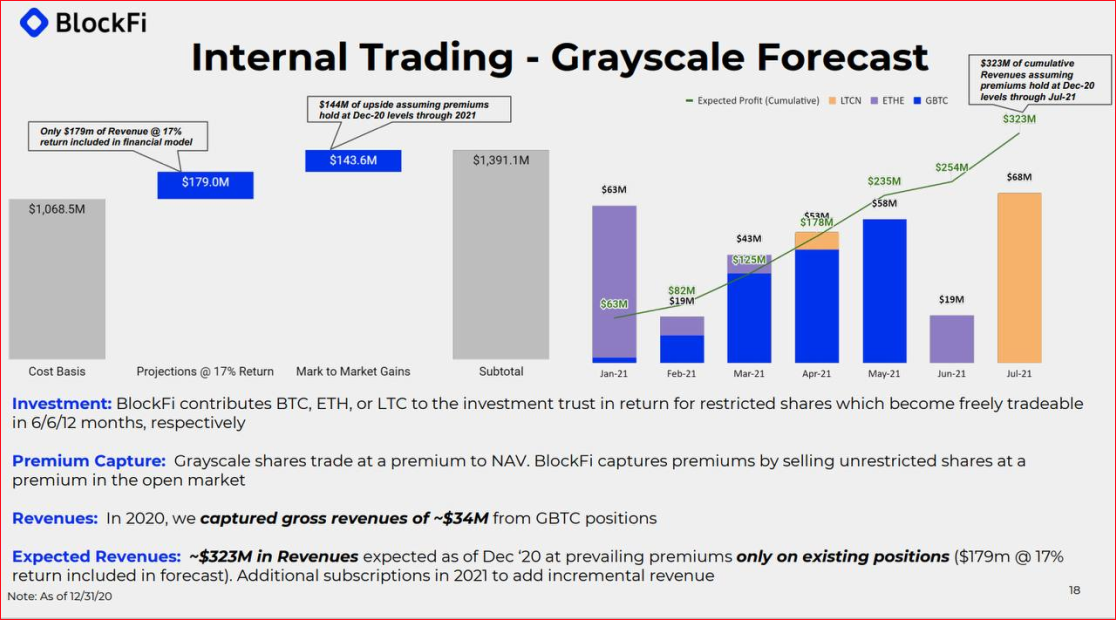

One year ago, Grayscale Bitcoin Trust (GBTC) was trading at a 40% premium above net asset value (NAV). This was a sign of high institutional demand for Bitcoin and caused Blockfi to offer a 6% yield to investors who would stake their Bitcoin with them. Blockfi would then transfer Bitcoin to GBTC for restricted GBTC shares that they would purchase at NAV and sell six months later at market value to capture the premium that GBTC was trading at. One year ago, Blockfi was promoting in a presentation to venture capital investors that they would soon generate $322.6 million in revenue from their then $1.07 billion cost basis investment into GBTC based on the assumption that GBTC premiums, "hold at December 2020 levels through July 2021".

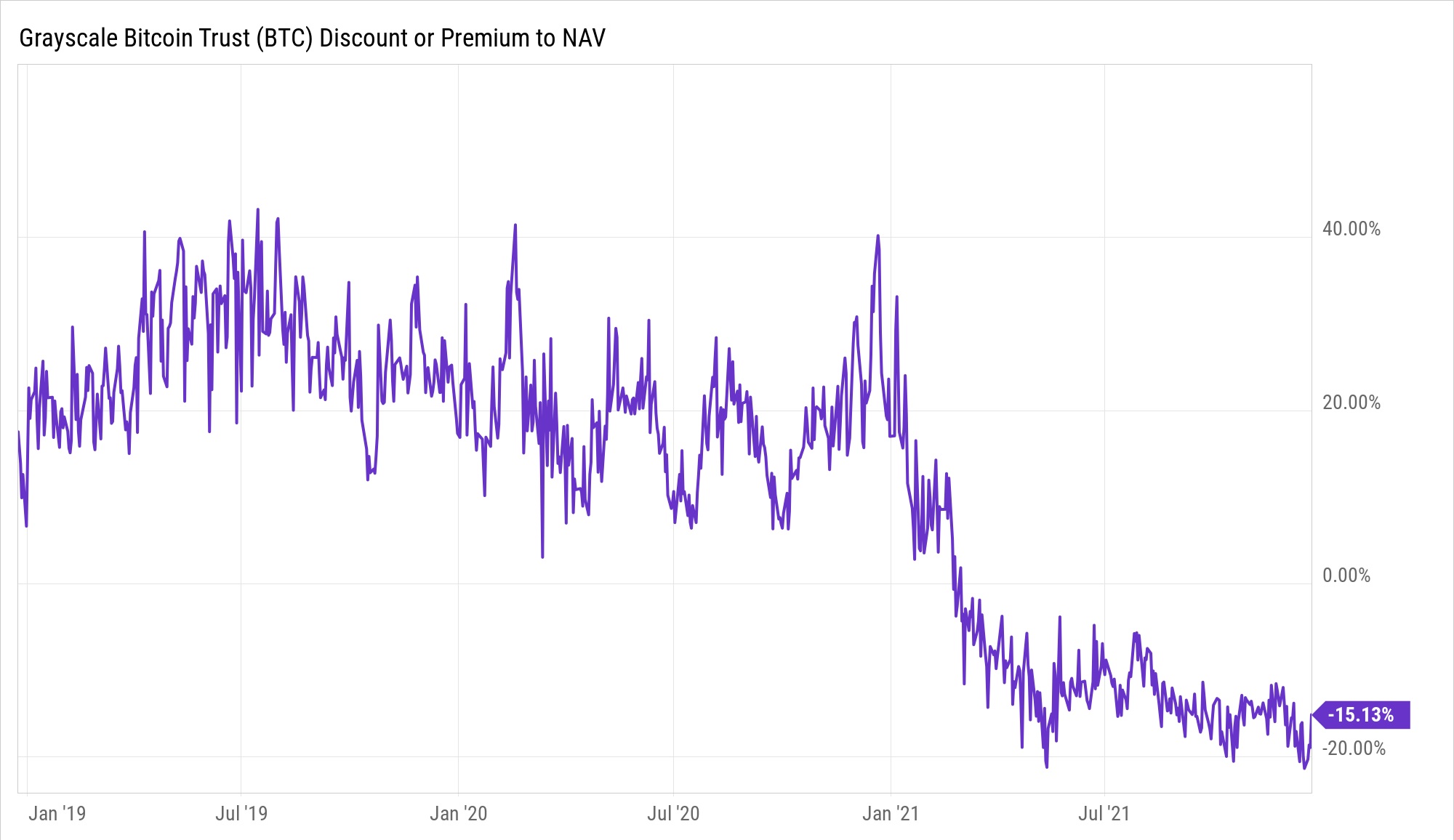

The only problem is, GBTC's premium plunged near the end of February 2021 and has traded at a significant discount below NAV for ten straight months. Currently, GBTC has a 15.13% discount below NAV. Instead of Blockfi earning a $322.6 million profit on a $1.07 billion investment, Blockfi after paying GBTC their 2% fee and covering the cost of promotions, referral fees, marketing expenditures, and the salaries of hundreds of employees... most likely suffered losses of $300 million or more not including additional investments that Blockfi made into GBTC in early 2021 plus investments that Blockfi made into additional Grayscale Crypto Trusts that are also now trading at significant discounts below NAV.

In March, Blockfi received a $350 million bailout from venture capital investors at a reported valuation of $3 billion, but on May 14th Blockfi when attempting to make a payout to clients for a "March trading promotion" in the form of Tether (USDT), accidentally sent clients massive amounts of Bitcoin. One client who was owed 700 USDT, was accidentally sent 700 Bitcoin worth $35 million. Blockfi tried to reverse these transactions, but many clients withdrew the Bitcoin before the transactions could be reversed and it is unknown how large Blockfi's losses were as a result of this mistake.

In June, only three months after Blockfi raised $350 million in VC funding, Reuters reported that Blockfi was in late-stage talks to raise an additional $500 million in VC funding at a $5 billion valuation. Despite Pitchbook incorrectly showing that Blockfi raised $500 million during the month of July 2021, the funding round never closed. We suspect that Blockfi leaked out fake news to the media about an imminent $500 million investment in an attempt to halt redemption requests that were accelerating during the month of May after they "gave away" an unknown number of Bitcoin possibly worth hundreds of millions of dollars.

Recently, Blockfi changed the structure of the yields they pay on Bitcoin to a way that resembles a ponzi scheme. Blockfi today will pay users a yield on Bitcoin of 4.5% but only on deposits of up to 0.10 BTC. If you deposit between 0.10 and 0.35 BTC the yield Blockfi offers drops to 1.0%. If you deposit more than 0.35 BTC the yield Blockfi offers drops to 0.1%.

Clearly, Blockfi does not want any large institutional investors to deposit Crypto on their platform where they would be at risk of insolvency due to a small number of redemption requests. By accepting capital from as many different small retail investors as possible, Blockfi is able to spread out their risk of redemption requests. In recent weeks, Blockfi has made it more difficult for retail investors to withdraw Crypto. Three days ago, Twitter user @btcYooper complained in a tweet, "I'm being required to do biometric verification to withdraw my #Bitcoin from @BlockFi . This is a wakeup call, I'll be removing the remainder of my funds from them to cold storage. This is way too creepy and intrusive for me."

Dozens of high yield ponzi schemes like Blockfi have reduced the supply of Bitcoin and other Cryptocurrencies available in the market, which together with artificial demand for Crypto created by printing over $70 billion in unbacked Tether (USDT) tokens, has fueled Crypto's artificial outperformance of all other assets while making gold the most hated asset in the world due to its underperformance of Bitcoin. Most investors incorrectly assume that Bitcoin will continue to outperform gold for many years into the future and will ultimately take away most of gold's $11.5 trillion market cap. Unfortunately, GBTC's discount of 15.13% below NAV is the clearest sign yet that institutional demand for Bitcoin is no longer there. Smart money is dumping their Crypto onto retail investors. As long as GBTC's discount exists, institutions will have no reason to buy Bitcoin in the spot market when they can buy GBTC at a massive discount. GBTC's discount 100% proves that Bitcoin's price is being artificially propped up by DeFi High Yield Ponzi Schemes (Blockfi and Celsius) and Tether (USDT) printing. Until this discount goes away, there is zero chance of Bitcoin making a meaningful and sustainable rally.

Bitcoin is a risk asset that benefits more than any other asset from 0% interest rates due to the many layers of leverage it allows. During a rising rate environment, investors always seek risk-off assets making gold the #1 best performing asset in the world, especially during periods of high inflation. NIA knew that Bitcoin would outperform in 2021 and suggested the two best performing Crypto stocks in the market Voyager Digital (TSX: VOYG) which gained by 6,225% from NIA's suggestion price and CurrencyWorks (CSE: CWRK) which gained by 2,793.75% from NIA's suggestion price. VOYG became a household name in the Crypto industry exactly like NIA predicted at $0.60 per share prior to it rising to a high of $37.95 per share. CWRK became the market's #1 NFT play exactly like NIA predicted at $0.16 per share at a time when nobody knew what an NFT was, but when NFTs became big it rallied to a high of $4.63 per share.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA was compensated by VOYG USD$60,000 cash for a one-year marketing contract which has since expired. NIA has received compensation from CWRK of USD$30,000 cash for a six-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.