The 2020 PEA for the North Bullfrog Gold Project being developed by AngloGold Ashanti (AU) showed an after-tax NPV of US$452M with initial CAPEX of US$167M. Click here to see. AU acquired Corvus Gold the owner of North Bullfrog a short time later paying a total valuation of US$450M. Click here to see. Corvus Gold also came with Motherlode, but its 2020 PEA showed an after-tax NPV of only US$303M with initial CAPEX of US$406M. Click here to see.

AU essentially paid full price for North Bullfrog and got Motherlode for free because Motherlode's economics are poor.

Corvus Gold's 2020 PEA estimated that North Bullfrog would produce a total of 1,466,550 ounces of gold. After AU conducted its Feasibility Study on North Bullfrog, they realized it will only produce 806,000 ounces of gold or 45% less than expected. In addition, the initial CAPEX to bring North Bullfrog into production has soared to US$369M. AU was planning to spend initial CAPEX on North Bullfrog of $113.87 per oz, but will now be spending initial CAPEX of $457.82 per oz or quadruple the initial CAPEX per oz.

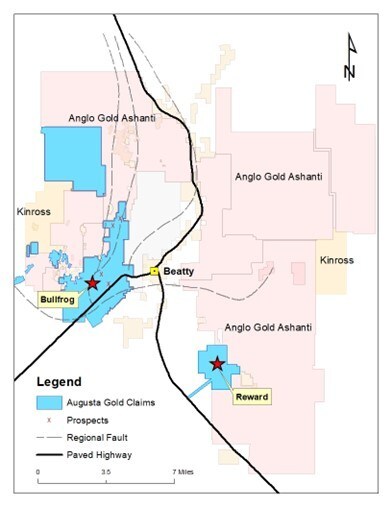

If Augusta Gold (TSX: G) were to offer a deal to AngloGold Ashanti (AU) where they pay full value for Reward of US$200M (based on its Feasibility Study) and get Bullfrog for free, there is no question AU would take this deal in a heartbeat, but Augusta Gold (TSX: G) shareholders after the repayment of debt would only walk away with $2.75 per share. This would obviously be a huge disappointment. We know Richard Warke is a tough negotiator and will try to get us at least $5-$6 per share before they move to Ecuador and Peru (it will take a few months for any transaction to close, and we know they want things wrapped up by the end of April).

There are several key differences between Bullfrog and Motherlode. AU isn't going to get Bullfrog thrown in for free like they did Motherlode.

Bullfrog is 95% oxide gold and AU is only developing oxide gold deposits in the Beatty Gold District. Motherlode is mostly sulfides and if the initial CAPEX was US$406 million in 2020, it would be over US$1 billion today. So, Motherlode is essentially worthless.

If you look at this graphic below, most of the oxide ore at Augusta Gold (TSX: G)'s Bullfrog Gold Project is in the green area.

It will be low cost for AU to mine Bullfrog's oxide ore contained in the northern extension. AU will be able to backfill nearly all waste into the Bullfrog Pit, thereby significantly reducing waste haulage costs and avoiding additional large waste dumps. A road is already built directly adjacent to the northern extension, which goes straight to the highway, and will allow for easy transfer to North Bullfrog for processing.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA's President has purchased 224,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.