The majority of historical drill holes at North Peak Resources (TSXV: NPR)'s Prospect Mountain Mine Complex were drilled in 1997 by European American Resources. We already know for a fact that there is a lot of near surface oxide gold/silver at NPR's newly acquired Prospect Mountain Mine Complex.

European American Resources drilled 91 closely spaced together drill holes totaling 8,417 meters in the Wabash area of the property, with each hole averaging only 92m in depth. All of these drill holes were vertical. European American Resources had an inexperienced management team that didn't know what they were doing, yet even they managed to make the following at/near surface oxide gold/silver discoveries on NPR's property:

15.24m of 4.08 g/t gold and 59.92 g/t silver

21.34m of 4.52 g/t gold and 34.98 g/t silver

12.19m of 2.98 g/t gold and 38.74 g/t silver

13.72m of 2.89 g/t gold and 42.3 g/t silver

12.19m of 3.09 g/t gold and 8.9 g/t silver

16.76m of 4.09 g/t gold and 25.3 g/t silver

13.72m of 5.61 g/t gold and 60.8 g/t silver

24.38m of 8.24 g/t gold and 22.61 g/t silver

NPR knows this is there, but they aren't drilling in this section... because the CRD deposits that NPR is targeting have the potential to be some of the highest grade in Nevada history. They just need one successful discovery hole and NPR will instantly be $5-$10 per share.

It is true that European American Resources only averaged a market cap of approximately US$18 million when they "owned" Prospect Mountain, but European American Resources owed the Erickson family US$100 million from a promissory note that they issued them to purchase the property. European American Resources had to make minimum payments towards the promissory note each year, which made it impossible for European American Resources to continue raising money for additional exploration. European American Resources only raised a total of US$2 million in cash vs. NPR having CAD$8.7 million in cash as of June 30th!

An US$18 million market cap in 1997 would actually equal at least US$90 million in today's dollars considering that gold prices are more than 5X higher today compared to 1997. If European American Resources didn't have such a bad deal structure with a US$100 million promissory note, we are sure it would have averaged a 50%-100% higher market cap in the US$27 million to US$36 million range, which would currently be equal to US$135 million-US$180 million adjusted for today's USD value. Based on the current USD/CAD exchange rate of $1.3713 this would be equivalent to NPR trading at a market cap in the CAD$185.13 million to CAD$246.83 million range.

Although NPR currently has only 30 million shares outstanding, NPR will be required to issue an additional 3 million shares to increase its current 80% ownership of Prospect Mountain up to 100%. This means we should use an estimate of 33 million shares outstanding when calculating a fair value for the company. A market cap for NPR today in the CAD$185.13 million to CAD$246.83 million range with 33 million shares outstanding (assuming NPR increases its stake in Prospect Mountain to 100% after its initial drilling results get announced before year-end) will value NPR at $5.61-$7.48 per share.

NPR has a much more experienced management team than the management team of European American Resources, which had no mining experience and no experience running a publicly traded company. NPR's Chairman/CEO Brian Hinchcliffe along with NPR's head geologist Mike Sutton co-founded Kirkland Lake Gold. Brian Hinchcliffe was CEO of Kirkland Lake Gold for 12 years turning it into a multi-billion-dollar market cap company that would eventually get acquired by Agnico Eagle Mines (AEM) for US$13.5 billion to form the world's third largest gold mining company. After leaving Kirkland Lake Gold, Brian Hinchcliffe and Mike Sutton co-founded Rupert Resources (TSX: RUP) with Brian Hinchcliffe becoming CEO of the company. RUP rose from $0.06 per share up to a record high of $6.77 per share where its market cap hit a high of CAD$1.23 billion.

One would have to believe that if European American Resources had a management team of equal experience to NPR, it would have averaged an additional 25% premium market cap in the US$33.75 million to US$45 million range, which would currently be equal to US$168.75 million-US$225 million adjusted for today's USD value. Based on the current USD/CAD exchange rate of $1.3713 this would be equivalent to NPR trading at a market cap in the CAD$231.41 million to CAD$308.54 million range. Assuming NPR increases its stake in Prospect Mountain to 100% after its initial drilling results get announced before year-end thereby increasing its shares outstanding to 33 million this will value NPR at $7.01-$9.35 per share.

Back in 2001, Homestake Mining the longest listed NYSE company of all time wanted to acquire NPR's newly acquired Prospect Mountain Mine Complex. Homestake signed a joint venture agreement with European American Resources to earn a controlling stake in it. However, after drilling only two holes in NPR's project area, Barrick acquired Homestake Mining and immediately closed down Homestake's adjacent Ruby Hill Mine thereby ending their need to explore Prospect Mountain. NPR was able to get the drilling data for Homestake's two holes and they were successful at intercepting strong grades of gold in a totally different area of the property compared to where European American Resources was discovering high grade gold.

The Prospect Mountain/Ruby Hill District in Eureka, NV is the only place we have ever seen besides the Beatty Gold District where Augusta Gold (TSX: G) has its two gold projects... where there is gold nearly everywhere!

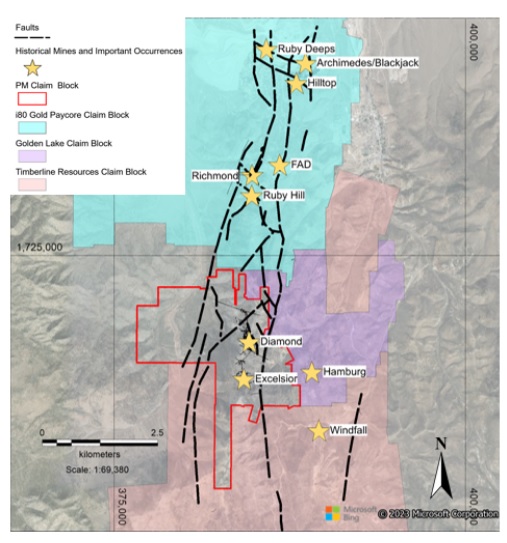

NPR's Prospect Mountain is in between the exact same faults as all of i-80 Gold (TSX: IAU)'s largest/highest grade gold deposits directly to the north.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA's President has purchased 60,000 shares of NPR in the open market and intends to buy more shares. NIA's President has purchased 224,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.