If You Support Israel Buy Zedge (ZDGE)

Back on August 21, 2023, NIA suggested Zedge (ZDGE) at $1.70 per share explaining, "We…

Important NIA Update

At some point in the not-too-distant future Solaris Resources (TSX: SLS) will be acquired at…

NIA’s SBSW Call Option Up 164.52%, NIA Members Profiting 7-Figures

NIA's Sibanye-Stillwater (SBSW) January 2027 $5 Call Option has just hit a new high this morning of…

Even AI Says J. David Lowell Is GOAT Geologist

We asked ChatGPT: Who is on the Mount Rushmore of greatest geologists of all time…

Platinum Up 5.58% to $1,274.85 Per Oz

Platinum is up by 5.58% today to $1,274.85 per oz. On March 27, 2025, NIA…

Borealis Announces Initiation of Crushing Ahead of Schedule at the Borealis Mine

June 11, 2025 7:00 AM EDT Toronto, Ontario--(Newsfile Corp. - June 11, 2025) - Borealis…

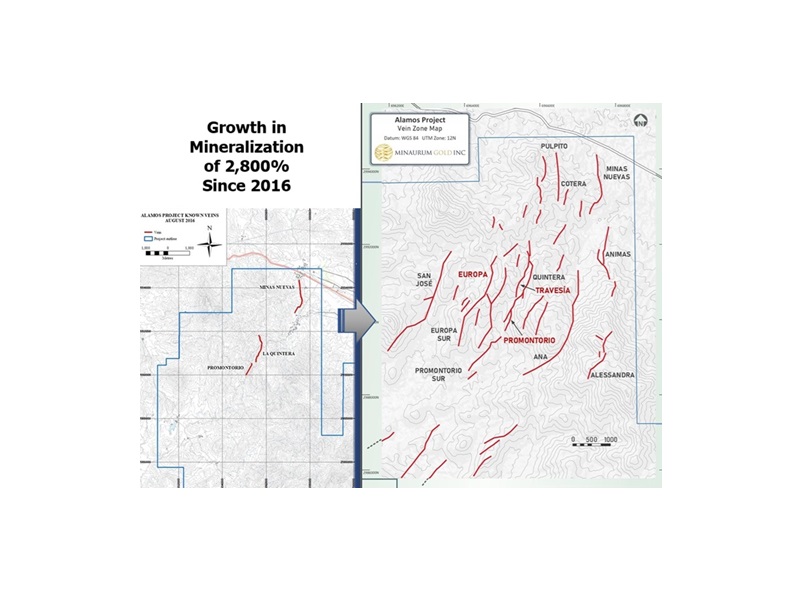

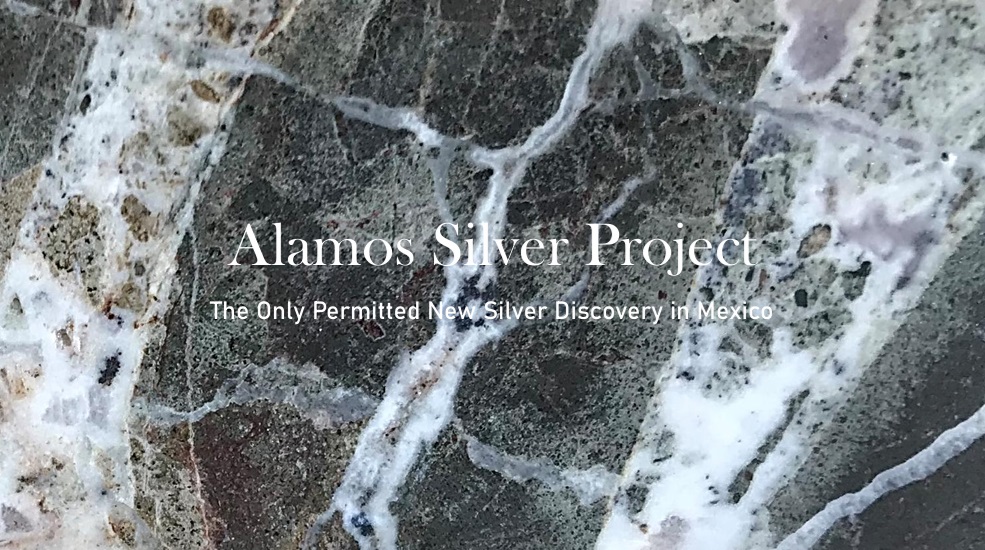

Notes From Minaurum Gold (TSXV: MGG) CEO

Minaurum Gold (TSXV: MGG)'s CEO said the following in a new interview: Drill results throughout…

Minaurum Gold (TSXV: MGG): Poised for Growth to 100M Ounces of Silver Resources

Minaurum Gold (TSXV: MGG) has the same co-founders as MAG Silver (MAG), a company acquired…

Why We Don’t Invest in Barrick or Newmont

Here is a great article from the mid-1990s about one of J David Lowell's companies…

MGG = High-Grade Silver, HSLV = High-Grade Gold

Minaurum Gold (TSXV: MGG) = high-grade silver play. Highlander Silver (TSX: HSLV) = high-grade gold…