The U.S. yield curve is now at its flattest level in over a decade and is getting ready to invert. On Friday, the U.S. 10-2 year yield spread declined by 2.2 basis points to settle the week at an 11-year low of 18.5 basis points. All together, the U.S. 10-2 year yield spread fell last week by 6.6 basis points and is down 11.3 basis points so far this month.

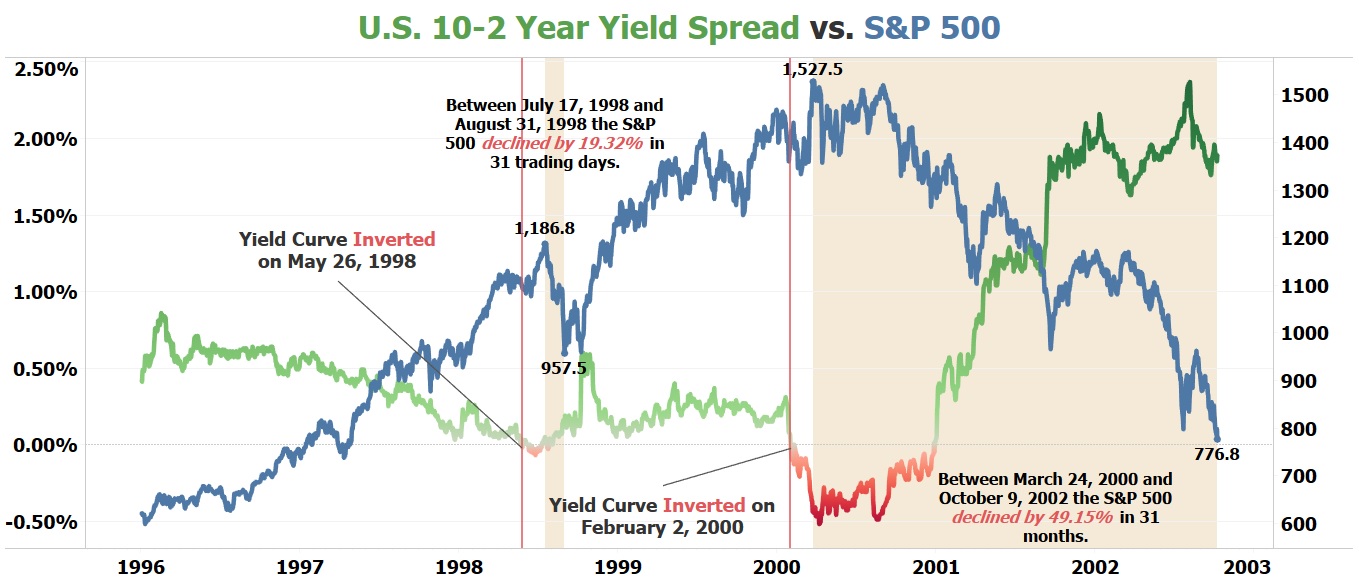

Historically, when the U.S. 10-2 year yield spread inverts, it has been a near perfect predictor that a recession is coming in the near-future. The only time that the 10-2 year yield spread inverted and a recession didn't follow was in 1998. Still, after the yield curve briefly inverted on May 26, 1998, the S&P 500 reached a short-term peak a few weeks later on July 17, 1998 of 1,186.80 and over the following 31 trading days it experienced a dramatic decline of 19.32% to finish August 31, 1998 at 957.50.

On February 2, 2000, the U.S. 10-2 year yield spread began to experience a much larger inversion that lasted for the remainder of the year. A few weeks later on March 24, 2000, the S&P 500 peaked at 1,527.50, a level that it needed over 7 years to return to. Over the following 31 months, the S&P 500 lost 49.15% of its value, declining to an October 9, 2002 closing price of 776.80.