We Are Being Honest Unlike Kevin Bambrough

Hydrograph Clean Power (CSE: HG) continues to go up despite no revenue or any legit…

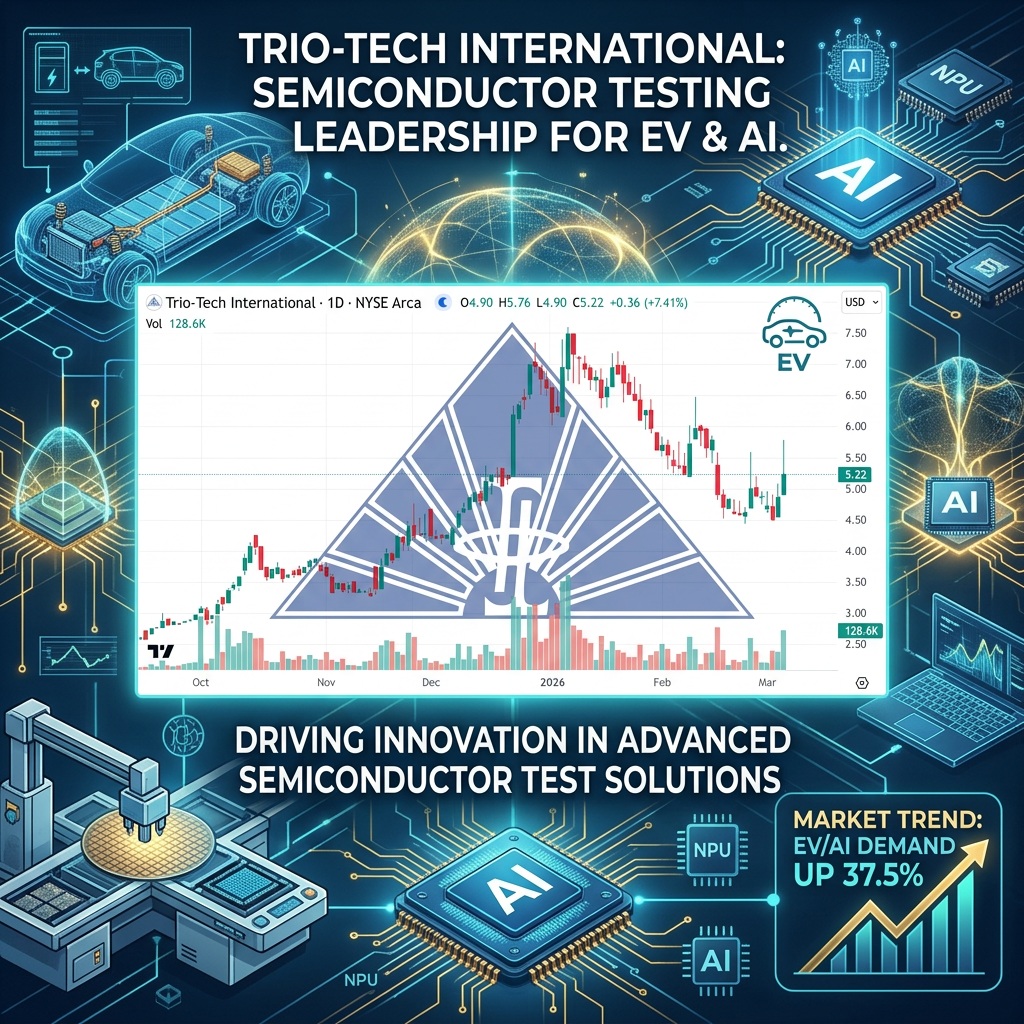

TRT Gains for Fourth Straight Day

This weekend, NIA explained Trio-Tech International (TRT) is the safest stock we have ever suggested…

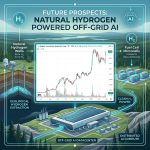

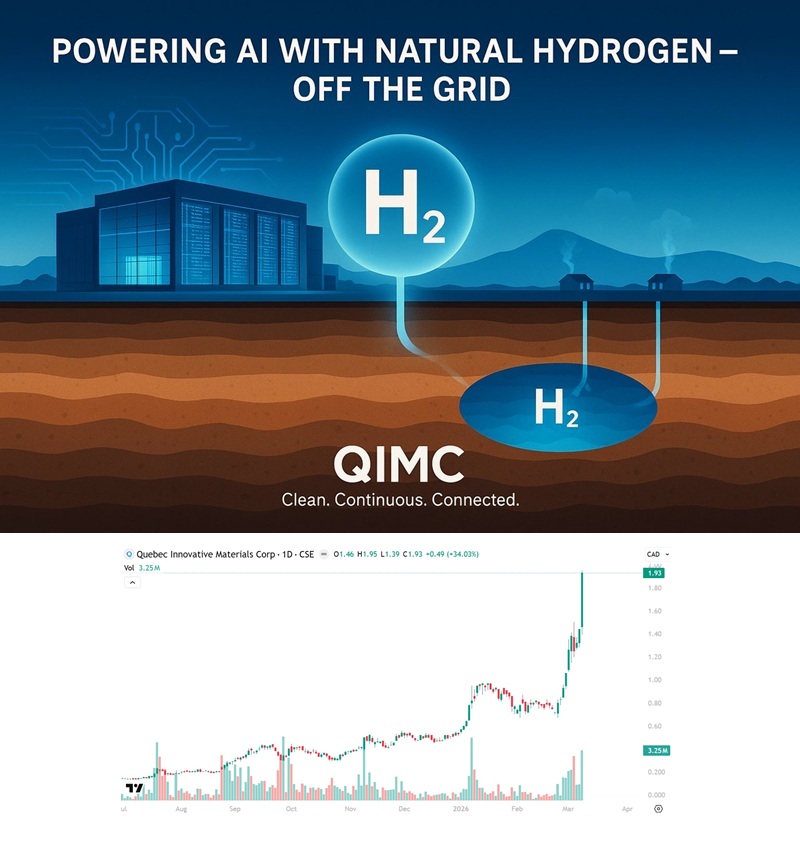

Natural Hydrogen in Infancy Like Bitcoin in 2015, QIMC Soars 34.03% to New All-Time High

Over the weekend, NIA explained QI Materials (CSE: QIMC) is the highest risk stock we…

NIA Sunday Evening Update: Must Read Immediately

In NIA's opinion, the only investment better than owning a massive resource of gold and/or…

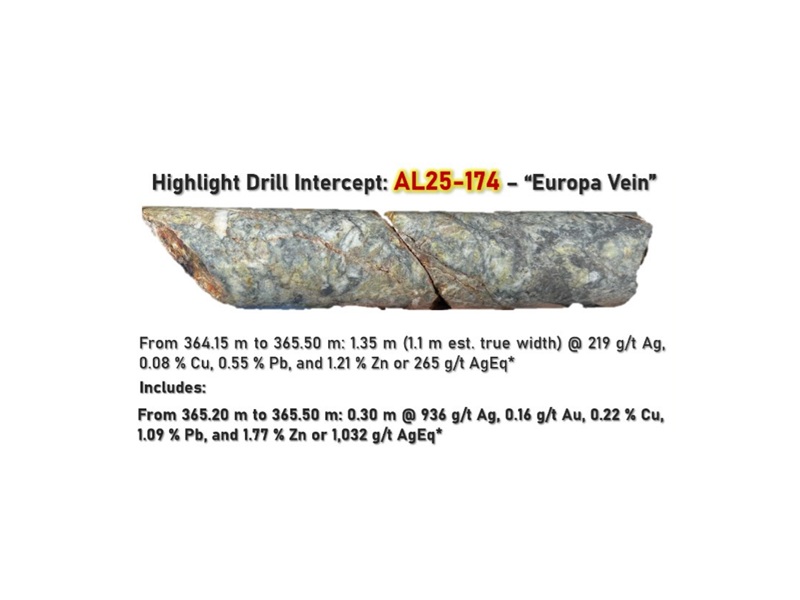

Highlander Silver NYSE Trading Begins on Wednesday

Highlander Silver (TSX: HSLV) will list on the NYSE American Exchange beginning on Wednesday under…

Will TRT Be $50+ Within Months?

Trio-Tech International (TRT) gained for its third straight day on Friday surging 4.79% to $5.47…

Natural Hydrogen = Bitcoin in 2015

Yesterday morning, NIA explained that Trio-Tech International (TRT) is the safest stock that NIA has…

TRT: Possible Rivian R2 Connection

If you read Trio-Tech International (TRT)'s press release from Wednesday, we know that TRT developed…

TRT Gains 7.41% to $5.22 and Has 100% Chance of Going Much Higher

Trio-Tech International (TRT) gained by 7.41% today to $5.22 per share and has a 100%…

The Safest Stocks in Today’s Market

In NIA's opinion, Trio-Tech International (TRT) is the safest stock in the market with a…