The TSX Venture Composite Index is up by 3.73% today and after slowly trending higher from an extreme low in late-2023 it is getting ready to make its most explosive breakout in history next week.

We said in recent weeks that many people were waiting for it to retest its March 2020 low before entering gold explorers, but it would never happen... and it was about to break through its most important long-term key breakout point.

In our opinion, the move it made this week briefly falling below the lower trend line followed by a rapidly upward reversal is almost exactly like the March 2020 setup. In all likelihood, the low it set this week is the equivalent of the March 2020 low immediately before the upward explosion.

Take a look again at this chart we made five days ago:

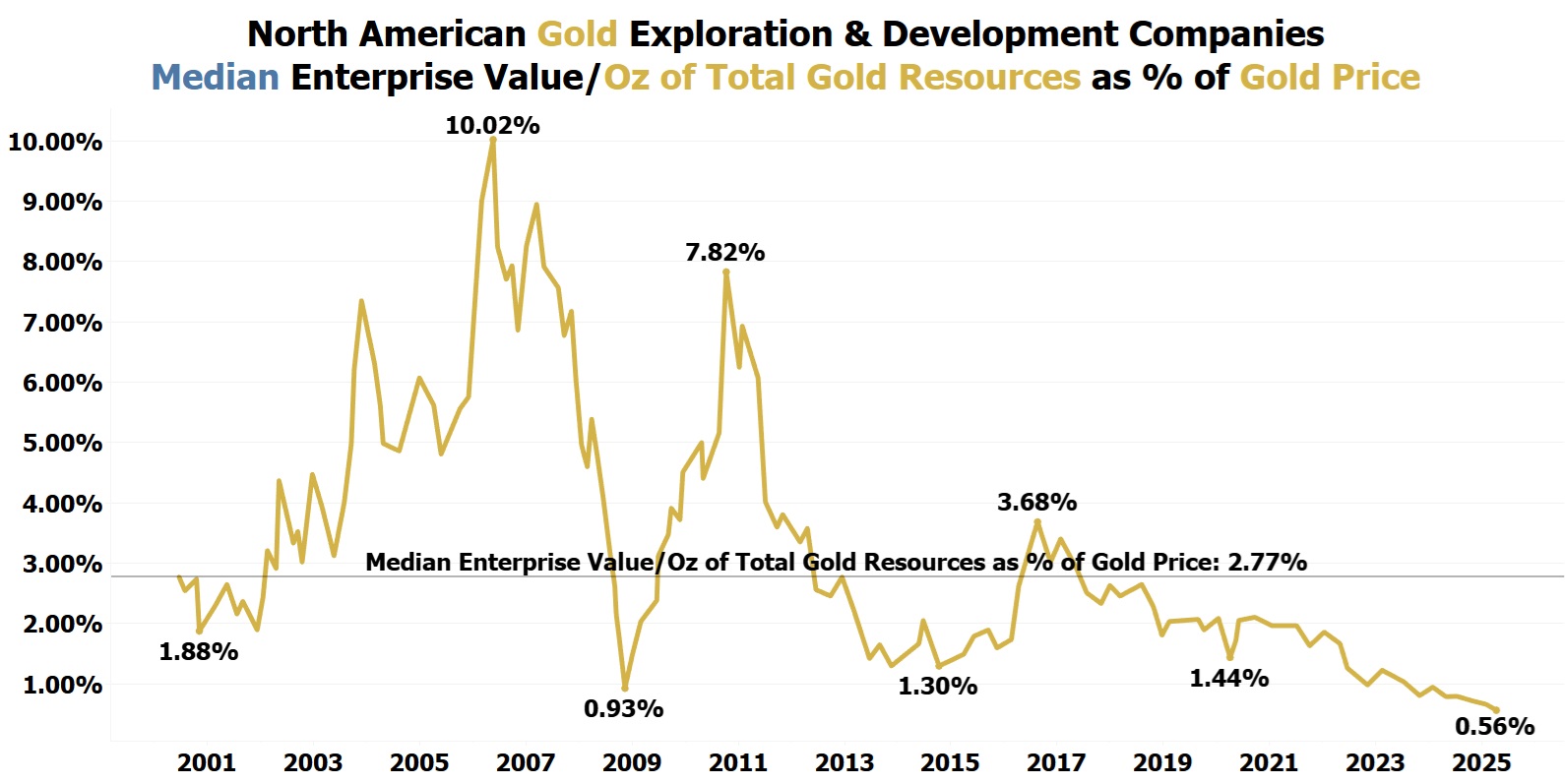

North American gold explorers with resources relative to the price of gold have never in history been more undervalued than today. We are already below the March 2020 lows and October 2008 lows when you consider the price of gold!

The above charts are irrelevant to Highlander Silver (CSE: HSLV) it is in a league of its own: click here to learn about HSLV.

The above charts are much more important for Augusta Gold (TSX: G) because they own the only remaining independent gold deposits in the Beatty Gold District. AngloGold Ashanti (AU) has already spent US$600 million acquiring North Bullfrog directly adjacent to Augusta Gold's Bullfrog and Sterling directly adjacent to Augusta Gold's Reward. AU definitely wants to finish consolidating the Beatty Gold District: click here to learn about G.

We love how Borealis Mining (TSXV: BOGO) owns a fully permitted mine in Nevada’s top-ranked Walker Lane Trend and is getting ready to begin processing its stockpile: click here to learn about BOGO (watch the Dark Pond of Money).

We love the large scale of Goldshore (TSXV: GSHR)'s gold resource in Ontario at a low enterprise value of less than US$15/oz: click here to learn about GSHR.

The only technology stock we are bullish on is Hydreight (TSXV: NURS): click here to learn about NURS.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA's President has purchased 125,000 shares of HSLV and can buy or sell shares at any time. NIA's President has purchased 232,200 shares of G and may purchase more shares. NIA has received compensation from NURS of US$30,000 cash for a three-month marketing contract. NIA has received compensation from BOGO of US$100,000 cash for a twelve-month marketing contract. NIA has received compensation from GSHR of US$30,000 cash for a three-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.