Apple (AAPL) yesterday became the first U.S. publicly traded company to reach a $1 TRILLION market cap and the financial news media was ecstatic! All afternoon on CNBC and Bloomberg, Tim Cook was celebrated for being "Apple's best CEO ever", implying that he has already surpassed the success of Steve Jobs. According to one CNBC host, Jobs was always too distracted with product development and didn't care enough about raising shareholder value.

Although Cook has yet to develop any new products capable of achieving a meaningful reduction in the company's overreliance on iPhone sales, analysts have shared a near-unanimous opinion that Apple's product sales no longer matter now that a "real CEO" like Cook is in charge who will respect the advice of elites on Wall Street by prioritizing share buybacks above all else!

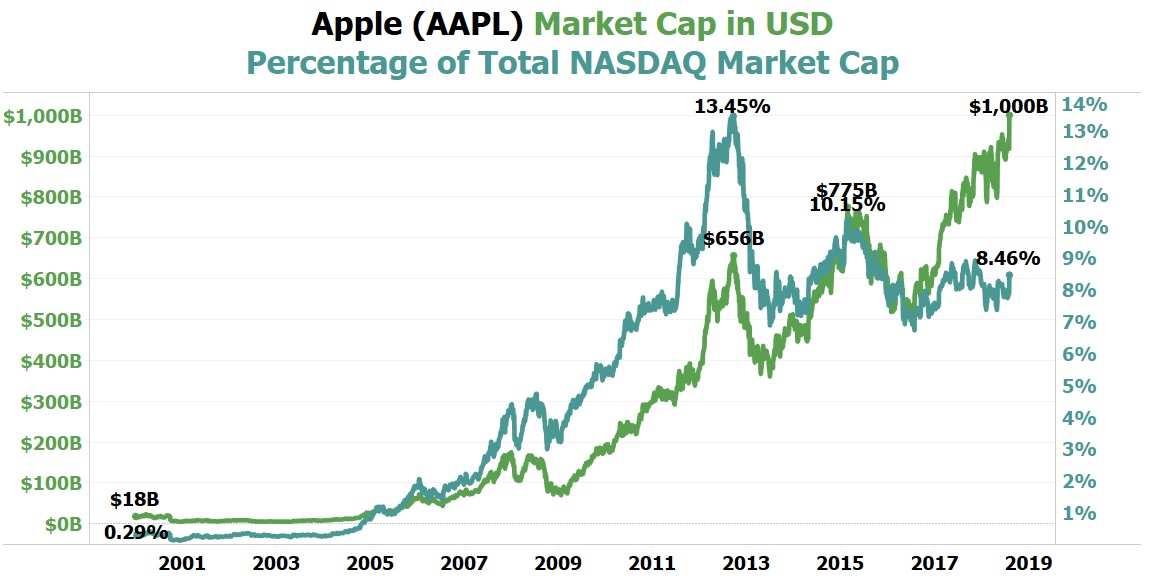

The truth is, when AAPL made its initial big rally in 2012 to a peak market cap of $656 BILLION, AAPL represented a record high 13.45% of the NASDAQ's total market cap. AAPL's 2012 rally was a result of rapid growth and solid fundamentals. AAPL didn't need buybacks to artificially boost its share price and inflate earnings.

However, after initially peaking in September 2012, AAPL's market cap crashed by 45.12% over the following nine months to a June 2013 low of $360 billion. With year-over-year revenue growth down to zero, a desperate Cook took advantage of the company's $40 BILLION in cash and zero debt, by announcing a HUGE share buyback.

Between June 2013 and February 2015, AAPL repurchased $70 BILLION worth of its own stock, driving its market cap up from $360 BILLION to a new all-time high of $775 BILLION! Despite AAPL's market cap reaching a level that was $119 BILLION above its previous peak, AAPL's share of the total NASDAQ market cap only reached 10.15%, no where near its record high of 13.45% from September 2012!

Since February 2015, AAPL has repurchased an additional $144.64 BILLION worth of its own stock. Even with AAPL's market cap now above $1 TRILLION, its share of the total NASDAQ market cap has continued declining to a current level of only 8.46%! For AAPL to have the same influence today as it had in 2012, it would need to be trading with a current market cap today of $1.6 TRILLION!

To fund the buybacks that were necessary to achieve a $1 TRILLION market cap, AAPL was forced to go deeply into debt. As of June 30, 2018, AAPL has total debt of $114.9 BILLION that well exceeds its cash+short-term investments of $70.97 BILLION.