When Orogen Royalties (TSXV: OGN) was $0.70 per share we calculated it was worth somewhere in between $1 and $2. We said it would definitely reach $1 per share but $2 per share would be the absolute full value for the company.

Triple Flag's announced acquisition price for OGN in U.S. dollars was US$305 million. They have a few non-Beatty Gold District royalties with CAD$7.33M in revenue that we estimate are worth 10x revenue valuing them at CAD$73.33 million or USD$52.90 million.

Therefore, Triple Flag agreed to pay approximately US$252.1 million for the 1% NSR royalty in Merlin+Silicon, so let's say US$250 million.

Merlin+Silicon have a total of 16.31 million oz of gold resources (mostly inferred). They estimate high recoveries of 94%. Gold is currently US$3,350 per oz.

If AngloGold Ashanti (AU) produces 16.31 million x 94% = 15.33 million oz at Merlin+Silicon X $3,350 = $51.36 billion X 1% = US$513.60 million, so let's say US$500 million.

Triple Flag agreed to pay US$250 million for a royalty that at today's gold price will only generate US$500 million in total royalty revenue and if AU only produces 300,000 oz per year it will take 50 years to produce 15 million oz.

Did Triple Flag overpay for this royalty? Beatty is North America's #1 most important new gold district of our lifetimes... so they definitely wanted the prestige of owning it.

If Triple Flag believes a 1% NSR royalty in the early-stage Merlin+Silicon Projects is worth US$250 million it implies that Merlin+Silicon (Expanded Silicon) is currently worth US$5 billion or US$306.56 per oz of total gold resources.

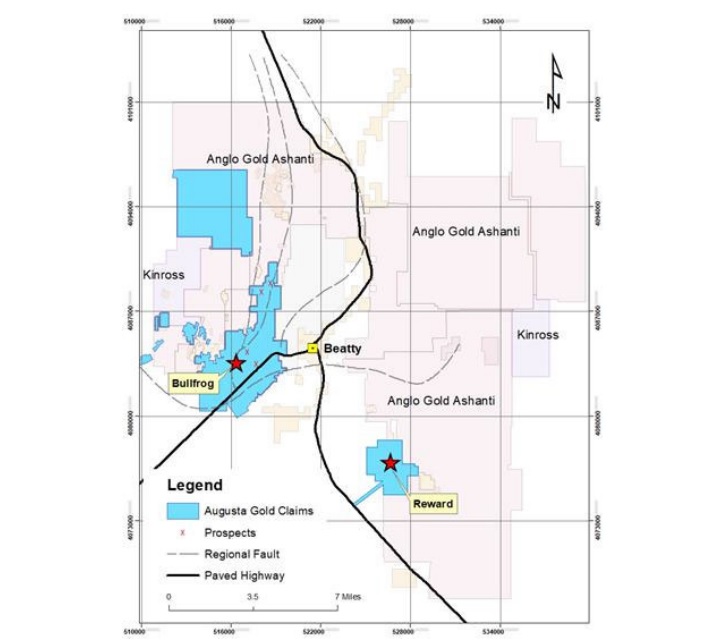

Augusta Gold (TSX: G) owns 1.92 million oz of gold resources in the Beatty Gold District at Bullfrog+Reward directly adjacent to Merlin+Silicon. A valuation of US$306.56 per oz values Augusta Gold (TSX: G) at $9 per share.

We know it seems unrealistic that Augusta Gold (TSX: G) will soon hit $9 per share, but normal project economics and fundamentals don't apply to a district consolidation play.

If Orogen Royalties (TSXV: OGN) is worth $2 per share, Augusta Gold (TSX: G) is worth $9 per share.

We love the idea of buying Augusta Gold (TSX: G) shares here at $1.08 per share knowing management paid an average of $1.30 per share for their positions. It is exactly like when we suggested Wildcat Silver/Arizona Mining at $0.37 per share, which was also below the price management paid of $0.45 per share. Arizona was later acquired for $6.20 per share for a gain of 1,576% from NIA's suggestion price.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. NIA's President has purchased 232,200 shares of G and may purchase more shares. This message is meant for informational and educational purposes only and does not provide investment advice.