Titan Mining Corporation (TSX: TI) has emerged as a standout investment opportunity in the metals and mining sector, combining operational excellence in zinc production with strategic positioning in critical minerals like graphite.

Titan has been repaying debt and trades with a current enterprise value at $0.56 per share of only 1.20x revenue.

Titan's Empire State Mines in New York saw its zinc production increase by 56% last quarter on a year-over-year basis.

Projected 2025 C1 cash costs of $0.89–$0.96/lb and AISC of $0.98–$1.05 position Titan well among peers, especially with zinc prices projected to rise.

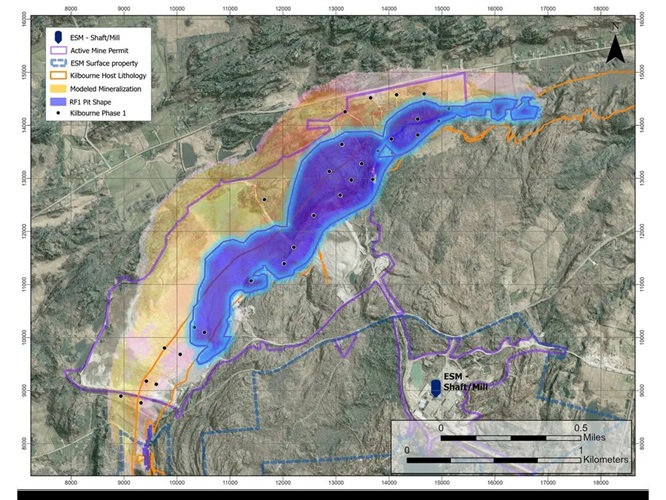

Titan has discovered a near-surface graphite deposit at the Kilbourne Project, within 1 mile of its Empire State Mines processing plant.

The company is building a commercial demonstration plant to process the newly discovered graphite. Here's why that's exciting:

Titan controls 80,000 acres of mineral rights in New York. The Kilbourne graphite discovery aligns with U.S. critical mineral strategies and may make Titan the first U.S.-based commercial graphite producer.

Executive Chairman Richard Warke has achieved $4.5 billion in successful exits over the last 15 years consistently achieving huge returns for shareholders.

CEO Donald Taylor previously discovered Arizona Mining's Taylor Deposit leading to a $2.1 billion sale to South32 for a gain of 1,576% from NIA's suggestion price.

Global zinc inventories are near multi-year lows while supply growth lags. Titan’s leverage to rising zinc prices could significantly boost EBITDA. A 10% zinc price increase may lift EBITDA by 25%.

Titan Mining Corporation (TSX: TI) represents a rare blend of value and growth. Its zinc expansion, graphite discovery, undervalued stock, and U.S.-based production advantage make it one of the most compelling resource investments of 2025.

United States Antimony Corporation (UAMY) is America's only producer of antimony and it closed yesterday at a new all-time high of $3.49 per share for a gain of 1,339.18% from one year ago. With Titan about to become America's only producer of graphite, look for it to make similar and potentially much larger gains than UAMY.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is meant for informational and educational purposes only and does not provide investment advice.