Augusta Gold (TSX: G) and Solaris Resources (TSX: SLS) Have Almost No Resistance

Augusta Gold (TSX: G) has almost no resistance in the market due to its Executive Chairman Richard…

SLS Closes at High of Day, New 32-Month High

Solaris Resources (TSX: SLS) gained another 2.87% today to close at its high of day…

Solaris Resources (TSX: SLS) Gains 12.62% Closes at High of Day

Solaris Resources (TSX: SLS) gained by 12.62% today to close at its high of day…

Solaris Resources (TSX: SLS) Hits New 26-Month High

On June 12th, NIA sent out an alert saying, "At some point in the not-too-distant…

Horrible Tragedy This Morning

There was a horrible tragedy this morning. Diogo Jota the superstar football player who had…

Augusta Gold (TSX: G) Gains by 5.38% to $1.37 Per Share

Augusta Gold (TSX: G) gained by 5.38% today to $1.37 per share and has the…

First Mining (TSX: FF) Gains by 5.41% to $0.195 Per Share

First Mining Gold (TSX: FF) gained by 5.41% today to $0.195 per share and its…

What a Huge Day for BYON and CTGO

Yesterday morning, NIA sent out an alert saying, "Look for Beyond (BYON) to bounce to…

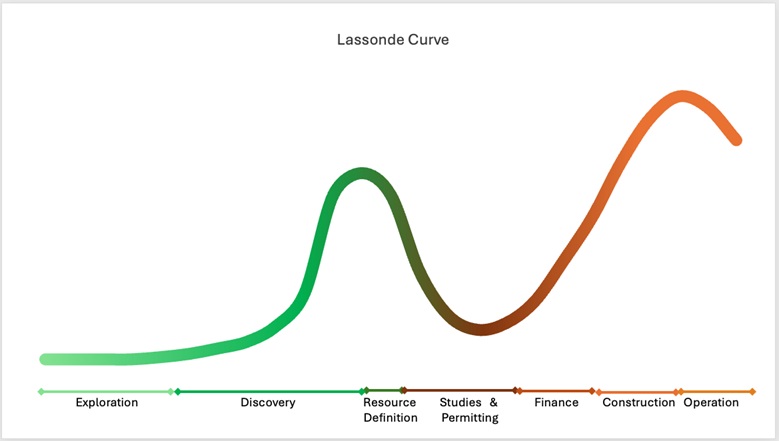

Augusta Gold (TSX: G) and First Mining (TSX: FF) Perfectly Positioned on Lassonde Curve

When you see the gains Augusta Gold (TSX: G) is about to make in the…

Augusta Gold (TSX: G) Fair Value: $7.20 Per Share

Canadian markets were closed today for a holiday but will reopen tomorrow. From the date…