Back on February 2, 2024, NIA suggested SPDR Gold Trust (GLD) March 28th call options. NIA members made a HUGE profit of 654% in 54 days. This was NIA's only option suggestion since it suggested Imax (IMAX) call options in October 2022, which gained by 357% in 22 days.

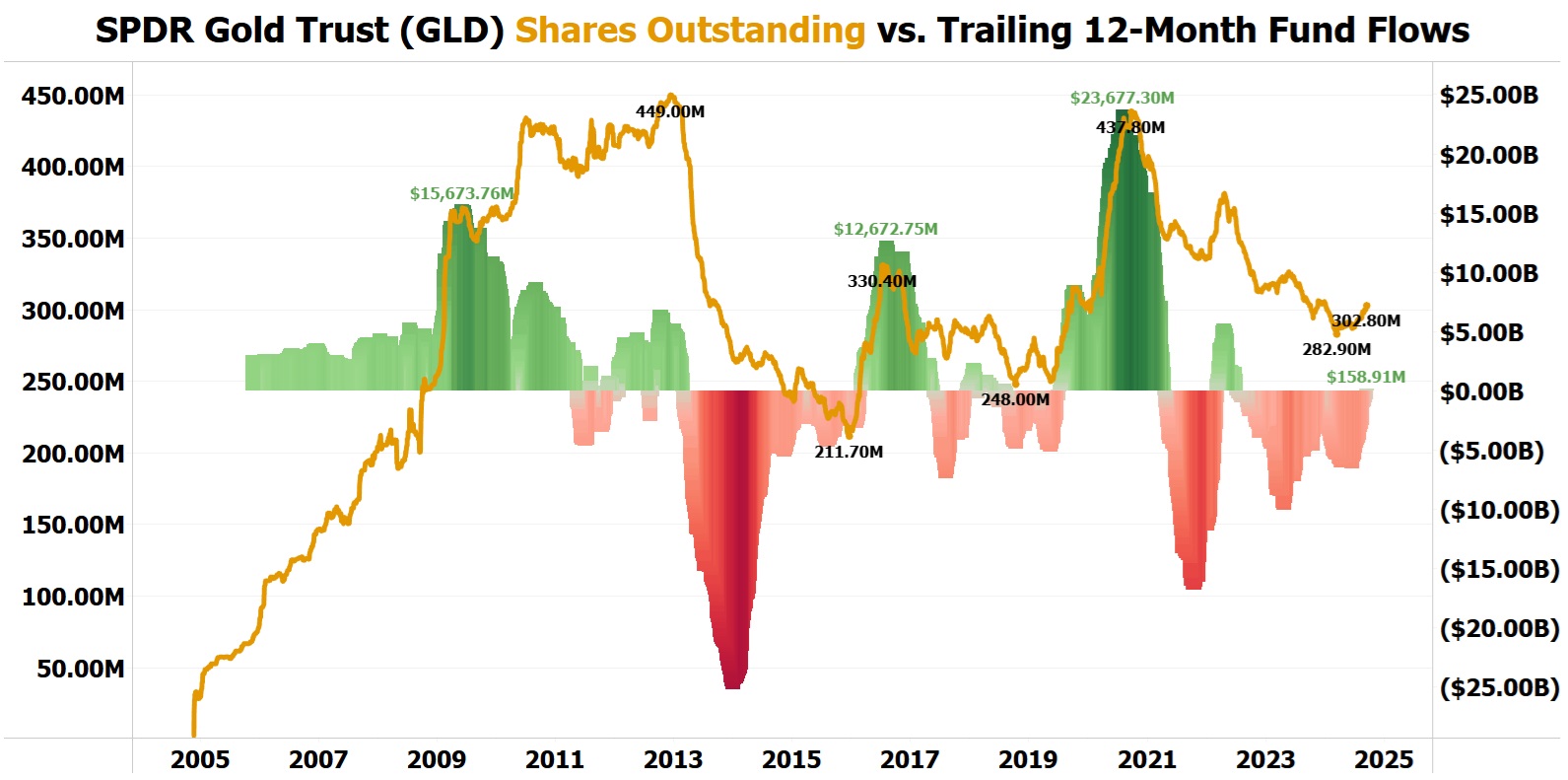

On Friday, GLD's trailing 12-month fund flows turned positive for the first time in over 26 months. Over the last 12 months, GLD has seen positive fund flows of $158.91 million. At the peak of the bull markets for gold mining/exploration stocks in 2016 and 2020, GLD trailing 12-month fund flows reached $12.673 billion and $23.677 billion, respectively.

Where will Augusta Gold (TSX: G) be trading after GLD shares outstanding return to between 437.8 million and 449 million? They are the only publicly traded junior resource company to own a fully permitted construction ready gold project in a brand-new Tier 1 U.S. gold district.

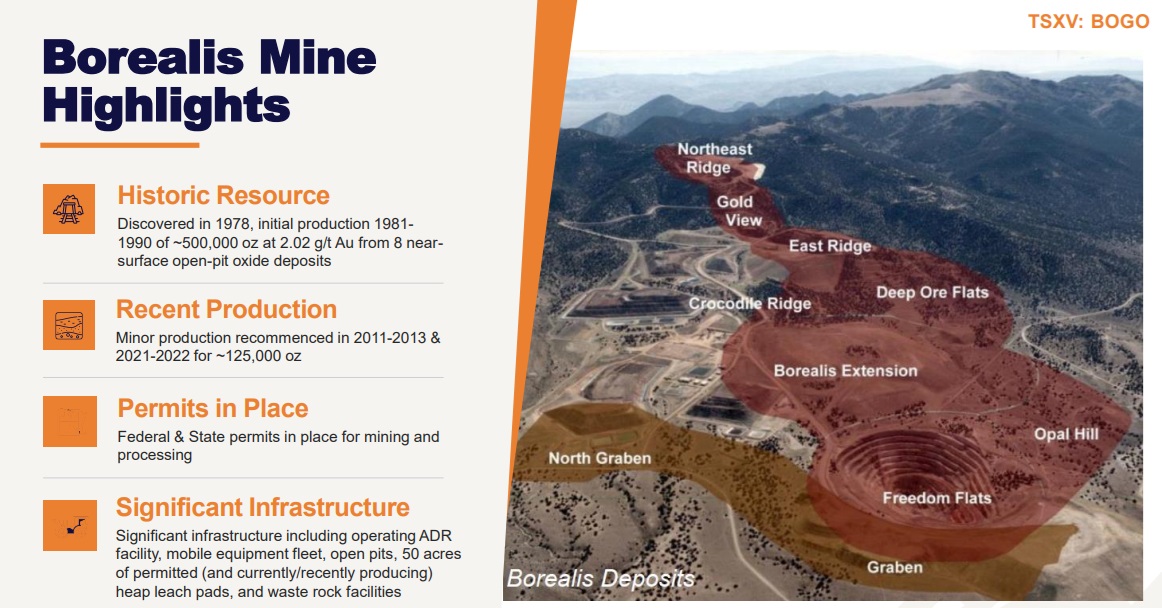

Borealis Mining (TSXV: BOGO) is worth researching for the simple fact that not only are they fully permitted, but they already have all of the infrastructure in place for production.