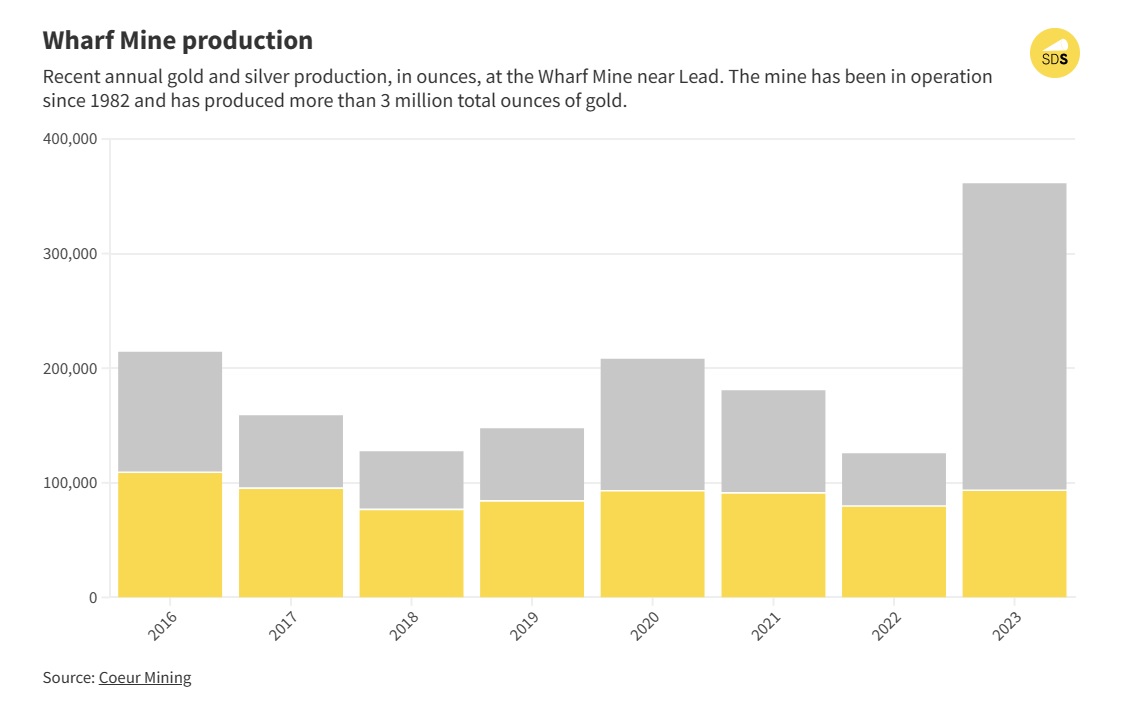

An article came out last week about how Coeur Mining (CDE)'s gold production from their Wharf Mine in South Dakota increased by 17% last year with its Wharf Mine silver production increasing by 481%. Click here to read.

Dakota Gold (DC) owns the directly adjacent Richmond Hill Gold Project where DC established a maiden gold resource this month of 2.46 million oz. DC made it clear that their Richmond Hill Gold Project remains open in all directions for resource expansion.

DC's highest grade gold discoveries are being made at their Maitland Gold Project, which is in the same district of South Dakota and directly on trend and adjacent to the historic Homestake Mine the #1 largest producing gold mine in U.S. history.

Another company with a gold project in the same district as DC and CDE is Solitario Resources (XPL), which closed last week at a new two-year high after announcing surface samples at their Golden Crest Gold Project containing bonanza gold grades of 57.9, 50.2, 42.7, and 32.3 g/t gold. XPL is an earlier stage company. DC owns the highest quality gold projects in the district. Click here to read about XPL's discovery next to DC and CDE in South Dakota.

The world's third largest gold producer Agnico Eagle Mines (AEM) owns the past producing Gilt Edge Gold Mine in the same district as DC, CDE, and XPL. AEM's Gilt Edge has a gold resource of over 3.5 million oz and an article came out last week about how AEM is doing secret drilling at Gilt Edge and may bring it back into production. Click here to read about AEM's secret drilling at Gilt Edge next to DC, CDE, and XPL.

DC is likely to become the #1 biggest U.S. listed gold play of 2024.

Even though it is unlikely that DC gains as much as Augusta Gold (TSX: G) in 2024, DC has potential to become the next household name gold exploration company.

Both G and DC have former Barrick owned gold properties. The only other company with a former Barrick owned gold exploration project is Skeena Resources (TSX: SKE), which has a significantly higher market cap than G and DC. SKE has no chance of receiving permitting to bring Eskay Creek back into production as an open pit gold mine.

If SKE's Eskay Creek did have potential to be redeveloped as an open pit gold mine, Augusta Gold (TSX: G)'s Executive Chairman would have jumped at the chance to acquire it years ago considering that his mentor from early in his career financed the early exploration/development of Eskay Creek, allowing for it to become the world's highest grade producing underground gold mine from 1994 through 2008 during which time Eskay Creek produced 3.3 million oz of gold.

He chose to acquire Bullfrog instead because not only did it produce 2.3 million oz of gold, but G's Bullfrog has a 100% chance of going back into production regardless of if it is under the ownership of Augusta Gold (TSX: G), AngloGold Ashanti (AU), or another gold mining company that may make a higher offer to acquire G.

AU has already paid more than double G's market cap to acquire the Crown/Sterling Gold Project in the Beatty Gold District from CDE, which contains less than half of the gold resources of G's adjacent Beatty Gold District properties.

Both G and DC are likely to surpass the market cap of SKE in 2024.

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA has received compensation from DC of US$30,000 cash for a three-month marketing contract. NIA's President has purchased 224,200 shares of G in the open market and intends to buy more shares. This message is meant for informational and educational purposes only and does not provide investment advice.