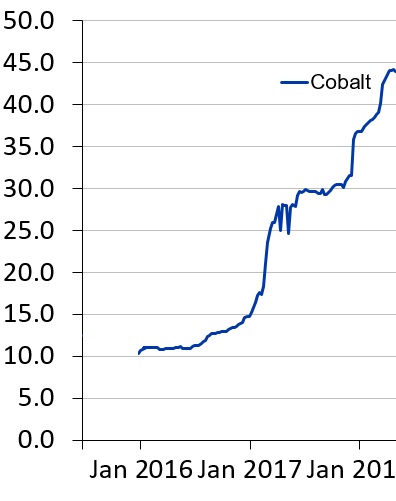

Prior to Tesla (TSLA)'s Nevada Gigafactory opening in January 2016, cobalt was trading at a decade-low of $10 per lb. As soon as the Gigafactory opened, TSLA's demand for cobalt rapidly ramped up sending cobalt prices exploding higher. Cobalt rallied for 26 straight months to a new all-time high in March 2018 of $44 per lb.

Most cobalt stocks gained between 500% and 10,000% during this time period!

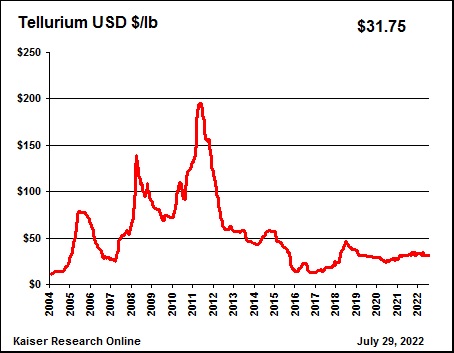

The world's #1 largest manufacturer of Tellurium-based CdTe solar cells, First Solar (FSLR), will be opening its new flagship U.S. manufacturing facility, in Lake Township, Ohio, in the first half of 2023. It will increase FSLR's annual production capacity by 3.3 GW up to a new all-time high of 6 GW for an increase of 122.22%. Current tellurium prices remind us exactly of depressed cobalt prices back in January 2016 prior to cobalt making its largest rally in history immediately after the opening of TSLA's Gigafactory!

Back in 2006, FSLR's production capacity was only 0.1 GW and tellurium was priced at $25 per lb. At the start of 2007, FSLR began to ramp up its production capacity of Tellurium-based CdTe solar cells, causing tellurium to explode by 460% within twelve months to a new all-time high in early-2008 of $140 per lb! In early-2011 when FSLR's production capacity hit 2.3 GW, tellurium prices peaked at an all-time high of $200 per lb!

A 2.2 GW increase in FSLR's Tellurium-based CdTe solar cell production capacity over a four-year period caused tellurium to rally from $25 per lb up to $200 per lb for an increase of 700%! When FSLR's new flagship U.S. manufacturing facility opens early next year, FSLR will rapidly ramp up its Tellurium-based CdTe solar cell production capacity by 3.3 GW in a single year!

If a 2.2 GW increase in production capacity over a four-year period caused tellurium to explode 700% higher, imagine what a 3.3 GW increase in production capacity within a single year will do to tellurium prices in 2023! Tellurium is currently at a rock bottom price of $31.75 per lb and is about to experience its largest and most rapid increase in demand in history!

Nearly all tellurium production comes out of China as a byproduct of copper mining! It will be 100% impossible for Chinese copper miners to ramp up tellurium production and keep pace with next year's explosion in demand for tellurium!

First Tellurium (CSE: FTEL) is the only way for investors to capitalize on the 2023 tellurium boom!

FSLR had previously planned to use FTEL's Klondike Project in Colorado as a potential primary source of tellurium, but FSLR decided not to enter the mining business! The tellurium grades at FTEL's Klondike were the highest encountered by FSLR's nationwide tellurium exploration program!

Past performance is not an indicator of future returns. NIA is not an investment advisor and does not provide investment advice. Always do your own research and make your own investment decisions. This message is not a solicitation or recommendation to buy, sell, or hold securities. NIA has received compensation from FTEL of US$100,000 cash for a six-month marketing contract. This message is meant for informational and educational purposes only and does not provide investment advice.