QIMC Soars 9.52% to New All-Time High of $1.38, Intersects Third Hydrogen-Bearing Structural Zone

QI Materials (CSE: QIMC) is the biggest discovery of our careers and surged by 9.52%…

Kevin Bambrough’s Ability to Trick Low IQ Investors

When Tesla (TSLA) had its IPO on June 29, 2010, at a split-adjusted $1.13 per…

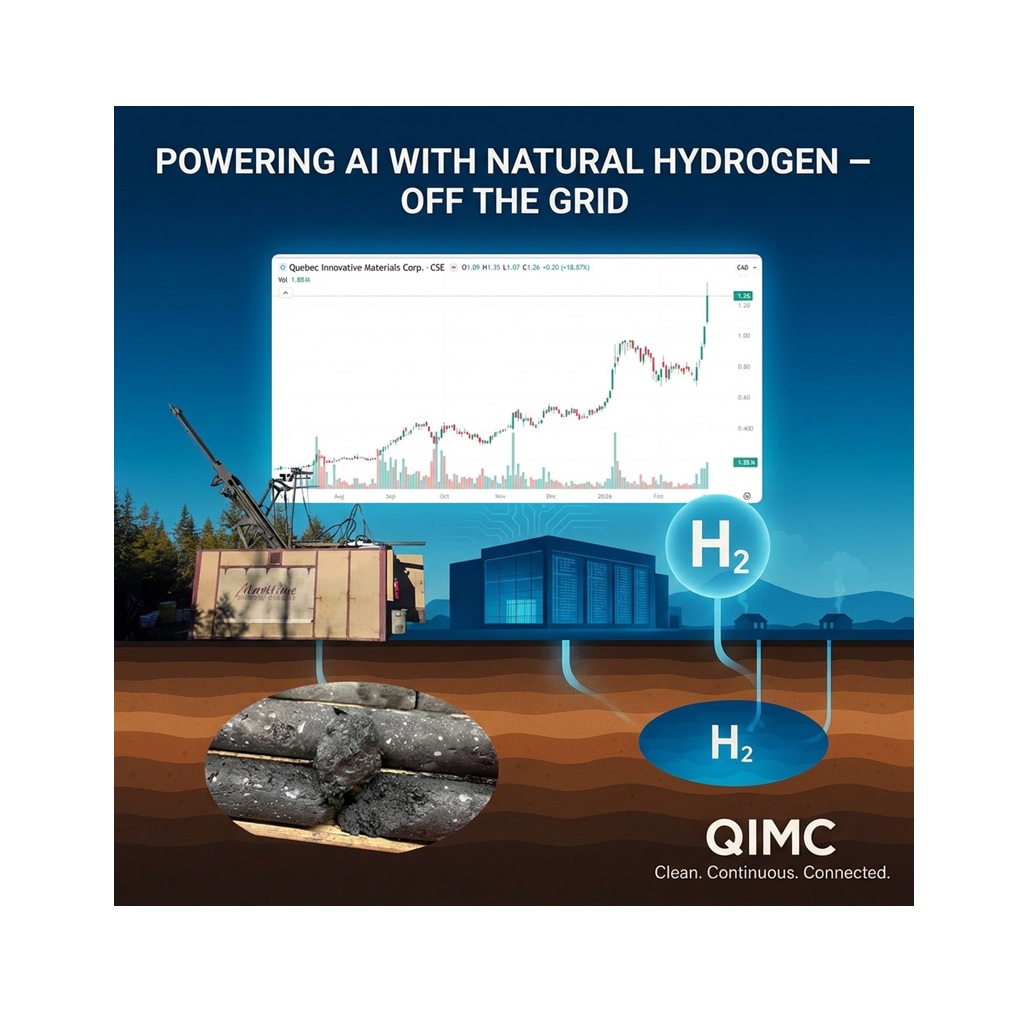

QIMC Soars to New All-Time High as Natural Hydrogen Momentum Builds

QI Materials (CSE: QIMC) surged by 18.87% today to a new all-time high of $1.26…

Will Capybara Research Be Proven Wrong About Hydrograph Clean Power?

We have no idea who Capybara Research is, but they seem to be always right.…

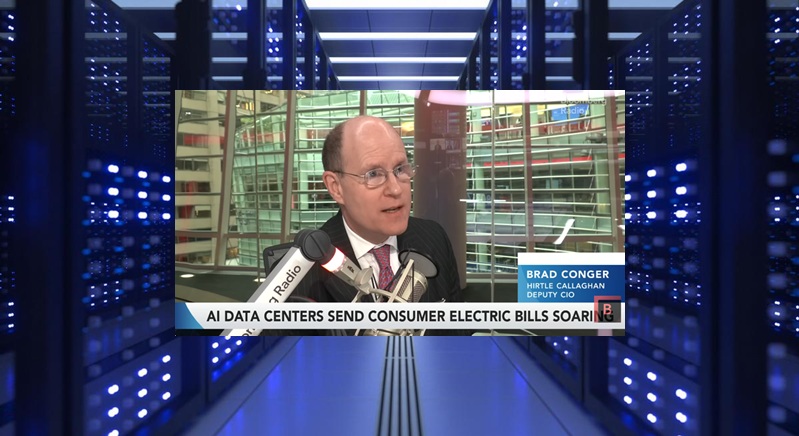

NIA’s Biggest Week Ever Is Ahead

Perpetua Resources (PPTA) closed Friday at a new all-time high of $36.86 per share with…

Is Energym a Legit Energy Source for AI?

There’s a viral AI video of Sam Altman, Elon Musk, and Jeff Bezos talking about…

QIMC Hits NEW All-Time High After 13.98% Surge!

QI Materials (CSE: QIMC) surged by 13.98% today to a new all-time high of $1.06…

Urgent NIA Friday Morning Update: Huge Day Ahead

QI Materials (CSE: QIMC)'s drill hole DDH-26-01 has intersected a second hydrogen-associated structural zone at…

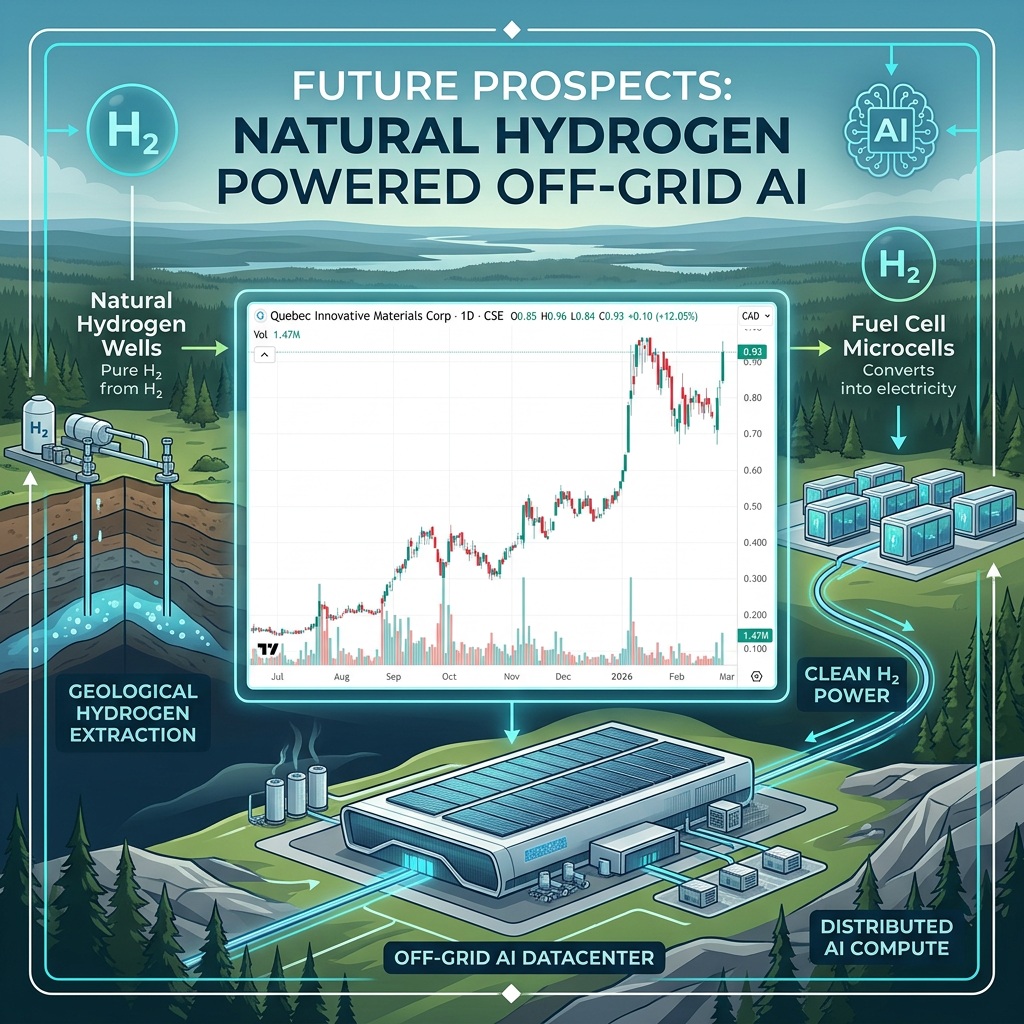

Is Natural Hydrogen the Real Boom Not Graphene?

QI Materials (CSE: QIMC) gained by 12.05% today to $0.93 per share and its chart…

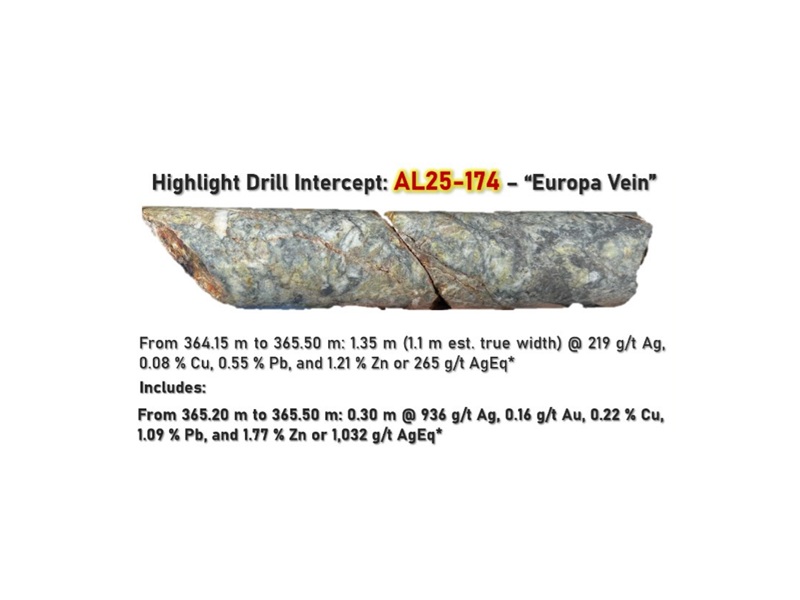

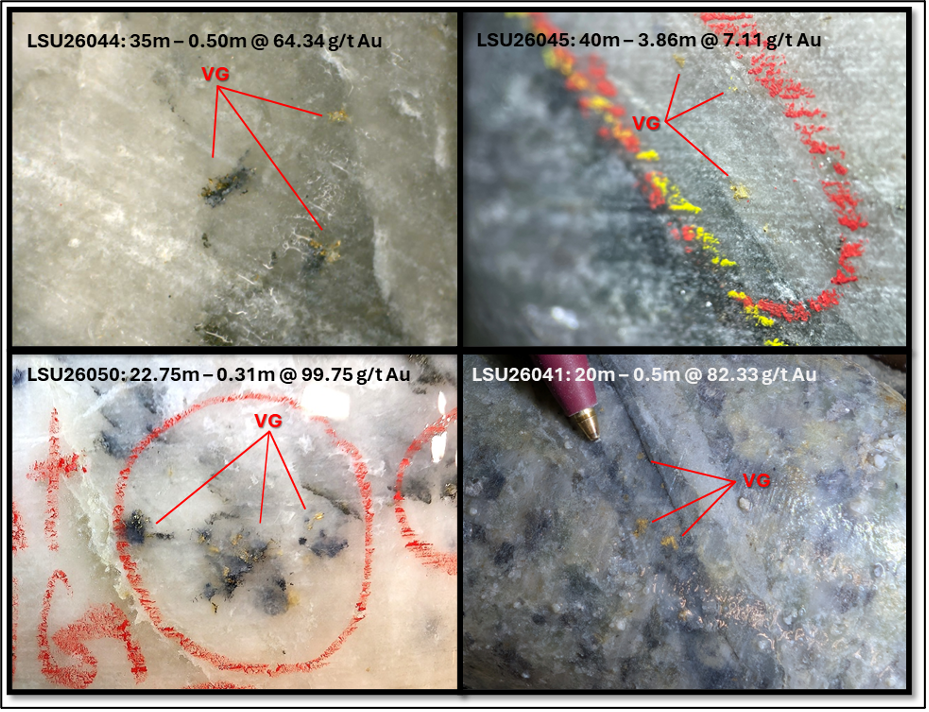

Minaurum Silver Hits 1,032 g/t AgEq and Adds 6th Rig

Minaurum Accelerates Exploration at Alamos Silver Project; Expands to Six Drill Rigs and Reports Additional…