All We Care About Is “Numbers Go Up”

It doesn't matter to us which co-founder of Kirkland Lake Gold serves as Executive Chairman…

Were Other NPR Executives Forced Out?

Did Harry Dobson force North Peak Resources (TSXV: NPR)'s other board members to leave the…

Did Harry Dobson Sell Manchester United to Glazers 20 Years Ago?

An NIA member has asked us if new North Peak Resources (TSXV: NPR) Executive Chairman…

HSLV Is #1 Strongest Silver Stock

On every single day that gold/silver stocks see a bull market shakeout and technology stocks…

Harry Dobson Becomes NPR Executive Chairman

Harry Dobson has just become Executive Chairman of our North Peak Resources (TSXV: NPR). Harry…

HSLV to Commence Trading on TSX Tomorrow; Drilling to Commence at San Luis Gold-Silver Project in the Coming Weeks

Highlander Silver to Commence Trading May 13, 2025 on the TSX; Drilling to Commence at…

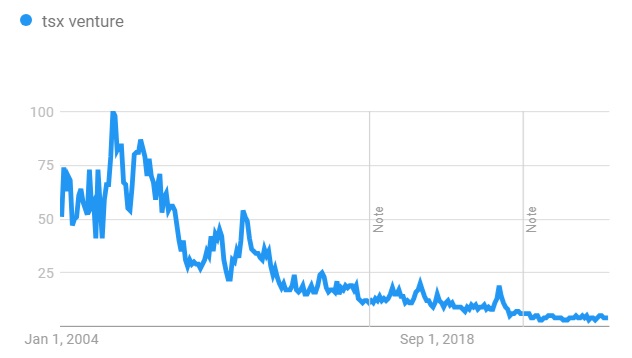

GDX Ownership = Retail Interest in Gold Stocks

In our opinion, a chart of VanEck Gold Miners ETF (GDX) shares outstanding is equivalent…

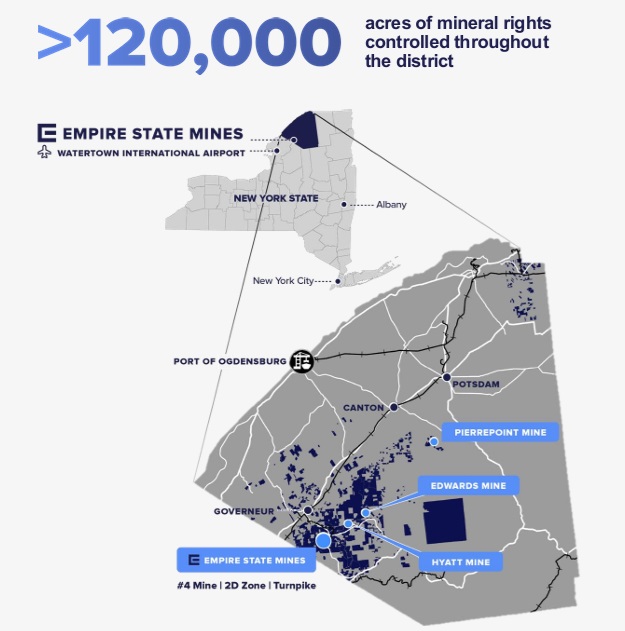

Titan Mining (TSX: TI) Gains by 5% to $0.63 Per Share

On April 17th, NIA suggested Titan Mining (TSX: TI) at $0.56 per share explaining that…

What Lundin Gold Hitting Record High Means for Highlander Silver and Augusta Gold

Lundin Gold (TSX: LUG) gained by 14.14% today to a new all-time high of $67.79…

Sibanye-Stillwater (SBSW) Reports Strong Earnings, NIA’s Call Option Is Rising Fast

Sibanye-Stillwater (SBSW) announced today that 1Q 2025 EBITDA increased by 89% year-over-year causing SBSW to…