Important NIA Tuesday Afternoon Update

Usually the CEO of QI Materials (CSE: QIMC) tells us the night before if a…

QIMC Intersects 40m Hydrogen Fault Corridor at 142m Depth

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth Feb 24,…

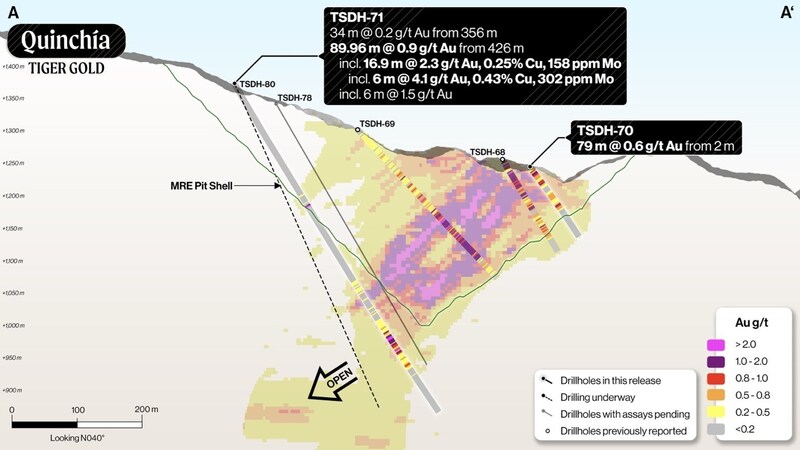

Tiger Gold Hits Potential Feeder Zone Beneath Resource

Tiger Gold Intersects Potential Feeder Zone Beneath Tesorito Mineral Resource with 16.9 m @ 2.3…

Massive Moves Today and Bigger Moves Coming

NIA sent out an alert this morning predicting a very big week ahead for Highlander…

New NIA Gold Stock Suggestion: Tiger Gold (TSXV: TIGR)

NIA previously suggested Frank Giustra's Aris Mining (TSX: ARIS) at $4.50 per share and it…

Huge Week Ahead for Highlander Silver (TSX: HSLV)

Ever since NIA's initial suggestion of Highlander Silver (TSX: HSLV) a little over one year…

What a HUGE Day for NIA’s Top Silver Picks

Yesterday morning, NIA made something very clear: If cost were no object... and we could…

NIA Silver Stock Update: Highlander to Close on Bear Creek Next Week

It was just announced this morning that Bear Creek shareholders have overwhelmingly approved Highlander Silver…

OSS Gains 26.23% to $10.54, Up 387.96% Since NIA’s Suggestion

This morning, NIA sent out an alert about how its #1 overall stock suggestion for…

NevGold Soars, Lahontan Breakout, OSS Signs U.S. Navy Contract

NevGold (TSXV: NAU) gained 8.49% yesterday to $1.15 per share on huge volume of 3.11…