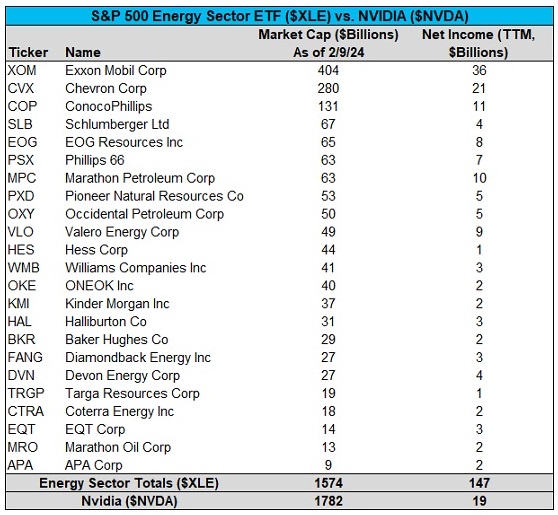

Nvidia (NVDA)'s market cap has surpassed the energy sector.

The problem with this is... not only does the energy sector earn 7.73X larger net income, but if NVDA's GPUs being sold were actually being used and not being hoarded by big tech companies that don't know what to do with them and are buying them to boost their share prices pretending they are developing something useful...

We would already be seeing a significant increase in U.S. electricity consumption equal to a city the size of Phoenix, which we haven't seen yet.

If NVDA were to grow large enough to justify its current market cap, future U.S. electricity consumption from GPUs will become so large that there will be electricity shortages and we will be forced to rebuild our infrastructure requiring massive investment into the development of new precious and base metal mines.

So, either NVDA is artificially inflating its earnings and will crash by 90% after they are forced to restate earnings later this year or NVDA is fairly valued, and we will see companies related to energy and metals increase by 1,000% in value.