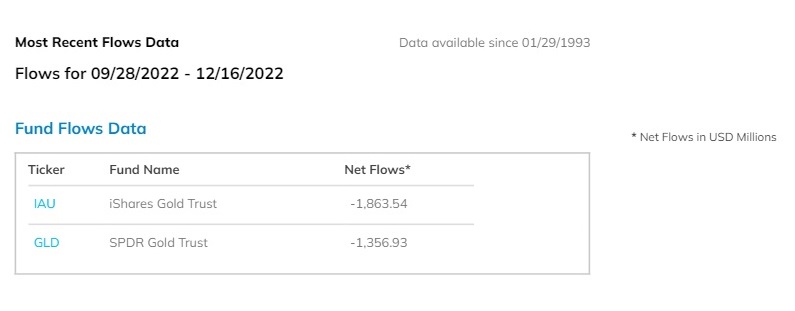

Despite smart money buying massive amounts of gold futures since gold's September 28th bottom of $1,615 per oz, there has been no retail follow through buying of the SPDR Gold Trust (GLD) or iShares Gold Trust (IAU) ETFs. In fact, since September 28th, GLD has experienced $1.357 billion in outflows while IAU has experienced $1.864 billion in outflows!

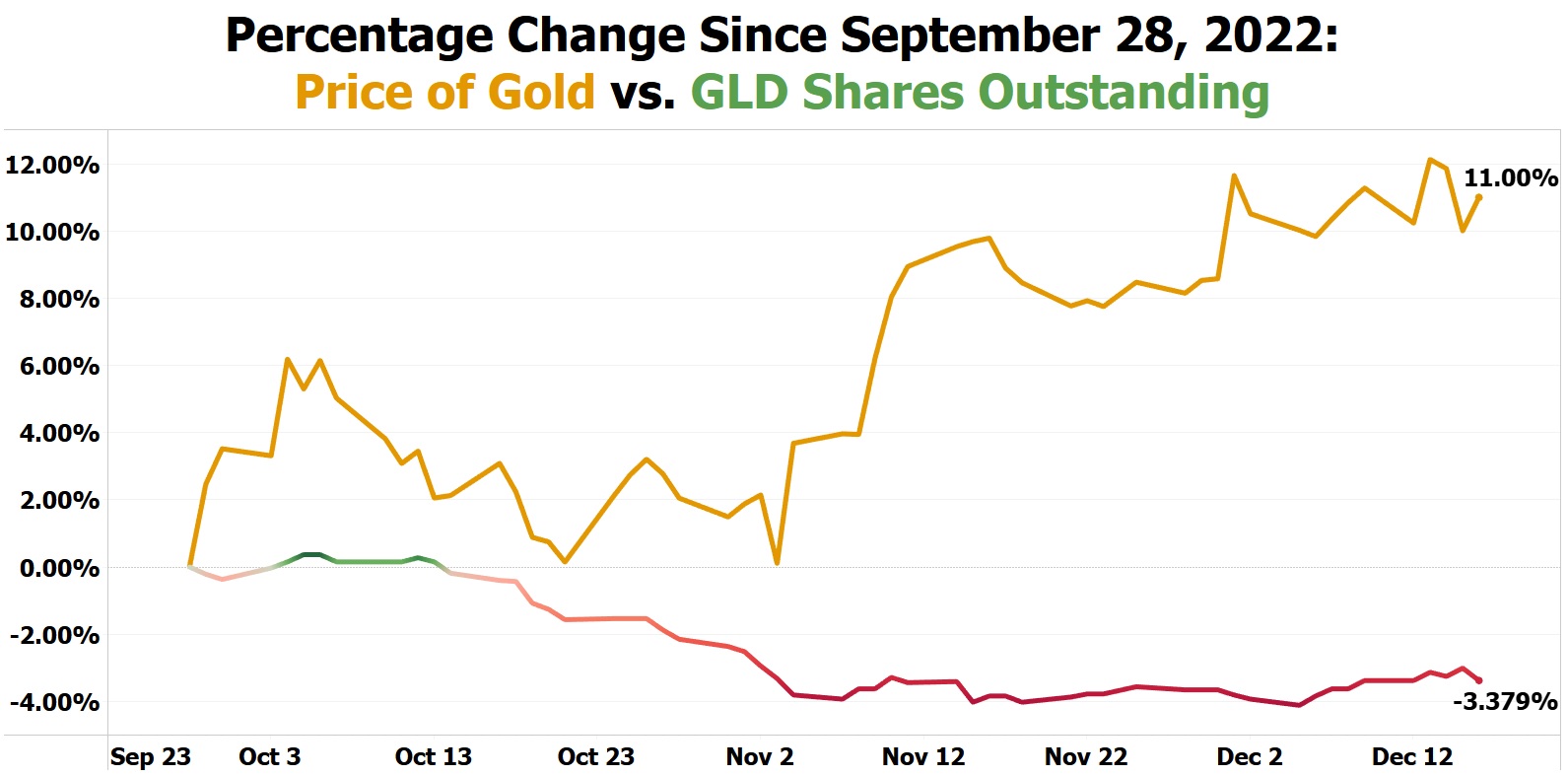

Incredibly, while gold is up by 11% since its September 28th bottom of $1,615 per oz, GLD's shares outstanding have declined by 3.379%!

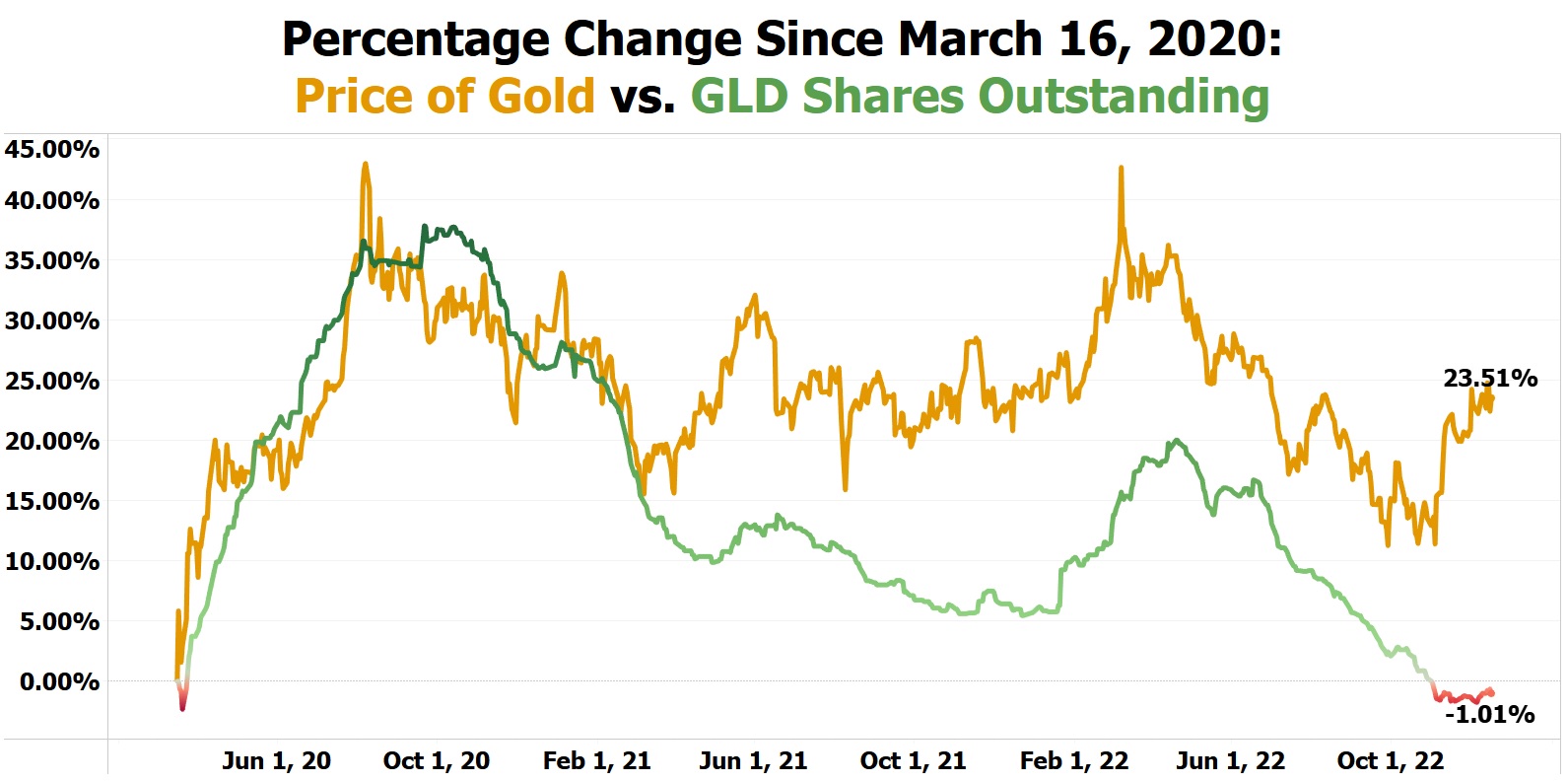

Even more incredible, since gold's March 16, 2020, COVID bottom of $1,488 per oz, gold is up by 23.51% vs. GLD's shares outstanding declining by 1.01%!

When ownership of gold ETFs return back to 2020 highs, it will result in a $2,500-$3,000 per oz gold price!